Accountants favor Donald Trump in the upcoming presidential election by a large margin, according to a recent survey — and regardless of who they're voting for, they expect the state of the country and the economy to improve significantly after Nov. 3.

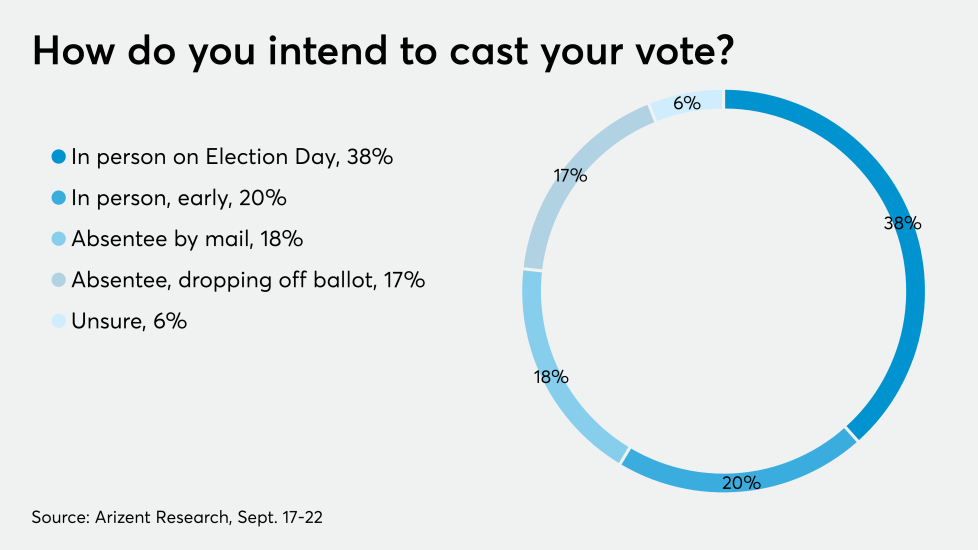

In a survey of over 400 accountants from across the country conducted by Arizent, the publisher of Accounting Today, 55 percent of respondents said that they plan to vote for the incumbent president, against 38 percent who plan to vote for his rival, Democrat Joe Biden. (See the data, below.)

That disparity, however, only hints at the depths of the polarization between supporters of the two candidates.

"I believe a Biden-Harris win would destroy the country. If this is the outcome, small business will suffer tremendously. I also believe the country that we know will drastically change and it will be difficult to recover," said one, reflecting a concern about Democratic plans and policies that many fellow accountants reported sharing. (All responses were anonymous.)

Said another, "I will close my business and retire if Harris/Biden is elected."

An accountant who opposes the president, on the other hand, said, "I've never been much into politics, but Trump is such a threat to the U.S. that I could no longer sit on the side lines and not express my opinion. I believe If Trump is re-elected, it will be a disaster for the country, the environment, and the health and well-being of the nation."

Respondents on both sides were convinced that this is an unusually consequential election, comparing it to turning-point contests in 1800, 1860 and 1964. A number also expressed concerns about the overall political system in the U.S., with some describing it as "broken," and others calling for term limits on politicians at all levels, as well as worries about the integrity of the electoral process and the possibility for disruptive delays in counting ballots.

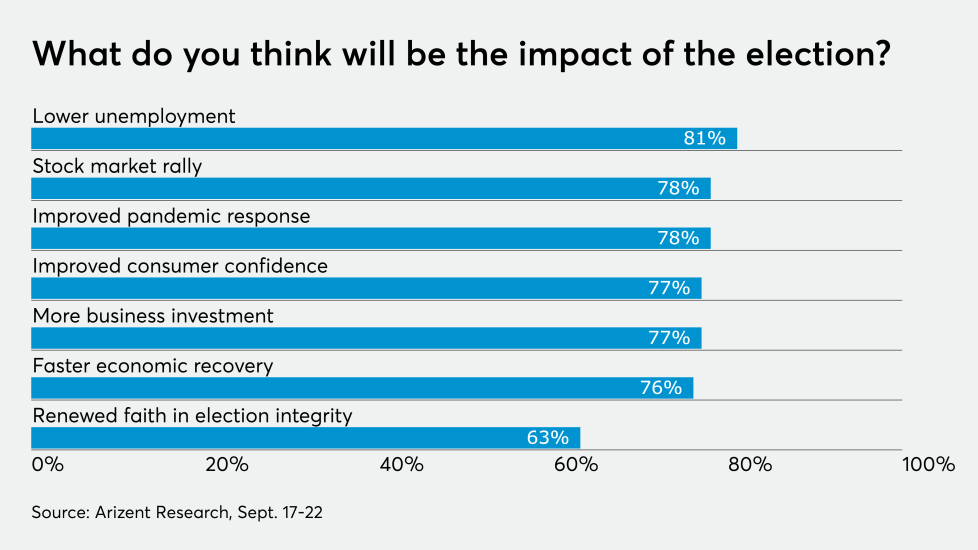

The accountants surveyed nonetheless overwhelmingly expected the election to lead to a stock market rally (78 percent), lower unemployment (81 percent) and an improved response to the COVID-19 pandemic, among many other positive results.

The tax impact

As accountants, some respondents naturally had opinions on the likely tax impacts of the election, and most of those who shared their thoughts believed that a Democrat victory would result in higher taxes.

"If we end up with a Democratic presidency and Democratic control of both houses, then the 2017 tax act will probably be vitiated and as much as the market increased due to the lower corporate rates, it will fall," predicted one respondent. "Ironically, raising the corporate rate will almost certainly cause less government revenue due to multinational business fleeing our shores, and less capital gains income tax income."

"Taxes are going to increase no matter who is elected," warned another accountant. "They have to, because of all the money given to aid individuals and business during the COVID-19 pandemic. If Trump is elected, the economy will continue to grow and the nation will sputter a bit, but when a vaccine is developed things will take off again and the tax increases will be lower than if Biden is elected. If Biden is elected, we can look forward to a depression comparable to the 1920s."

A third respondent, however, took a different view. "If we do not address wealth inequalities the U.S. will go further into absolute discontent. I have a hard time explaining to my lower-income clients the reason they are not getting a refund as they always did, or why they owe money. The tax reform of 2018 benefits the rich and businesses. I have nothing against that, but it must create a benefit and protect the middle class. If not, the division in this country will grow larger and larger."

(See comparisons of the presidential candidates' proposed tax policies