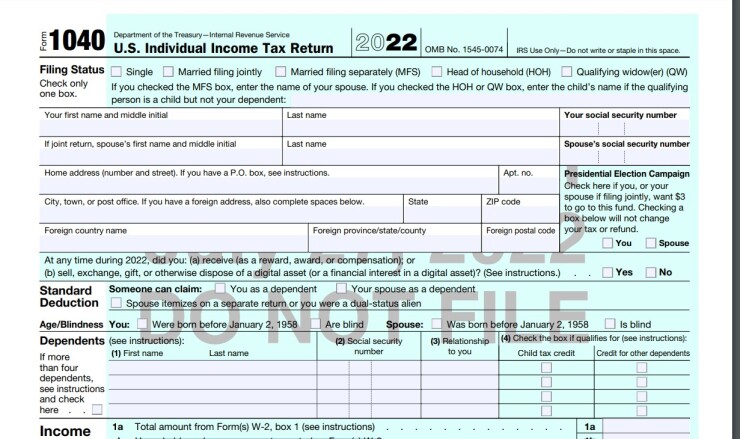

The American Institute of CPAs proposed a set of revisions Monday to its Statements on Standards for Tax Services and separately sent the Internal Revenue Service its recommendations for revising the virtual currency question and instructions on the Form 1040, asking it not to switch the term to "digital asset."

The

"Revising the standards is a powerful step forward to enhancing services provided by AICPA members so that they continue to be perceived as the premier providers of tax services," said AICPA Tax Executive Committee chair Jan Lewis in a statement.

The AICPA is asking for comments by Dec. 31, 2022. They can be submitted through an

Separately on Monday, the AICPA also submitted its comments to the IRS about the virtual currency question on the

On the draft form, the IRS is planning to change the question from one about "virtual currency" to "digital asset" (

The question could potentially be interpreted as asking about types of cryptocurrency such as nonfungible tokens, or NFTs.

The AICPA is asking for the question to be clarified before the 2022 forms are finalized in order to provide greater certainty to taxpayers and tax preparers and to help them comply with the question and overall reporting requirements for virtual currency.

It is asking the IRS to clarify the meaning of virtual currency. It recommends the IRS modify the definition of virtual currency as described in the first paragraph of the Form 1040 instructions to make it consistent with the definition in Rev. Rul 2019-24 and Notice 2014-21. The definition in the instructions should state that the IRS uses the term "virtual currency" to refer only to convertible virtual currency. In addition, it suggested examples of convertible virtual currency should be included.

The AICPA also wants further clarification on whether the terms "unit of account," "store of value" and "medium of exchange" all need to be present or if just one must be present. Each of the terms should be defined, and the AICPA believes the reference to any asset with the "characteristics of virtual currency" should be removed because it's not part of IRS official and binding guidance, creates confusion and is potentially broad beyond the definition of virtual currency provided by the IRS.

As for changing the term from "virtual currency" to "digital asset," the AICPA believes the IRS should not ask about "digital assets" until the term has been defined in final regulations under Section 6045 of the Tax Code and that the form should continue to use the term "virtual currency" until final regulations are issued to officially define the term "digital asset" as added to Section 6045 by the Infrastructure Investment and Jobs Act.

The AICPA instead recommends that the virtual currency question be modified to say, "At any time during 2022, did you have a taxable event involving virtual currency? See instructions. ___ Yes ___ No"

The AICPA also wants more information to be added to the instructions, including a definition of virtual currency and examples of taxable and nontaxable events in line with new wording. The IRS also should explain if a taxpayer needs to answer "yes" if a dependent had a virtual currency event but doesn't have a filing requirement. The AICPA recommended the instructions specify that a virtual currency event of a child or dependent claimed on the return does not require the individual filer to answer "yes." The instructions should also say an individual filer who otherwise doesn't have a filing obligation isn't required to file Form 1040 just to answer "yes" to the virtual currency question.

"Taxpayers and their advisors want to comply with IRS guidance on virtual currency, but they lack adequate instructions to do so," said Annette Nellen, chair of the AICPA Virtual Currency Task Force, in a statement. "We strongly urge the IRS to consider our recommendations, which will facilitate compliance from taxpayers on these important issues that affect a growing number of taxpayers."