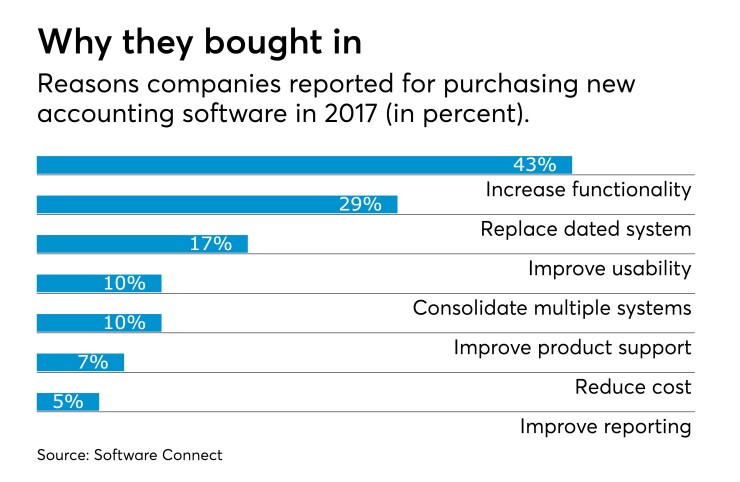

New buyers made up a significant portion of the market for accounting software last year, at 37 percent. More companies are finding that legacy accounting systems can’t keep up with their needs, and say that online accounting software is more in line with their business processes.

The findings, uncovered in a survey conducted by Software Connect, point towards a rapid increase in the adoption of accounting software, as well as the adoption of cloud computing.

More than one-third of upgraders last year were QuickBooks users, and 11 percent come from Sage 50. One-fifth of buyers were looking for functions that go beyond accounting, such as payroll, inventory and invoicing. Larger companies tended to look for business intelligence capabilities: Businesses with more than 50 employees were over 70 percent more likely to need software that handles budgeting, business intelligence and fixed assets.

Non-accounting features may be the key selling point for businesses on the fence about upgrading, according to Kelly Hummel, ERP practice director with business software consultancy Net@Work, in the Software Connect report.

Hummel also noted that many users are ultimately deciding to migrate to more advanced software “when they require more industry-specific functions outside core accounting, such as inventory, service management or EDI [electronic data interchange].”

Cost is a major reason why companies hesitate to upgrade to a new accounting system, even when they see the need, according to Hummel. She added, “QuickBooks customers are probably the most resistant because of the next jump in cost.”

Software Connect looked at more than 3,000 accounting projects from 2017 for the report. The sample included only buyers who needed just one major additional feature aside from core accounting, invoicing, inventory management, payroll, order management and procurement. For the full report, click