Enjoy complimentary access to top ideas and insights — selected by our editors.

The choice between itemizing your deductions and taking the standard deduction — a decision that can have serious repercussions for a taxpayer's bill to the government — varies across income groups. As you might expect, those with more income are more likely to choose to itemize their deductions, while those earning less favor the standard deduction.

Taxpayers earning $1 million or more filed 168,831 returns with itemized deductions, compared to 116,226 returns with the standard deduction. Taxpayers earning less than $5,000 filed 120,949,008 returns with the standard deduction compared to 10,960,515 itemized deductions.

Read more about the standard deduction vs. itemized deductions across income groups.

Source: IRS

Standardized and itemized deductions across income groups

| Taxpayer AGI | Standard deduction (by number of returns) | Standard deduction (thousands of $) | Itemized (by number of returns) | Itemized (thousands of $) |

| Total returns | 120,949,008 | 2,363,845,187 | 10,960,515 | 445,268,286 |

| No AGI and deficit | 993,956 | 17,980,841 | 57,383 | 3,732,705 |

| $1 to under $5,000 | 5,500,241 | 69,855,352 | 82,033 | 3,122,943 |

| $5,000 to under $10,000 | 6,384,435 | 91,677,161 | 76,840 | 3,238,663 |

| $10,000 to under $15,000 | 7,352,036 | 121,394,158 | 83,780 | 3,950,492 |

| $15,000 to under $20,000 | 7,138,559 | 123,892,041 | 104,208 | 7,043,178 |

| $20,000 to under $25,000 | 6,577,054 | 115,979,586 | 123,022 | 7,478,122 |

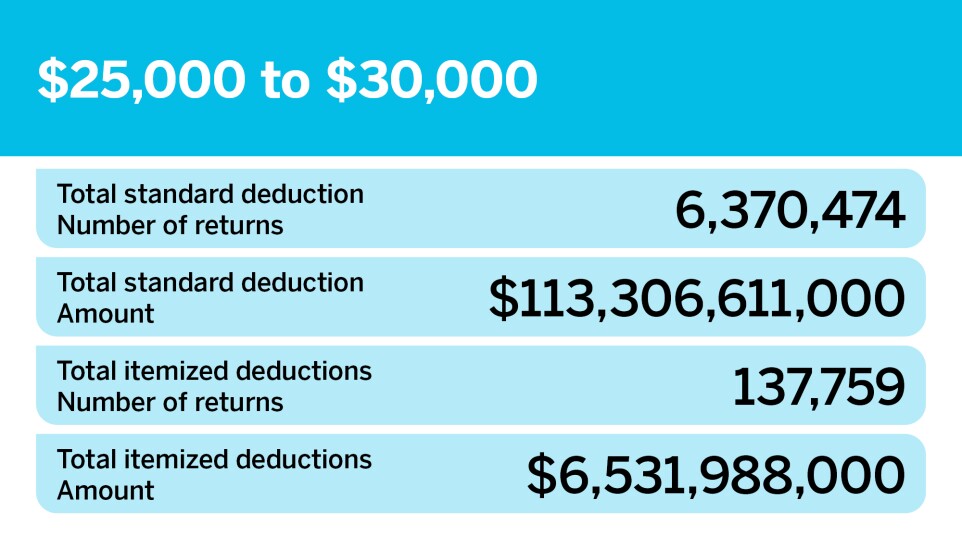

| $25,000 to under $30,000 | 6,370,474 | 113,306,611 | 137,759 | 6,531,988 |

| $30,000 to under $40,000 | 12,812,065 | 228,825,489 | 340,458 | 13,713,832 |

| $40,000 to under $50,000 | 11,063,326 | 200,374,140 | 419,518 | 15,783,907 |

| $50,000 to under $75,000 | 19,407,446 | 371,447,329 | 1,340,412 | 48,734,265 |

| $75,000 to under $100,000 | 11,828,444 | 257,659,519 | 1,463,500 | 50,880,577 |

| $100,000 to under $200,000 | 19,139,464 | 481,538,118 | 3,677,038 | 129,577,729 |

| $200,000 to under $250,000 | 2,698,753 | 71,560,045 | 864,072 | 33,507,132 |

| $250,000 to under $500,000 | 3,046,090 | 81,289,527 | 1,524,925 | 66,396,752 |

| $500,000 to under $1,000,000 | 520,439 | 13,960,552 | 4,96,736 | 28,663,127 |

| $1,000,000 or more | 116,226 | 3,104,718 | 168,831 | 22,912,874 |