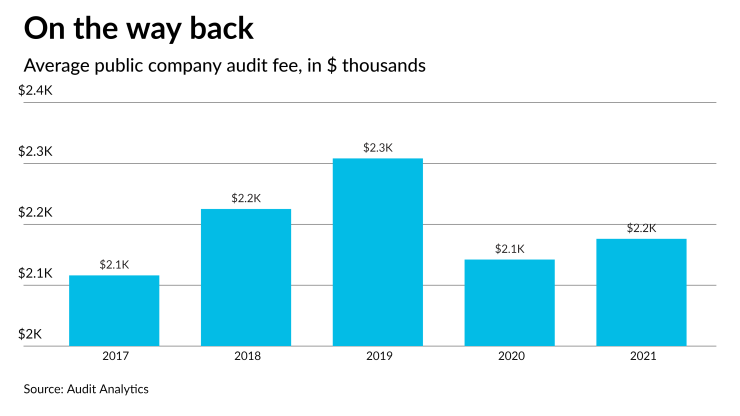

After dropping in 2020, audit fees bounced back in 2021, according to a recent study, but they still haven't reached their pre-COVID highs.

The

The study also found that the ratio of audit fees to revenues continued a five-year decline from 0.063% to 0.059%, which it attributed mostly to revenue drops due to the pandemic.

Over the long-term, total audit fees charged have almost tripled since 2002, when the Sarbanes-Oxley Act was passed. There was a near-doubling in 2004 as the ramifications of the act were felt, and declines in 2009 and 2010 during the Great Recession, but otherwise the climb has been moderate and steady.

Audit fees as a percentage of total fees have also risen since SOX, with non-audit fees declining every year since 2012, decline from 11.8% of all fees to 8.9% in 2021.

Among the report's other takeaways:

- Big Four firm PwC tops the league tables in terms of audit fees in 2021, with $4.5 billion, followed by Ernst & Young with $4.04 billion, Deloitte with $3.3 billion, and KPMG with $2.6 billion.

- After declining steadily since 2006 from 10,114 down to 6,382 in 2019, the population of public companies rose in the first two years of the pandemic, hitting 7,133 in 2021.

- The number of non-accelerated filers jumped significantly over 2020 and 2021, though their aggregate audit fees decreased.

For more details, see