Taxpayers must meet certain criteria to qualify for claiming the Child Tax Credit for the 2023 tax year, including having an eligible child dependent under 17 at the end of the year.

This child would have to live with the taxpayer for more than half of the year, and the taxpayer must have an annual income of no more than $200,000 if filing individually or $400,000 if filing a joint return.

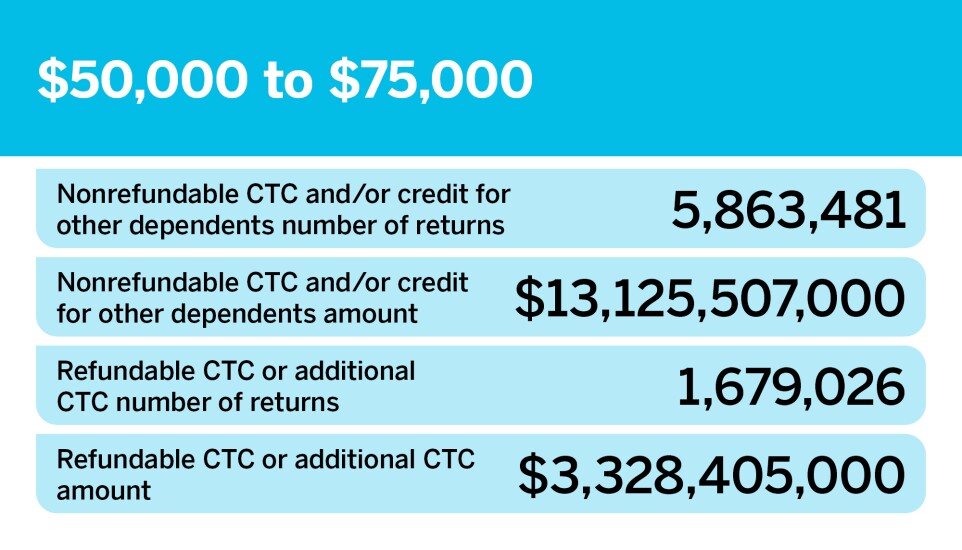

Those in the middle-income groups are more likely to receive refundable CTC, with those earning between $50,000 and $75,000 filing 1,679,026 refundable CTC claims and receiving a total of $3,328,405,000 in refunds.

Read more about who is filing for the CTC.

Source:

CTC filings across income groups

| CTC | Nonrefundable CTC and/or credit for other dependents (number of returns) | Nonrefundable Child Tax Credit and/or credit for other dependents (In thousands of $) | Refundable CTC or additional CTC (in thousands of $) | |

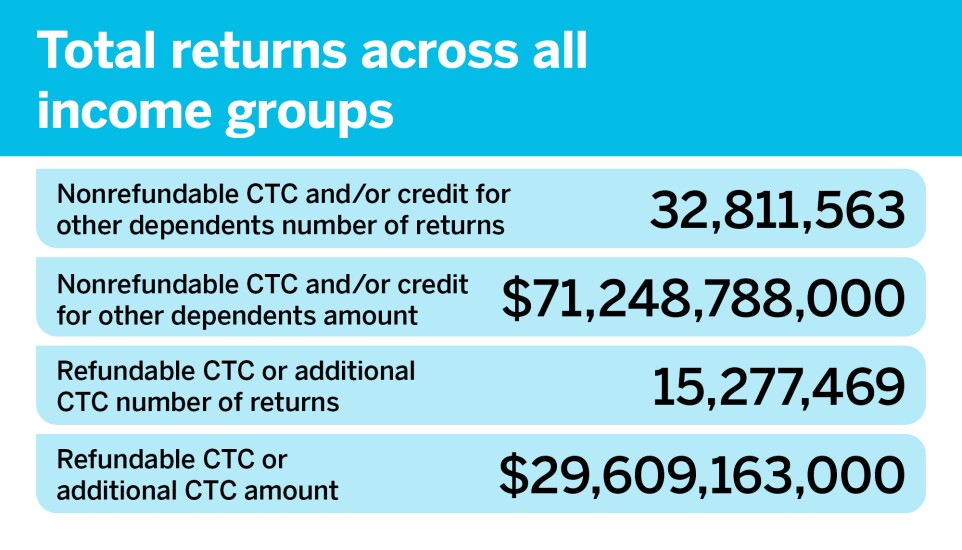

| Total returns | 32,811,563 | 71,248,788 | 15,277,469 | 29,609,163 |

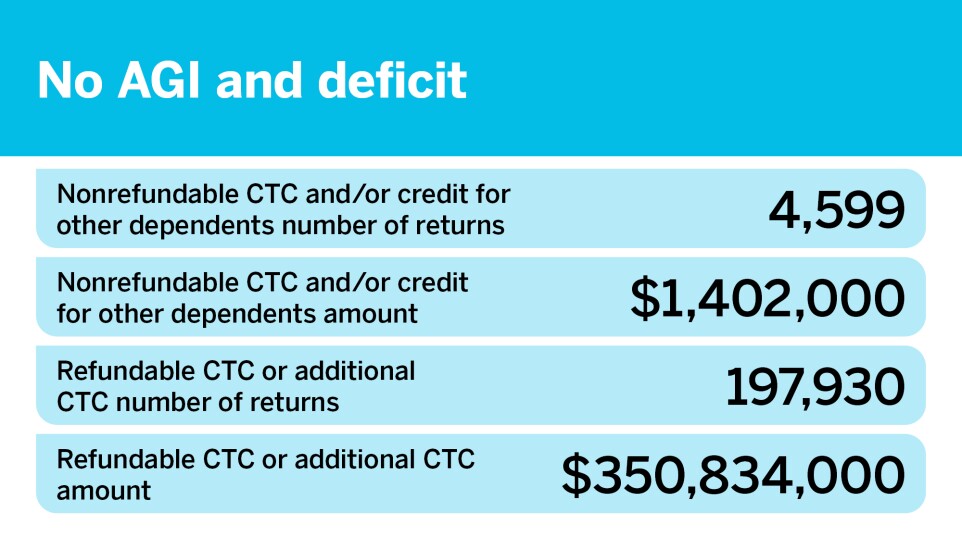

| No AGI and deficit | 4,599 | 1,402 | 197,930 | 350,834 |

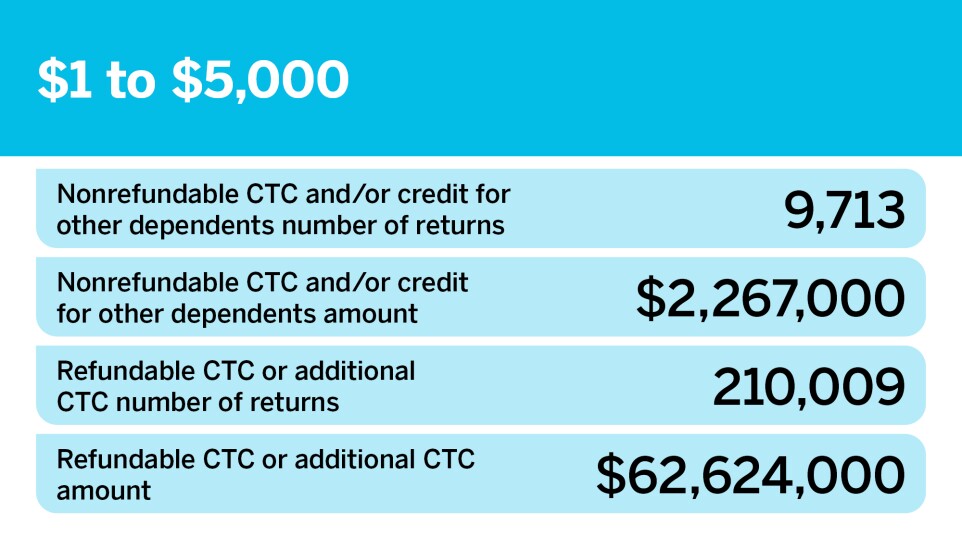

| $1 to under $5,000 | 9,713 | 2,267 | 210,009 | 62,624 |

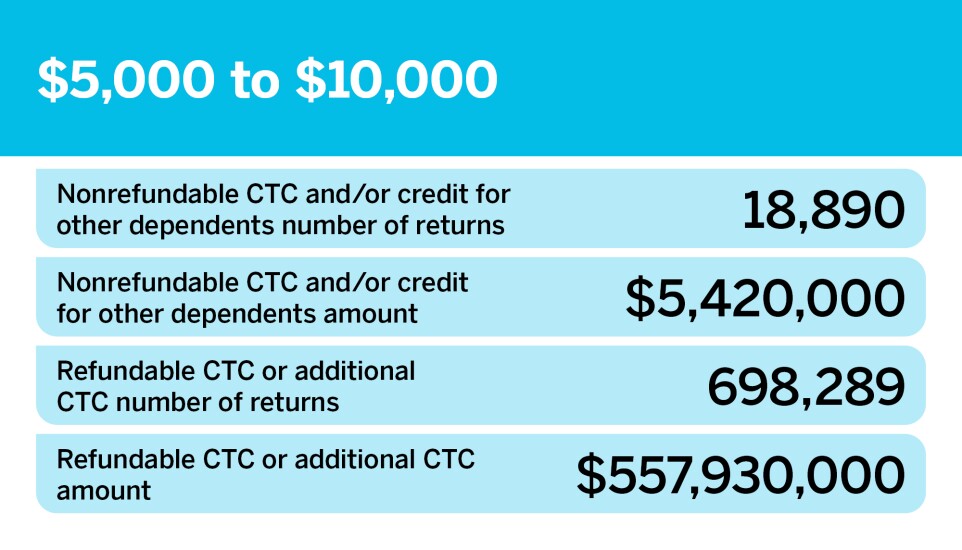

| $5,000 to under $10,000 | 18,890 | 5,420 | 698,289 | 557,930 |

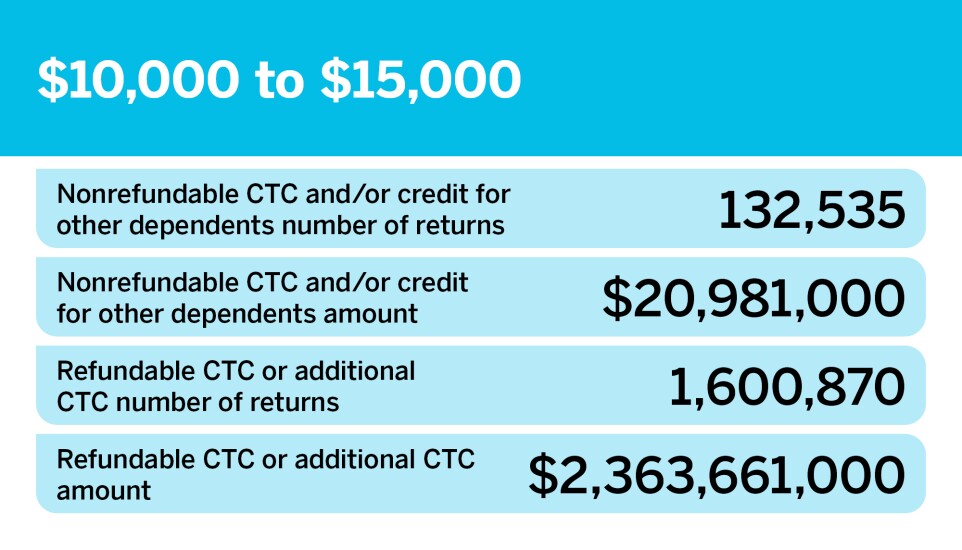

| $10,000 to under $15,000 | 132,535 | 20,981 | 1,600,870 | 2,363,661 |

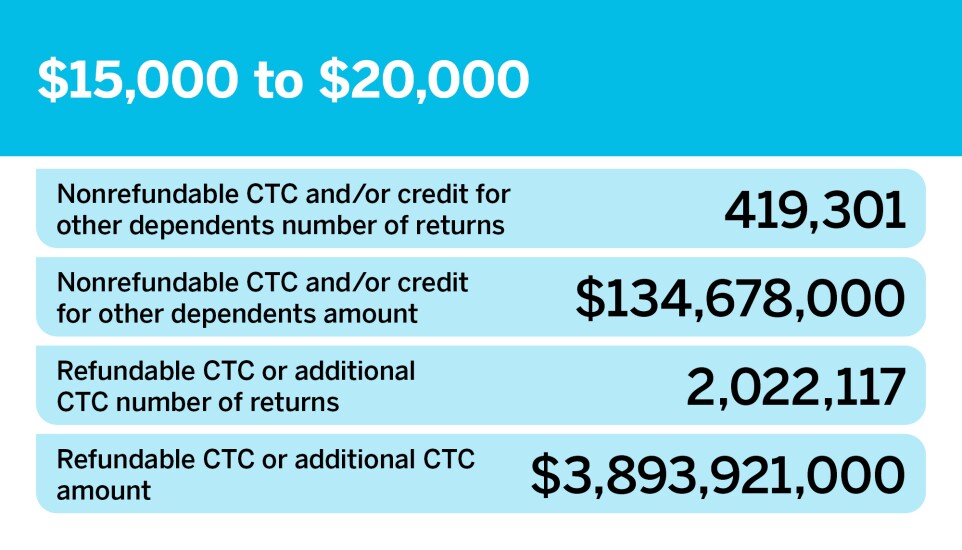

| $15,000 to under $20,000 | 419,301 | 134,678 | 2,022,117 | 3,893,921 |

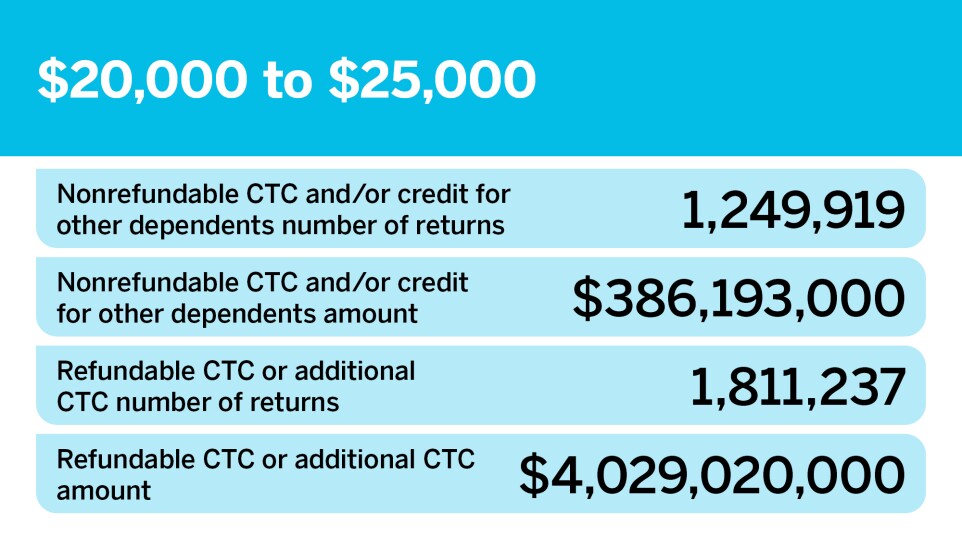

| $20,000 to under $25,000 | 1,249,919 | 386,193 | 1,811,237 | 4,029,020 |

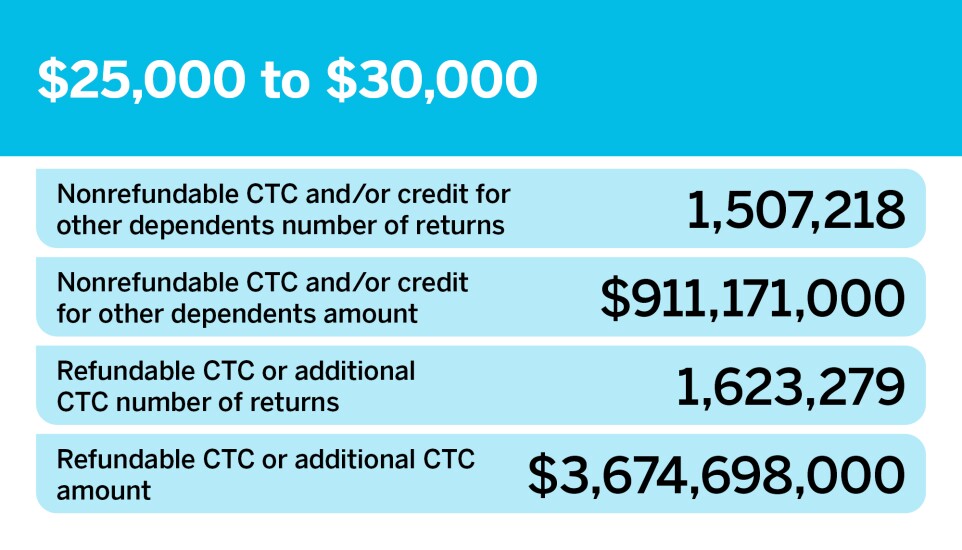

| $25,000 to under $30,000 | 1,507,218 | 911,171 | 1,623,279 | 3,674,698 |

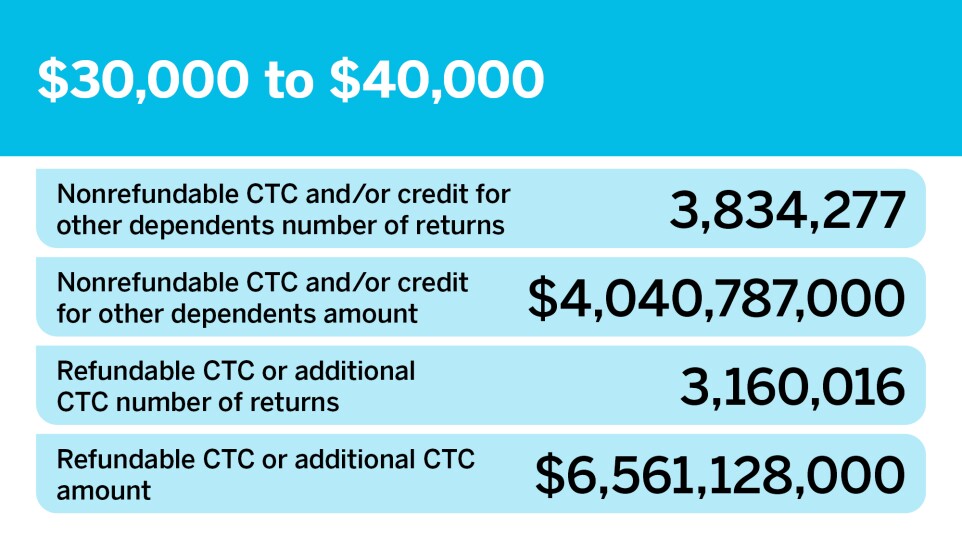

| $30,000 to under $40,000 | 3,834,277 | 4,040,787 | 3,160,016 | 6,561,128 |

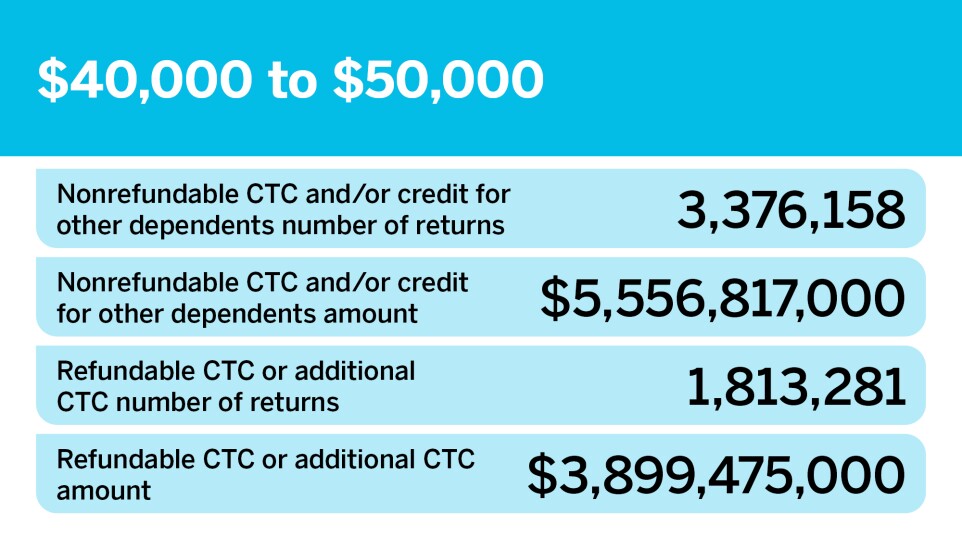

| $40,000 to under $50,000 | 3,376,158 | 5,556,817 | 1,813,281 | 3,899,475 |

| $50,000 to under $75,000 | 5,863,481 | 13,125,507 | 1,679,026 | 3,328,405 |

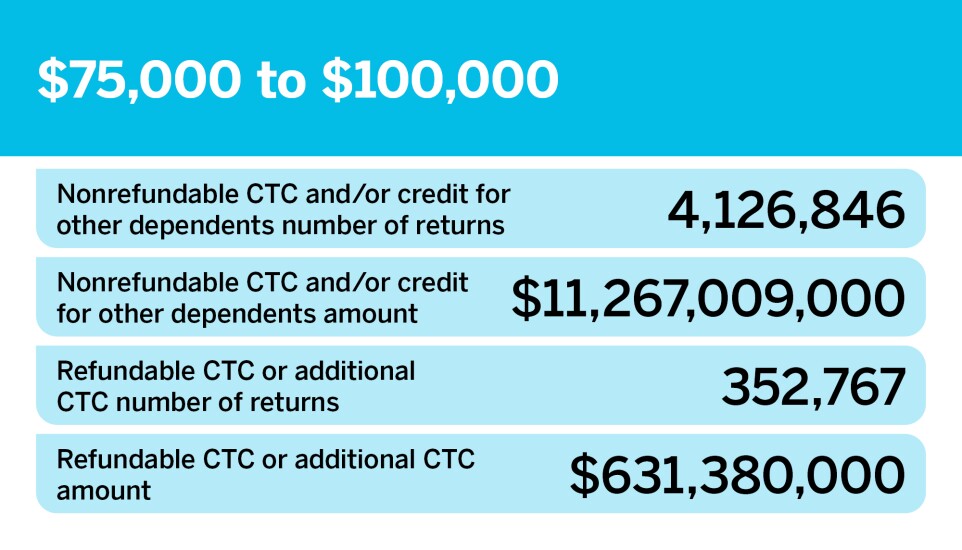

| $75,000 to under $100,000 | 4,126,846 | 11,267,009 | 352,767 | 631,380 |

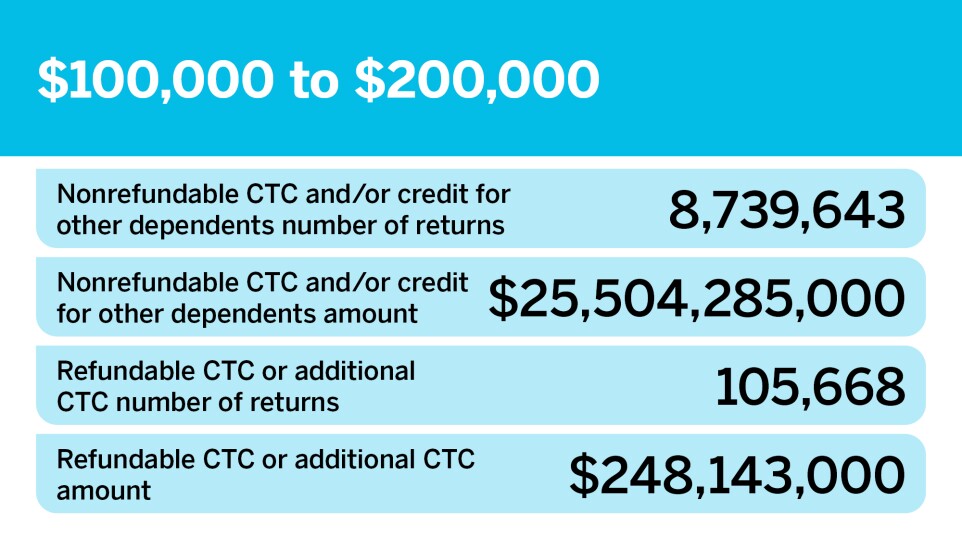

| $100,000 to under $200,000 | 8,739,643 | 25,504,285 | 105,668 | 248,143 |

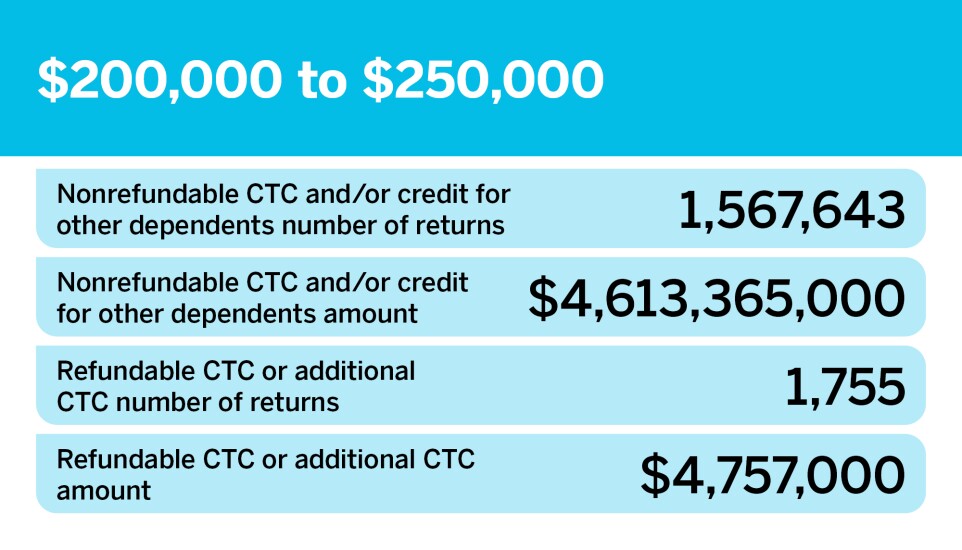

| $200,000 to under $250,000 | 1,567,643 | 4,613,365 | 1,755 | 4,757 |

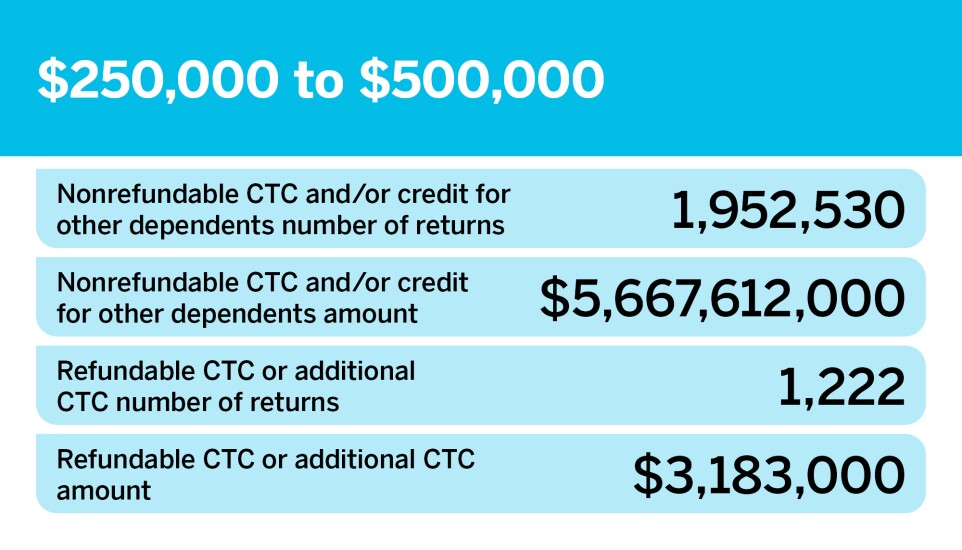

| $250,000 to under $500,000 | 1,952,530 | 5,667,612 | 1,222 | 3,183 |

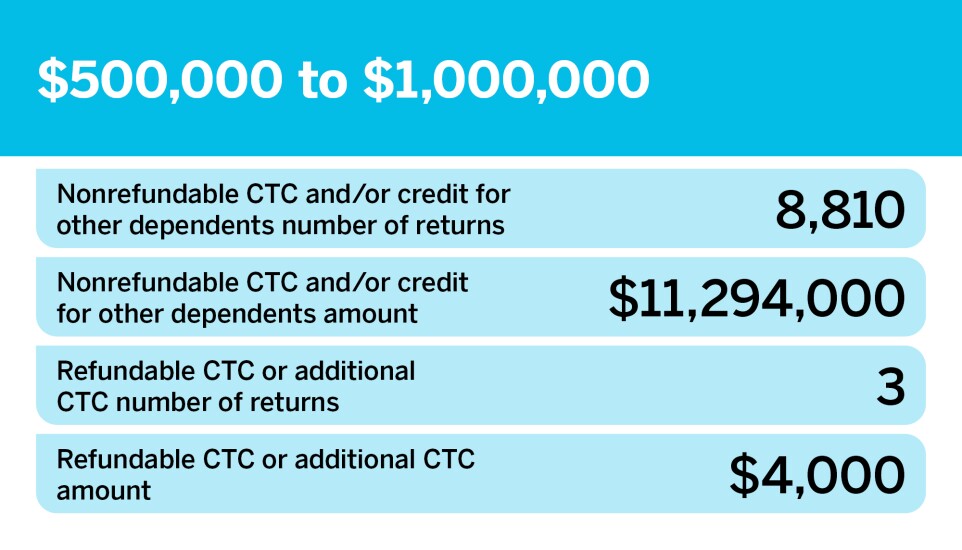

| $500,000 to under $1,000,000 | 8,810 | 11,294 | 3 | 4 |

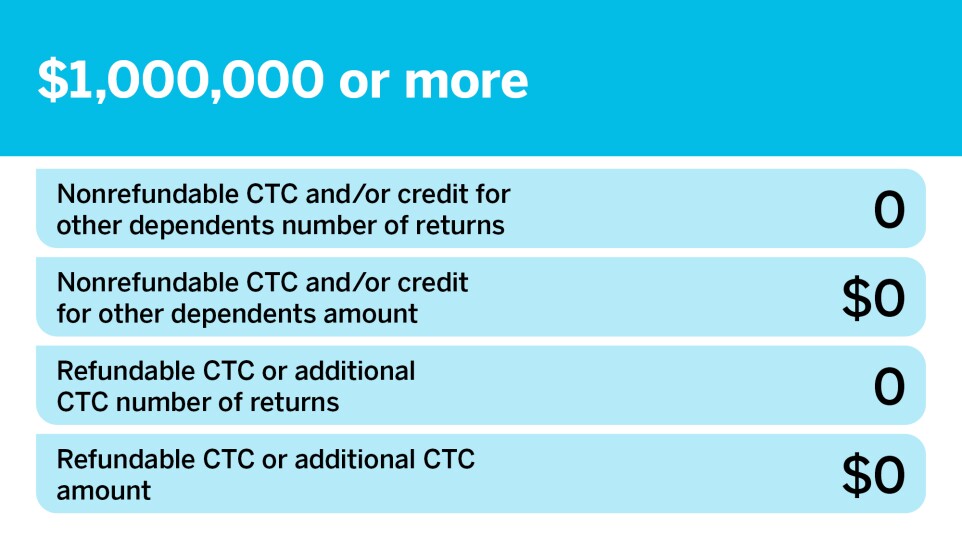

| $1,000,000 or more | 0 | 0 | 0 | 0 |