A roundup of influential and important legal decisions from the past year.

<BR>

David De Jong, CPA, Esq., a partner at Stein Sperling Bennett De Jong Driscoll PC, keeps tabs on such developments as they occur. He maintains a twelve-month Top 40 list, which he updates on a monthly basis. The following are among his picks for the most important tax cases of the past 12 months.

Have you been injured on the job?

Relief from indebtedness

Be it ever so crumbled …

There goes the rectory

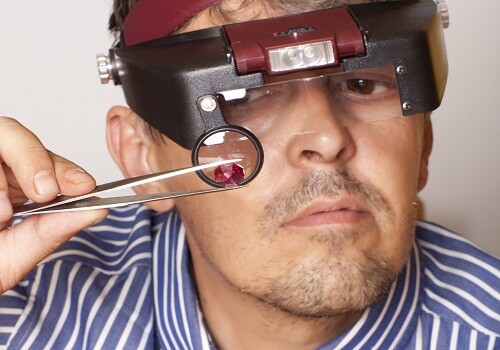

Surgical precision

Not for your vacation

Real estate professionals

A lender be

Parenting issues

Liquidity issues

Estate issues

Attorney error

Farm relief

Insurance scam?

More attorney errors