Most accountants sooner or later need to have awkward conversations with clients about overdue bills or work that goes beyond the scope of their services, but putting off those conversations can mean they never collect those extra fees.

Nearly all (94%) the accountants and bookkeepers said they have encountered an awkward client situation in their practice, according to a new survey, including 94% having to chase clients for late payments. In addition, 90% indicated they have clients who are not being billed for out-of-scope work, with 43% of respondents saying their firm just absorbs these costs and work, while 88% experience clients being sent proposals or engagement letters with errors, two to three times a month on average. The survey, released Tuesday by Ignition, a practice management software provider, and YouGov, polled 506 decision makers in accounting and bookkeeping firms with between one and 50 employees.

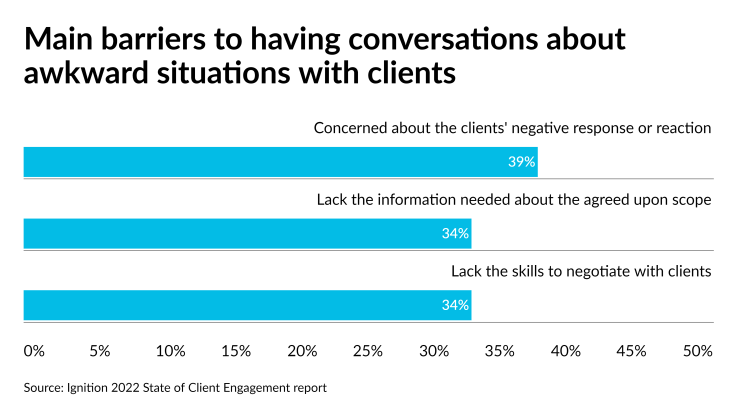

The survey found that 88% of the accountants and bookkeepers surveyed in the U.S. have admitted to delaying or avoiding an awkward conversation with a client, including 68% who said they were trying to improve or maintain the client relationship. The top barriers to having an awkward conversation cited by respondents were 39% are concerned about the clients' negative response or reaction, 34% lack the information needed about the agreed upon scope, while 34% lack the skills to negotiate with clients.

"You have to have that awkward conversation with clients if you want to move to a monthly recurring revenue model," said Matthew Kanas, head of AMER at Ignition. "Long story short, if you're unable to have that conversation, it's not going to enable you to transition in a period where it's a once in a lifetime, once in a century industry chance to do it. And because small businesses are relying on their accounting professionals to guide them through uncertainty, especially as we enter into a potential recession, now is the time for them to take stock."

To avoid having an awkward conversation with clients, 38% of the accountants and bookkeepers surveyed admitted their business has written off part or all of an invoice in the past 12 months. By putting off awkward conversations, accountants and bookkeepers have traded short-term comfort for the long-term health of their firm. The top financial and business consequences seen by the respondents were 41% experienced a loss of potential income for the business, 35% faced cash flow pressures, and 21% had to shut down part of their business due to profitability issues.

"It's really about finding a way to effectively engage at the outset of any new business with a client, whether it's an existing client or a new client, setting that scope of work, agreeing on that scope of work, having a copy of that scope of work, and then automating that payment," said Kanas.

On average, accountants and bookkeepers in the U.S. estimate that out of scope work that hasn't been fully billed is costing their business more than $76,000 each year and in the last 12 months alone, 43% of respondents said the quality of their work had suffered and three in ten (30%) say their projects had run over budget.

In addition, 92% said they experienced late payments, and 31% of invoices were paid after the due date. On average, client invoices past their due date are 30 days overdue.

Putting off awkward client conversations has also impacted the workplace culture of firms. By avoiding or delaying awkward client conversations, the survey respondents reported detrimental implications for personal and team health and well-being, including 43% who experienced low morale and 28% resentment among staff members, with 40% reporting it has had a negative impact on their and their staff's mental health, and 30% indicating staff members have quit and they've had difficulty retaining staff.

"The awkward conversation is something that we know that each tax professional in the U.S. and Canada is having a struggle doing," said Kanas. "If they're not able to have that conversation, it's going to stymie their growth, and it's going to have an impact on employees. It's about owning your value and understanding what your value is and then bringing that to bear on those clients. In speaking with customers, one of the conversations that's tough to have is increasing pricing. As one customer relayed to me, that was the scariest conversation she ever had with all of her clients. That was her No. 1 concern. The clients that didn't want to stick with her were probably the clients that she hated the most and she was happy to see them go. So, the awkward conversation can have incredible effects for the firm and everyone's mental health in that way."