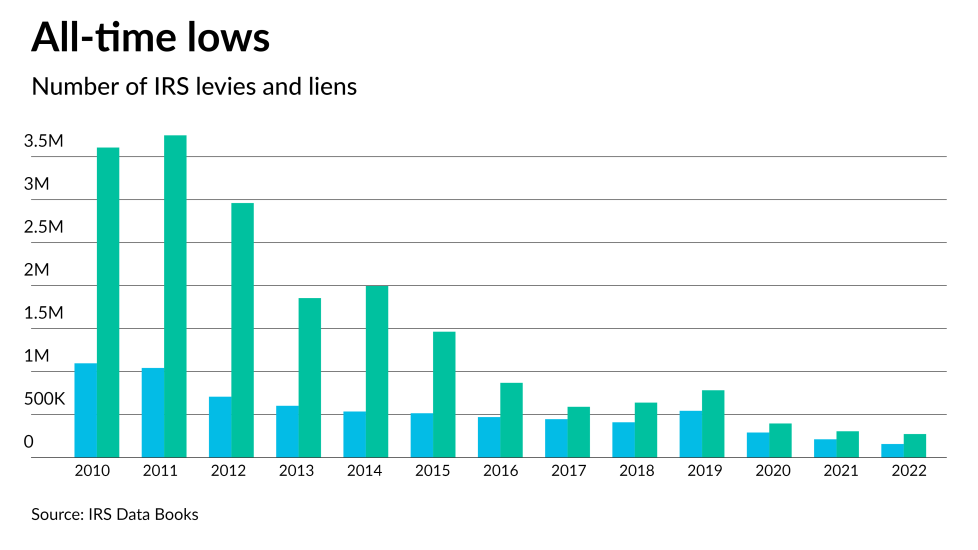

At the beginning of the COVID pandemic in March 2020, the Internal Revenue Service appropriately stopped most enforcement with its

Most audits, field collection and automated compliance notices were halted so the IRS could focus on the massive effort of distributing rounds of stimulus payments. Remote work also meant return-processing backlogs. The IRS struggled to get back to normal operations as the backlog of unprocessed returns

There were some attempts by the IRS to re-engage its collection enforcement operations. The service restarted some collection enforcement in 2020 and 2021, with mostly Social Security and starting income tax refund levy notices and some reminder notices — but this enforcement was short-lived due to mounting service needs. In

Campus compliance functions were not the only areas affected by the pandemic. IRS field collection (i.e., its "revenue officers") was also

IRS field collection gradually increased in 2022. Currently, with additional newly hired and trained revenue officers, field collection appears to be back to full capacity.

Overall, during the pandemic, the IRS rightfully put aside many of its enforcement functions in favor of helping taxpayers through the pandemic. To that end, there were tradeoffs in not enforcing collection during the pandemic. IRS data and changes to collection operations over the past four years show 10 clear lingering effects on post-pandemic IRS collection, which are detailed below.