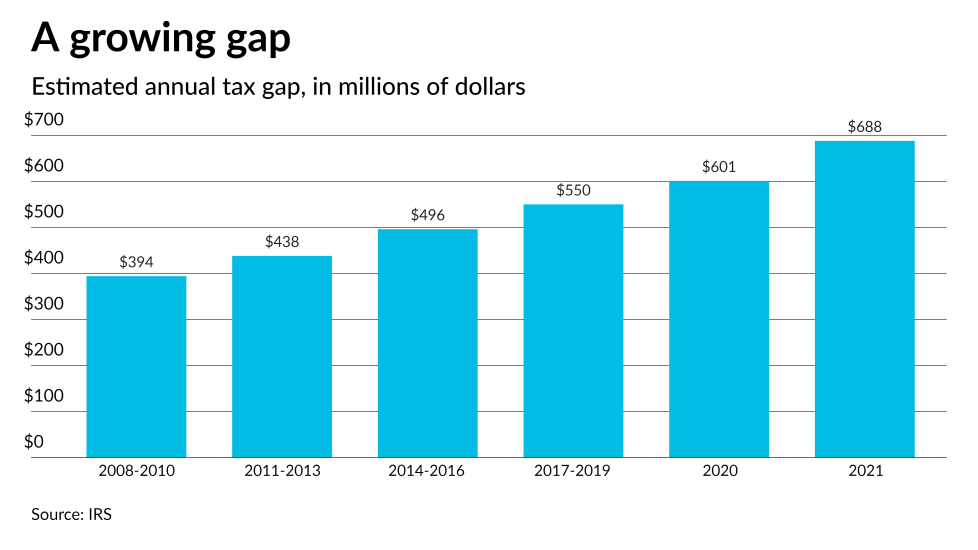

On Oct. 12, 2023, the Internal Revenue Service released the long-awaited, updated tax gap estimates. The tax gap measures how much the U.S. Treasury loses annually due to taxpayer non-compliance.

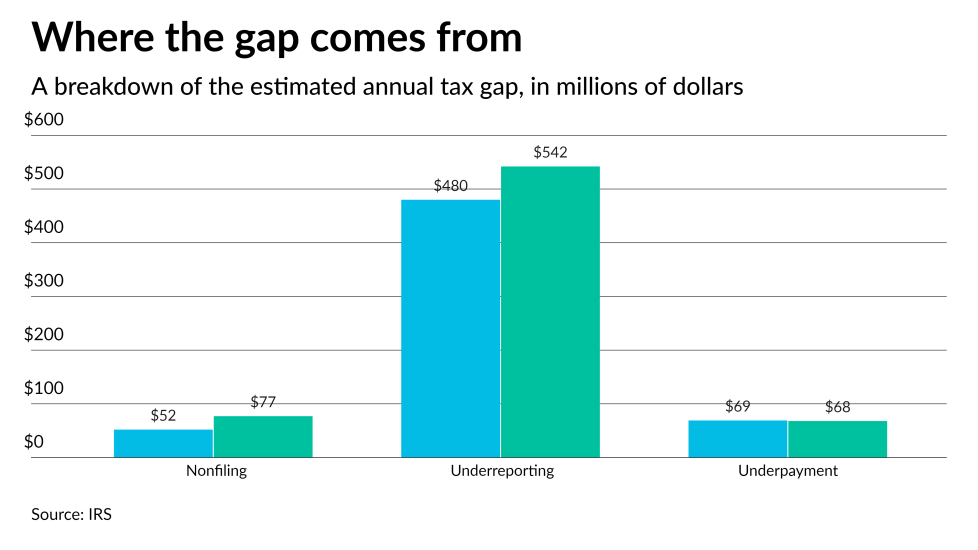

To no one's surprise, the tax gap has risen since the last IRS study for the 2014-2016 tax years, and the service updated estimates for the 2017-2019 tax years. The most current figure, for tax year 2021, estimates a loss to the Treasury of $688 billion a year, comprised of the sum of these three components:

- Non-filing: $77 billion (from failure to file a required tax return);

- Underreporting: $542 billion (from inaccurate tax returns); and,

- Underpayment: $68 billion (from failure to pay taxes owed).

The tax gap has been a renewed focus of Congress in recent years, and tax gap estimates have been used as much of the rationale for additional IRS funding in the Inflation Reduction Act passed in August 2022. Details in the recent 24-page IRS Tax Gap Projections research study (

What's next?

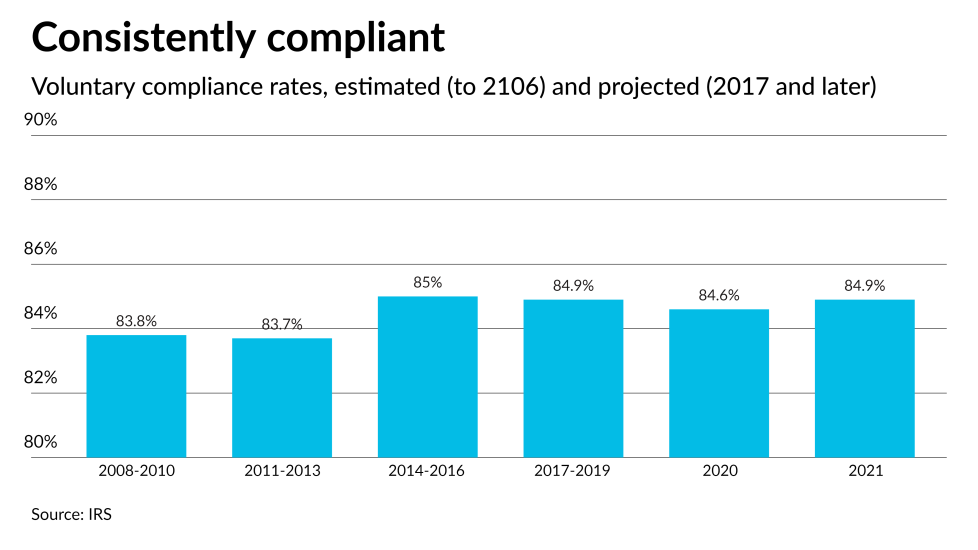

The tax gap provides the IRS strong data for both improved compliance programs on the one hand and service initiatives on the other. On the service side, the agency has been making much progress in the past year. It exceeded its 85% phone level of service goal in the 2023 tax season and is rapidly advancing its online account help. It plans more progress in 2023 and 2024 with new business online accounts and enhancements to the tax pro online account.

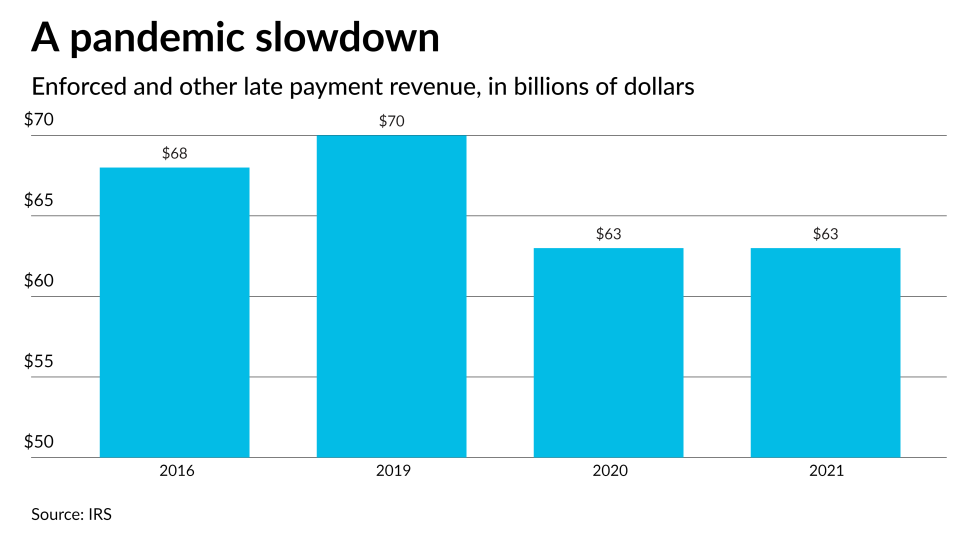

But compliance enforcement has been slow to return. Since the beginning of the COVID-19 pandemic in March 2020, much of compliance enforcement has been on hold. In 2022, the service returned its local field collection and examination functions to be fully operational. And both functions have been actively growing through aggressive hiring efforts.

But local enforcement is only a very small part of overall compliance enforcement. Most of the heavy lifting is not done locally, but rather in its "campuses," which until recently sent millions of notices each year to taxpayers questioning the accuracy of their returns, asking for payments on late balances, and inquiring about non-filing. In these functions, the IRS is still very much on hold. Its automated underreporter unit (CP2000) has maintained a limited presence during the pandemic but is far from the volume of notices that it reached in 2011 and 2012.

The conclusions from the recent tax gap study support the IRS increasing its compliance presence and turning back on notice systems. Taxpayers must know that the tax agency is present. Continuing to hold off campus enforcement may fuel a different tax gap estimate when the service measures it next year.

The six tax gap data points below will bolster calls for a well-resourced IRS: