A proposed revision to the standard withholding document heralds major changes.

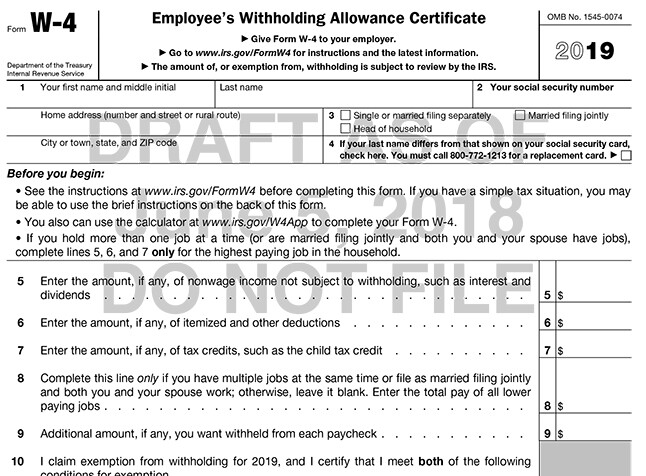

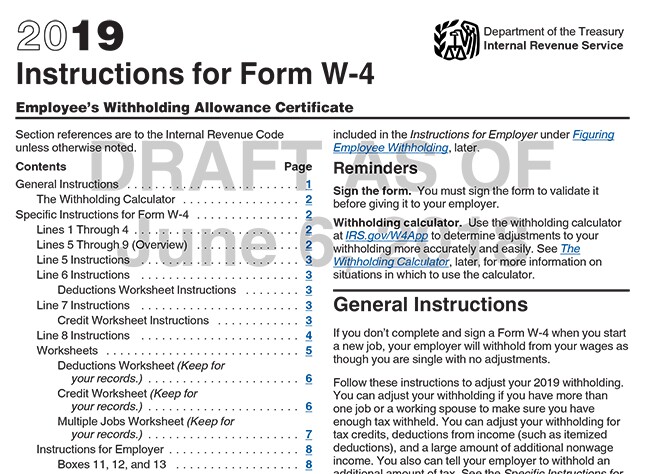

And in June, they released a draft of a proposed version of Form W-4, “Employee’s Withholding Allowance Certificate,” along with new instructions for filling it out. Here are some of the highlights.

No allowances

Tell us more

Groups like the American Institute of CPAs and the National Association of Enrolled Agents have pointed out that not all employees will be comfortable sharing some of this information with their employers.

Shorter … or not

Between the extra information and the extra calculations suggested in the instructions and other IRS guidance, the result will be something like what industry experts have described as a “mini-1040” that will allow taxpayers to much more accurately determine the appropriate withholding.

No change at all, unless you want it

Take a look