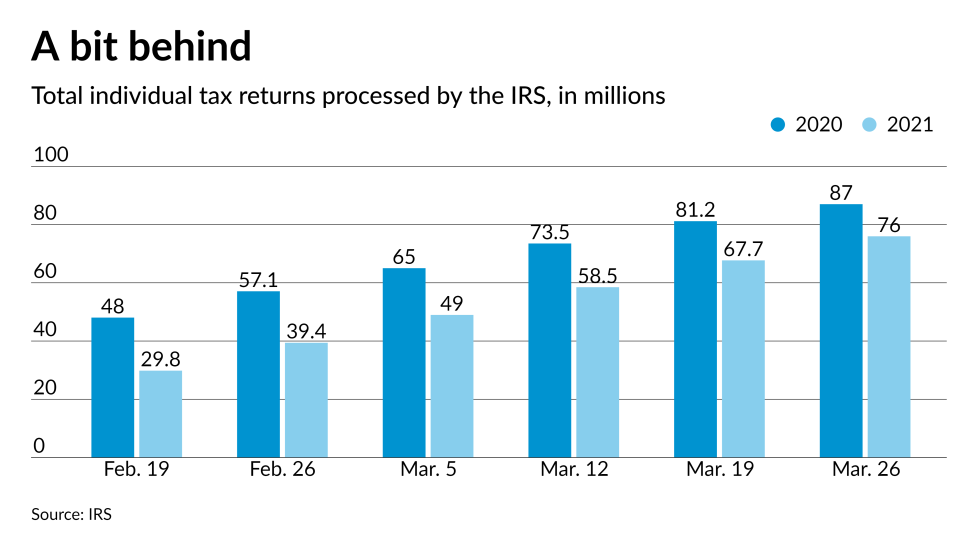

If your firm is like most, you know all about the long hours and stress leading up to the tax deadline in a typical year. That is why so many firms don’t consider doing tax planning during these pivotal months. However, with the IRS recently extending the tax deadline to May 17, you now have 32 extra days. Could you conceivably fit some tax planning into your schedule, even if you’ve never done tax planning before? Let’s consider it.