Ryan LLC CEO Brint Ryan is donating $30 million to his alma mater, the University of North Texas; and New Jersey Society of CPAs CEO Ralph Thomas will appear live on a local PBS station to answer property tax questions.

RYAN LLC

The donation will support business research through academic endowments, as well as funds to support various program initiatives.

“I’m so proud of G. Brint Ryan and I am pleased to celebrate his achievements and his commitment to ensuring that UNT’s business students receive the very best education possible," stated UNT president Neal Smatresk. "Like Brint, UNT students have always been hard-working, passionate contenders who want to make a difference in the world. The impact of this generous gift will be transformational for today’s students and the generations to come. It will further UNT’s ability to drive progress and enable our continued success as a top-tier university, especially at a critical time when we are gaining momentum in many areas.”

The commitment will create at least six endowed chairs and provide funding for academic programs over the next seven years. Programs will focus on taxation and tax research, entrepreneurship, finance, logistics, information technology, cybersecurity and behavioral accounting.

“My experience at UNT transformed me," said Ryan in a statement. "It opened my eyes to a world of incredible possibility. The skills and lessons I learned at UNT enabled me to build and lead a fantastic team of people to the top of the global tax services and software business. I’m thrilled to be able to share some of that success with UNT business students and faculty. This gift will help the College of Business attract and retain some of the best minds in the field, enabling us to be more competitive and more effective in our mission at UNT.”

The naming of the G. Brint Ryan College of Business will go into effect after final approval from the UNT System Board of Regents at their quarterly meeting this February.

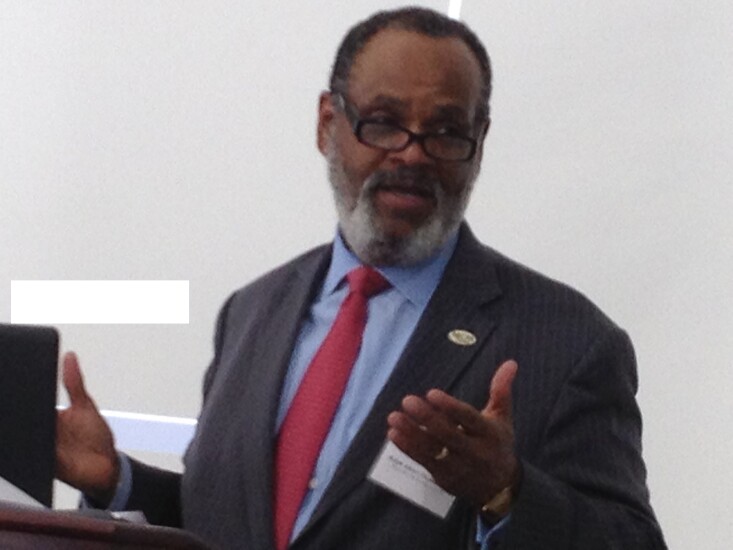

NJCPA

Hosted by NJTV business correspondent Rhonda Schaffler, the program will stream live on NJTV’s

The panel is part of a three-part series. The first session will focus on property taxes, with viewers asked to submit their property tax questions directly to the panelists

A second session on Feb. 20 will discuss the impact of property taxes on the New Jersey real estate market, featuring representatives from the local housing market. A third session on Feb. 27 will go over changes in tax law as well as state and local tax deductions with panelists (and NJCPA members) Kenneth Bagner, a partner at Sobel & Co., and Karen Artasanchez, a shareholder at WilkinGuttenplan. These two sessions will also stream at noon on NJTV’s Facebook and YouTube pages.

“With New Jersey’s high property taxes, it’s important to inform the public about where our tax dollars go and to discuss how they are calculated,” stated Thomas. “Shows like this help to keep the topic of taxes at the forefront of residents' and business owners’ minds.”

The NJCPA recently released a new property tax booklet, New Jersey Homeowner’s Guide to Property Taxes, which will be discussed during the first PBS session. The guide is available online