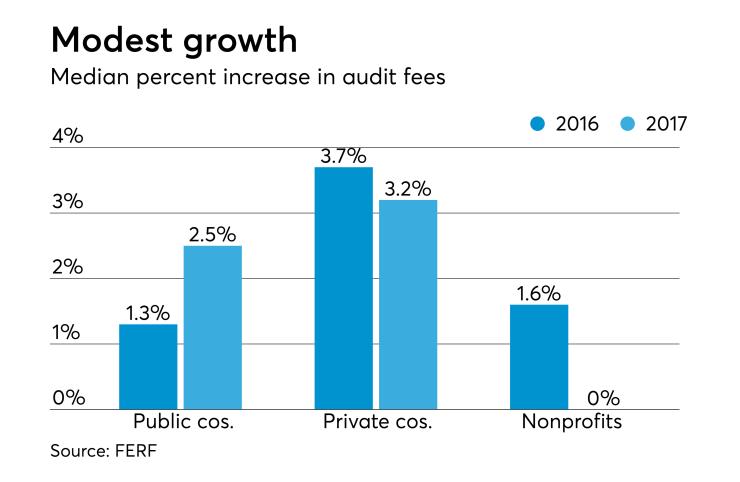

Though overall audit fee increases were modest, average public company audit fees grew at nearly twice the previous rate last year, according to a new report.

The

The reasons cited for the audit fee increases at public companies echoed previous years, starting with the impact of new standards from the Financial Accounting Standards Board, especially related to revenue recognition and leases. Other factors include high levels of mergers and acquisition activity as well as detailed documentation requests responding to Public Company Accounting Oversight Board inspection reports and PCAOB staff alerts.

Despite extra demands on companies and organizations, survey respondents suggested audit complexity by itself didn’t exceed reasonable expectations.

Both private companies and nonprofit organizations indicated they were able to lessen audit fee increases thanks to a competitive audit services marketplace. They also managed to keep audit fees in line with the help of extensive planning and information preparation before undergoing an audit, and increasing the amount of collaboration between companies and auditors during the year, such as proposed transaction reviews to identify implications or requests for more detailed audit plans and scoping documents. They have also been negotiating with their auditors about rates, hours and audit assistance by conducting low-risk audit tasks in-house.

Within larger companies and organizations, automation is also having an effect. Automating account reconciliation and data transfers between finance systems, for instance, can increase operating efficiency and improve the finance team’s overall contributions to the broader organization. While the survey respondents admitted that implementing such automation tools and processes may increase audit-related costs in the near-term, the initiative is expected to reduce costs over time.

“The last year has seen financial departments focus heavily on improving audit management and control strategies through smarter use of human resources and technology. Inevitably, complying to new standards and oversight requirements brings new responsibilities and, in some cases, additional work and related fees,” said Andrej Suskavcevic, president and CEO of both Financial Executives International and the Financial Education & Research Foundation, in a statement.