Want unlimited access to top ideas and insights?

Taxpayers who

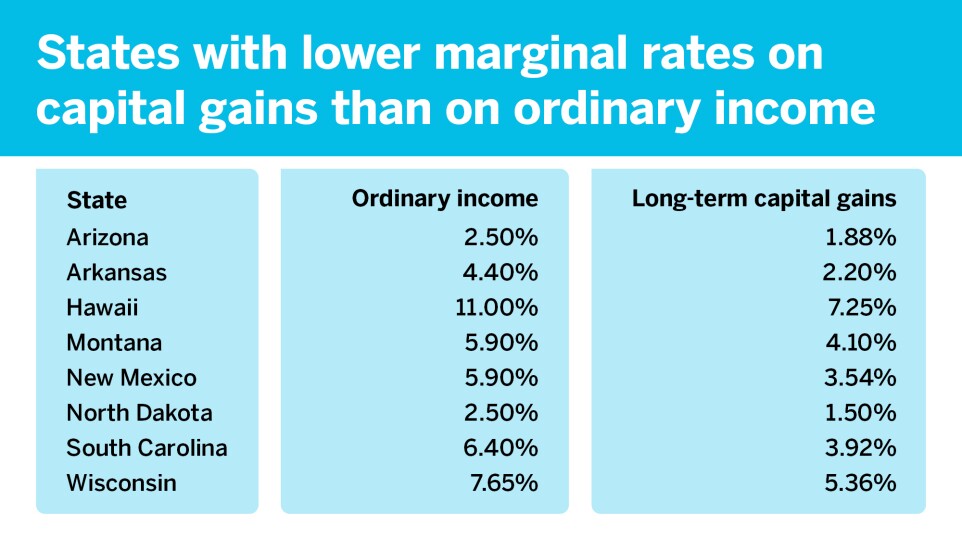

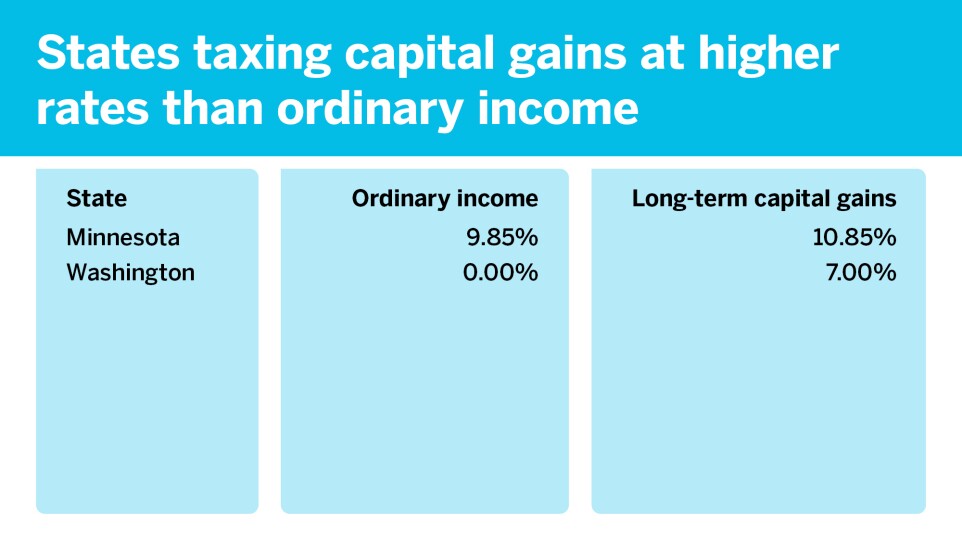

Eight states tax

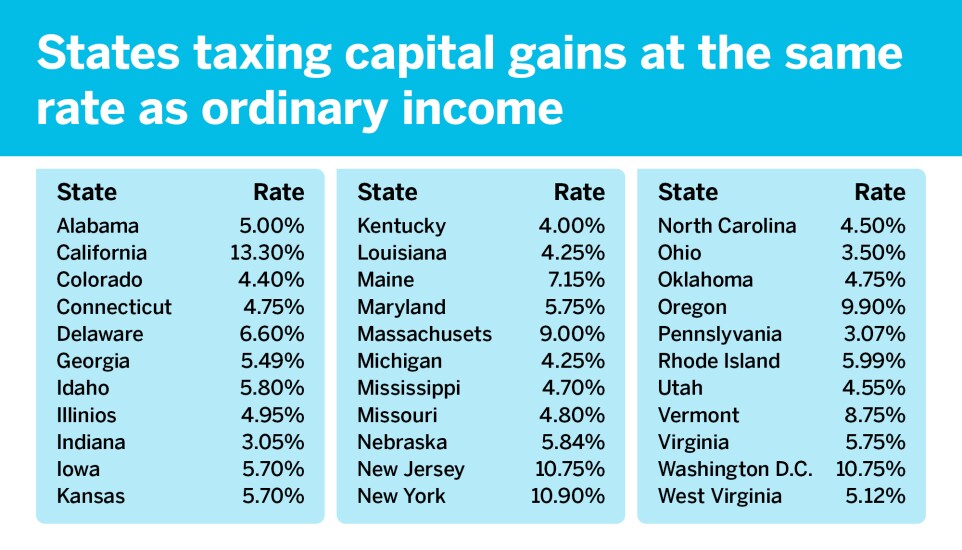

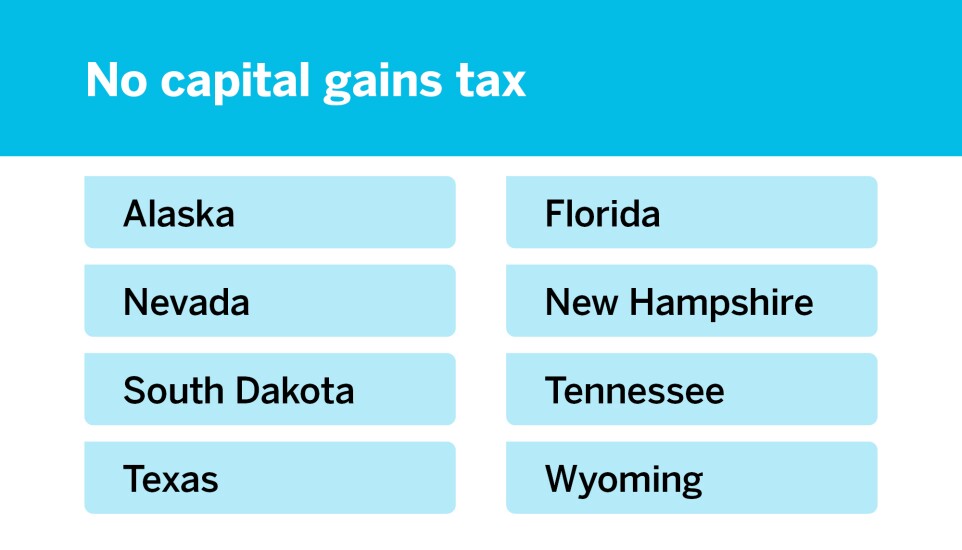

Scroll through below to learn more about the states and their tax rates on capital gains.

Source:

Taxpayers who

Eight states tax

Scroll through below to learn more about the states and their tax rates on capital gains.

Source:

Senate and House Democrats introduced legislation to bring back the Direct File free tax preparation program that was ended by the Trump administration.

The International Federation of Accountants released data on the growth of private equity in the global accounting profession.

Jim Peko, the CEO of Grant Thornton Advisors, says it was only by abandoning a vision of incremental change that the firm was able to achieve its current rapid growth.

The IRS terminated its collective bargaining agreement with the National Treasury Employees Union, which represents most IRS and Treasury Department employees.

The Pinpoint Policy Institute's public campaign against the Institute for the Fiduciary Standard reflects a mysterious phase of the ongoing debate on private investments in 401(k) plans.

The Top 25 Firm acquired MSTiller, expanding its presence in the Southeast.