Want unlimited access to top ideas and insights?

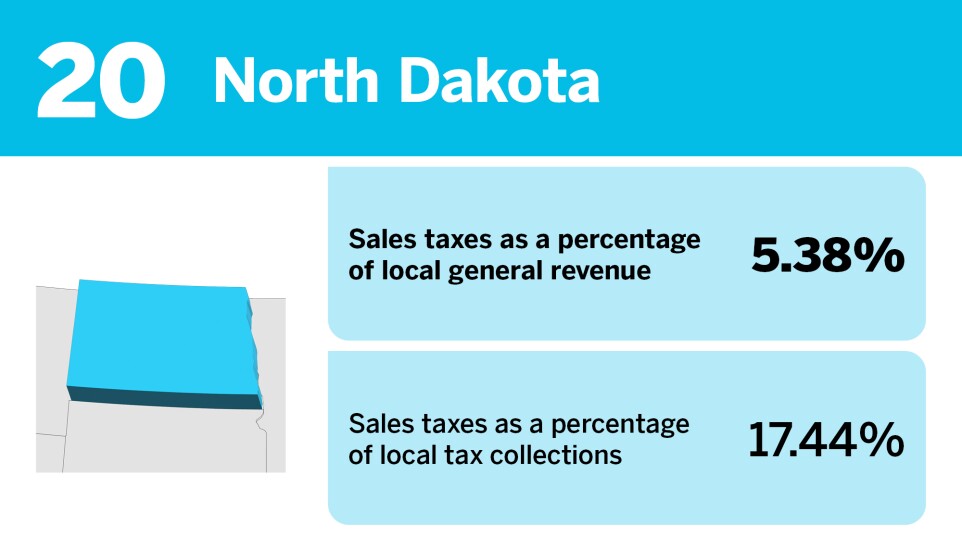

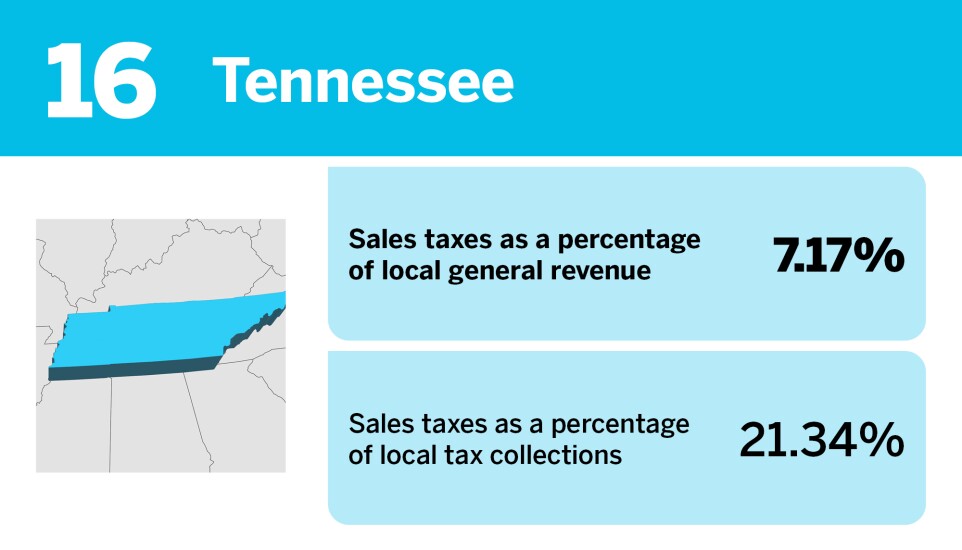

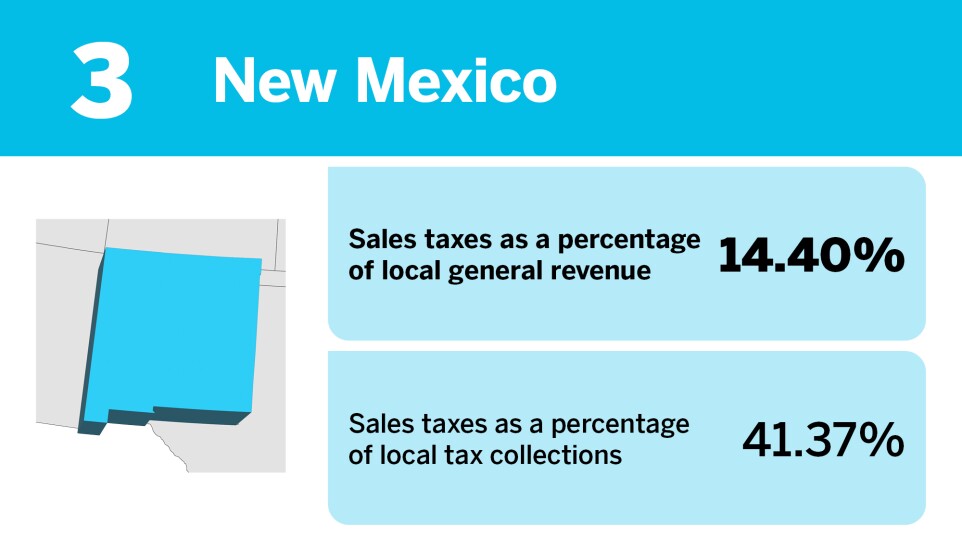

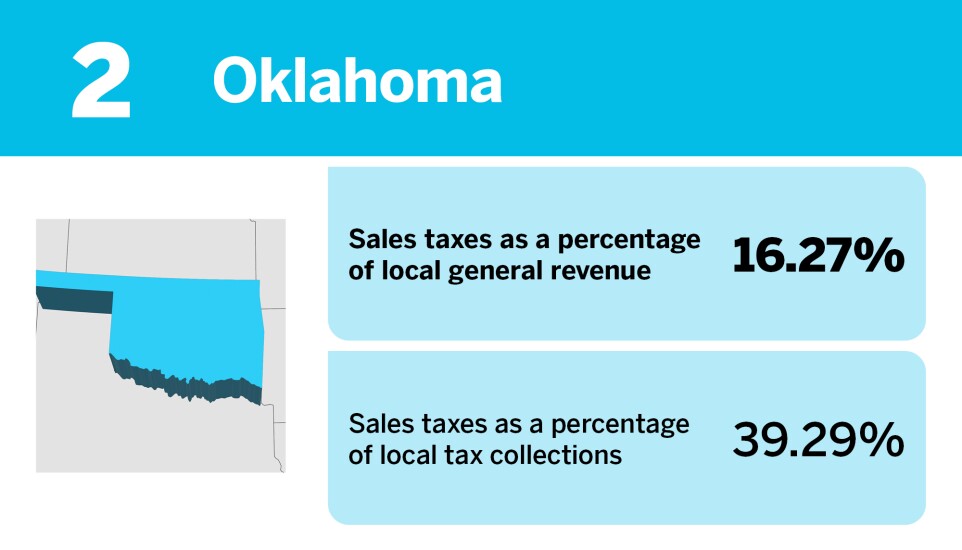

Thirty-six states and the District of Columbia utilize local sales tax as a major revenue source for local government, though the amount of revenue collected can vary significantly from state to state.

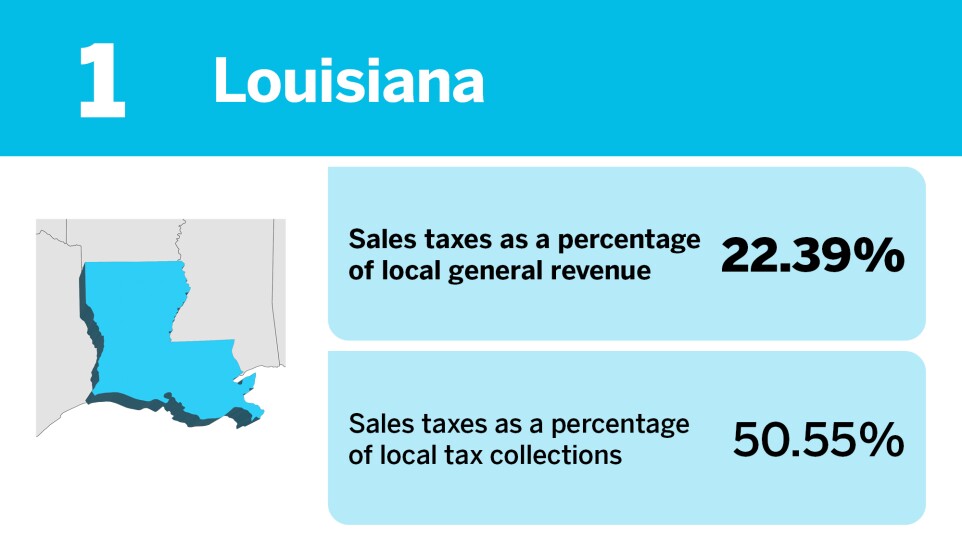

In the state that most relies on sales tax, for example, they account for more than 50.5% of local tax collections and 22.4% of local general revenue.

Read the complete ranking below on the states that rely the most on local sales taxes.

Source: