Want unlimited access to top ideas and insights?

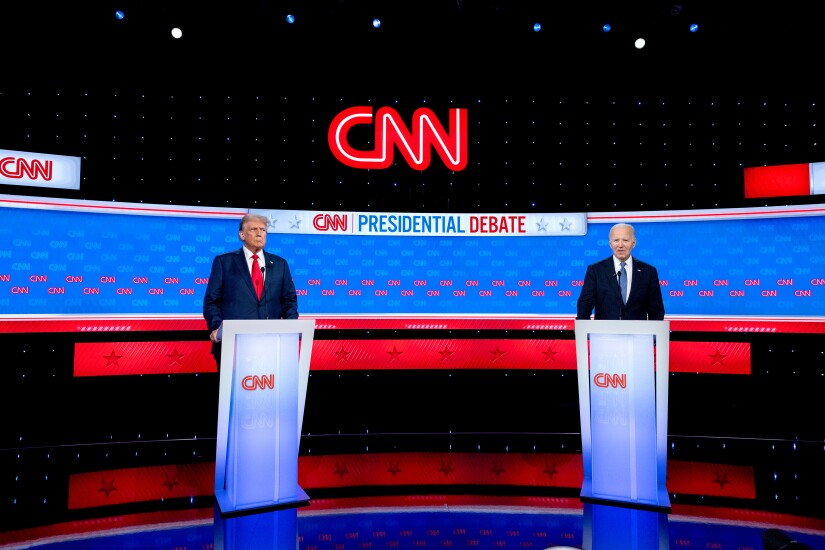

Since President Joe Biden announced his decision not to seek reelection, the race to the White House has heated up, pushing tax practitioners to scrutinize the legislative track records of both candidates in the hopes of understanding what each potential administration could mean to the accounting profession at large.

Former U.S. President Donald Trump has touted changes for a second term ranging from

Trump's administration was successful in passing the landmark

"Republicans will make permanent the provisions of the Trump Tax Cuts and Jobs Act that doubled the standard deduction, expanded the Child Tax Credit, and spurred economic growth for all Americans," as stated in the

The platform goes on to additionally call for

Read more:

Sunil Kansal, head of consulting and valuation services at the London-based Shasat Consulting, said the focus under a Trump administration "could shift towards maximizing benefits from deregulation and tax cuts."

"Here, accountants should focus on optimizing tax strategies and staying updated on potential shifts in trade policy that could impact international transactions," Kansal said.

While Harris and Trump have

From her time as a state attorney general, California senator and in the White House, Harris has backed numerous efforts largely focused on those who make less than $100,000 per year. Examples include LIFT (Livable Incomes for Families Today — the Middle Class Act bill she proposed in 2018), the Rent Relief Act, her "Medicare for All" plan and more.

The impact that increasing the refundability of the Child Tax Credit had on her proposed refundable tax credit could be a major part of Harris' platform, said Caroline Bruckner, tax professor at American University's Kogod School of Business and chief counsel for the U.S. Senate Committee on Small Business and Entrepreneurship, in an interview with Accounting Today's

"The Child Tax Credit is a real opportunity for her to tout the success of the refundable tax credit," Bruckner said. "It was an essential part of her tax proposal in 2019, and the Biden administration was actually able to do that with the credit. There was a bipartisan proposal just sitting there that was passed by the House earlier this year which would have expanded the credit."

Read more:

Below are in-depth looks at the potential impact of the upcoming presidential election on the accounting profession, and predictions on what each candidate's administration will bring to the table.