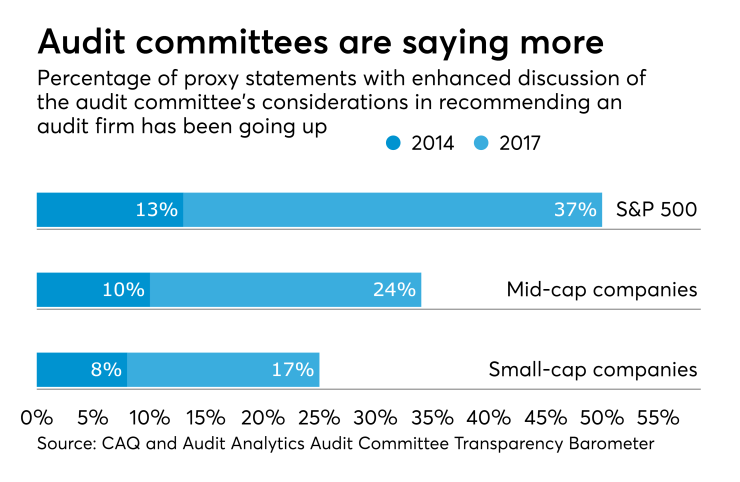

Audit committees are providing investors with more information about their outside auditing firms, according to a new report.

The annual report, from the Center for Audit Quality and Audit Analytics, sees the amount of information disclosed about audit committee oversight of external auditors continuing to increase since last year.

The fourth annual

The report found 38 percent of S&P 500 companies disclosed the evaluation or supervision of the audit firm this year, a jump from just 8 percent in 2014.

On top of that, 28 percent of mid-cap companies disclosed the evaluation or supervision of the audit firm in 2017 (a big jump from 7 percent in 2014). That compares to 27 percent of small-cap companies in 2017 (up from 15 percent in 2014).

“For the fourth year in a row, audit committees have continued to enhance transparency around their oversight of the external auditor by voluntarily and broadly increasing disclosure,” said CAQ Executive Director Cindy Fornelli in a statement.

Each year since 2014, the Barometer has measured the strength of proxy disclosures among companies in the S&P Composite 1500. This index looks at S&P 500 companies (large-cap companies), the S&P MidCap 400 and the S&P SmallCap 600.