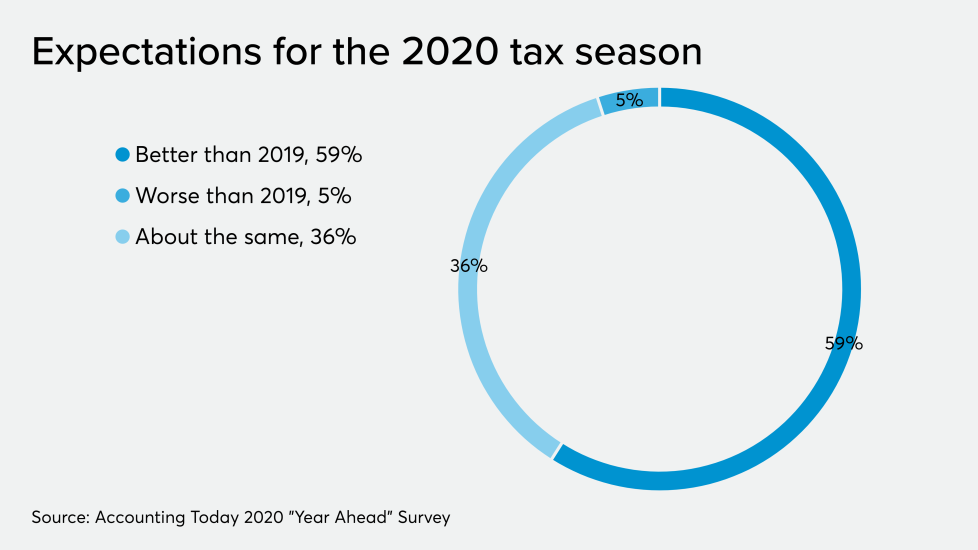

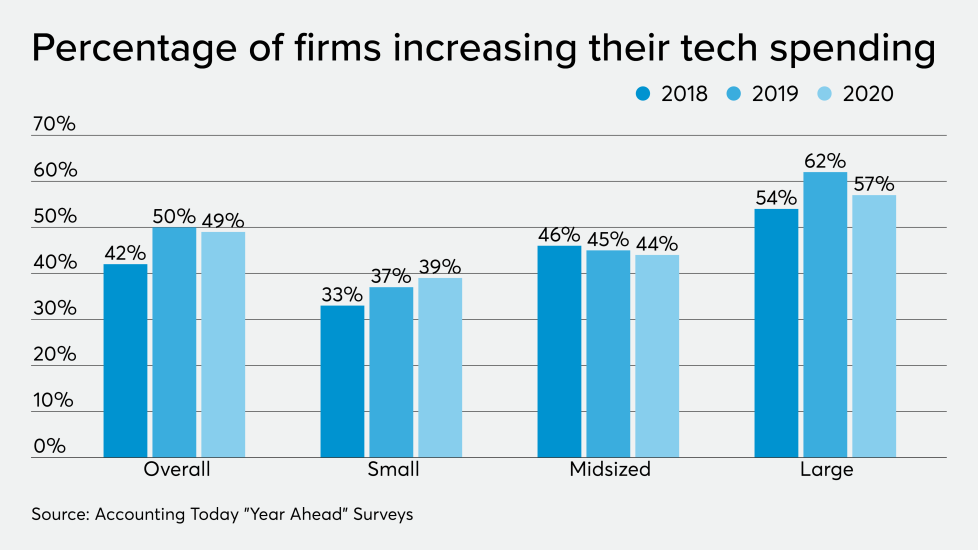

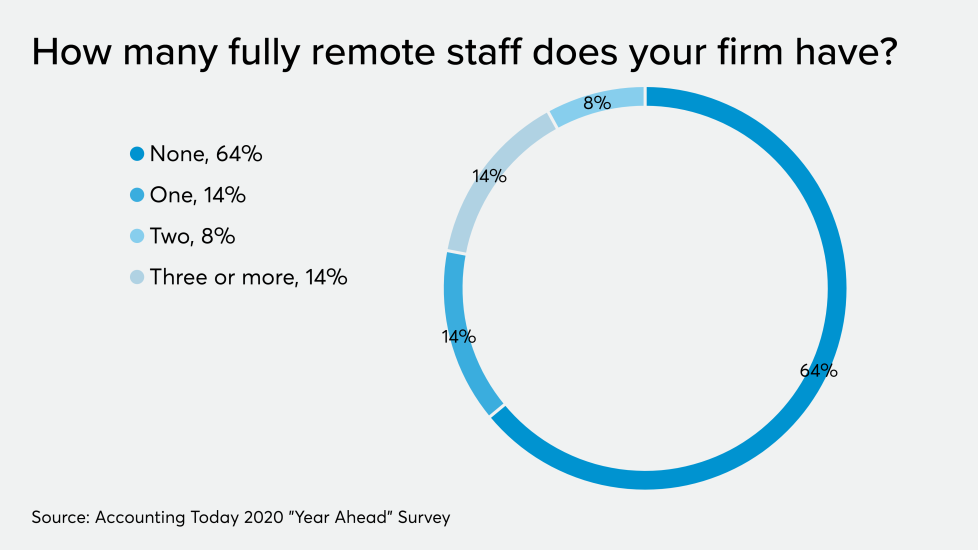

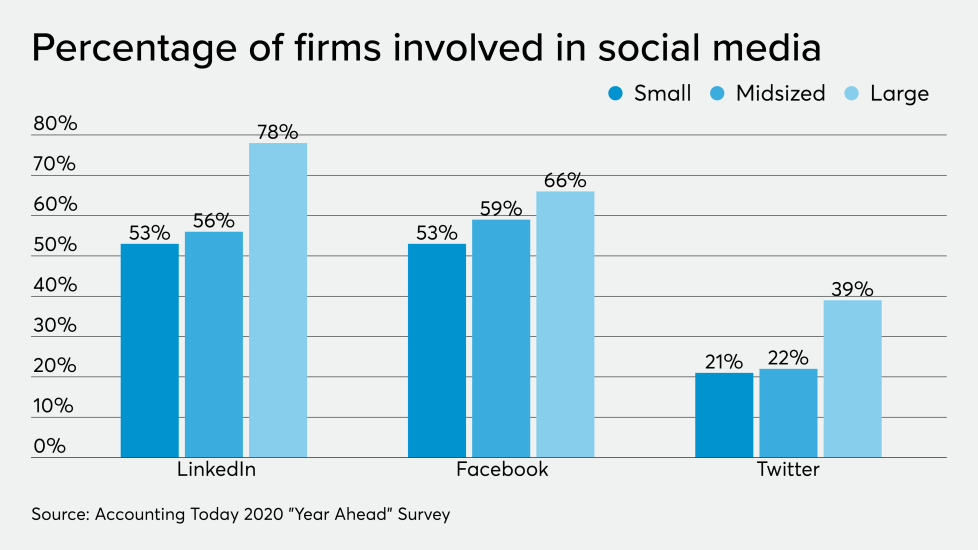

In order to see what CPAs and accountants believe 2020 has in store for them — and what they have in store for it — Accounting Today conducted its annual survey of almost 600 firms of all sizes in late October, polling them on everything from their growth expectations to their plans for tech spending, their use of social media, and the new services they're offering.

In addition, a panel of firm leaders share what they expect 2020 to bring the accounting profession