For the second quarter in a row, Colorado-based firm BF Borgers netted the most new Securities and Exchange Commission clients, adding nine new clients in the third quarter of 2021, and netting eight.

Top 100 Firm WithumSmith+Brown added 14 new SEC clients over the quarter — with a dozen of those coming thanks to its July merger with San Francisco-based OUM & Co. — and Top Eight Firm BDO USA and Top 100 Firm Marcum both added eight, but all three netted far fewer than BF Borgers due to client departures (see “

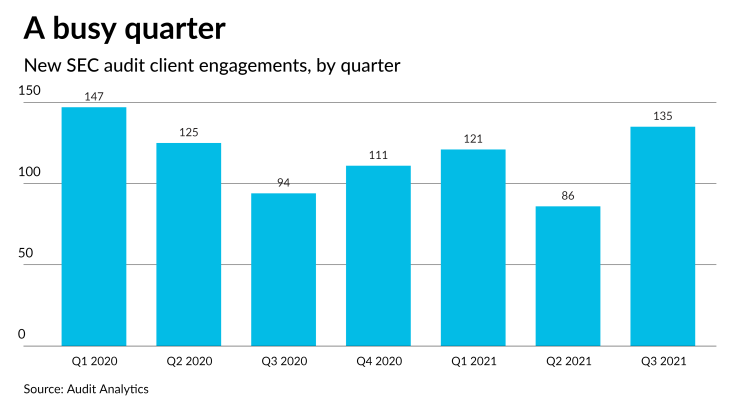

Overall, it was a strong quarter for new engagements; after a two-year low in the second quarter, the total of new clients for Q3 jumped to the highest level seen since the beginning of 2020.

Clients by filing status, and more

BF Borgers led the league tables for smaller reporting companies again, while the three clients that Top 100 Firm BPM brought on from merging in California-based Gumbiner Savett in July put it at the top of the combined table for non-accelerated files and non-accelerated special reporting companies. (See “

Finally, Deloitte led the field in terms of new market capitalization audited, new assets audited, and new audit fees, thanks in large part to Apartment Income REIT Corp., which brought on $7.84 billion in market cap, $6.3 billion in assets audited, and $2.87 million in audit fees, with an assist from Visteon Corp., with $3.45 billion in assets and $3.25 in fees. (See “

Withum came in second for new market cap audited thanks to its high number of new clients, Heron Therapeutics stood out with $1.9 billion.

Top 100 Firm BKD took second for new assets audited, with all of its $3.8 billion coming from Capital City Bank Group.

And Grant Thornton took second in new audit fees, thanks for $2.34 million from Extreme Networks Inc. and $1.8 million from GAN Ltd.

Data for the quarterly rankings are provided by Audit Analytics, a premium online intelligence service delivering audit, regulatory and disclosure analysis. Reach them at (508) 476-7007,