Want unlimited access to top ideas and insights?

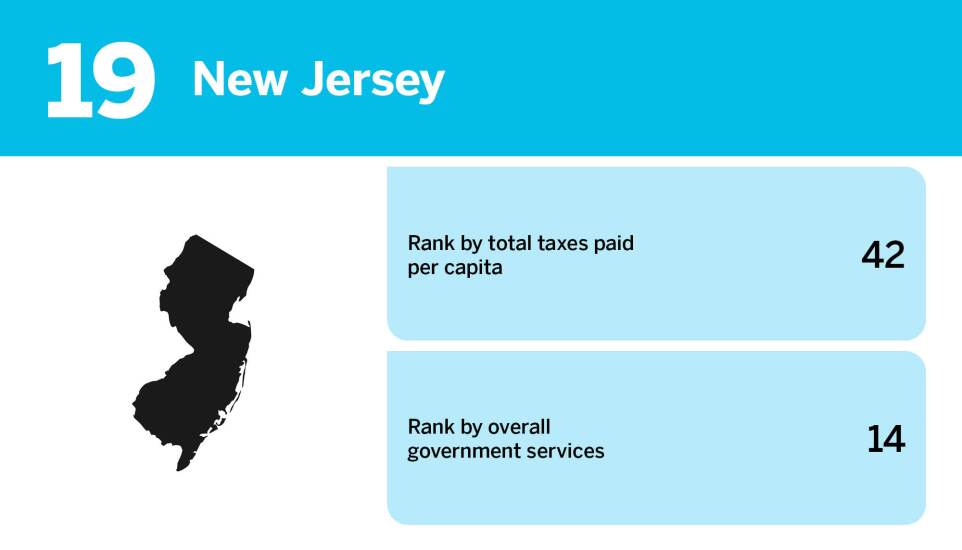

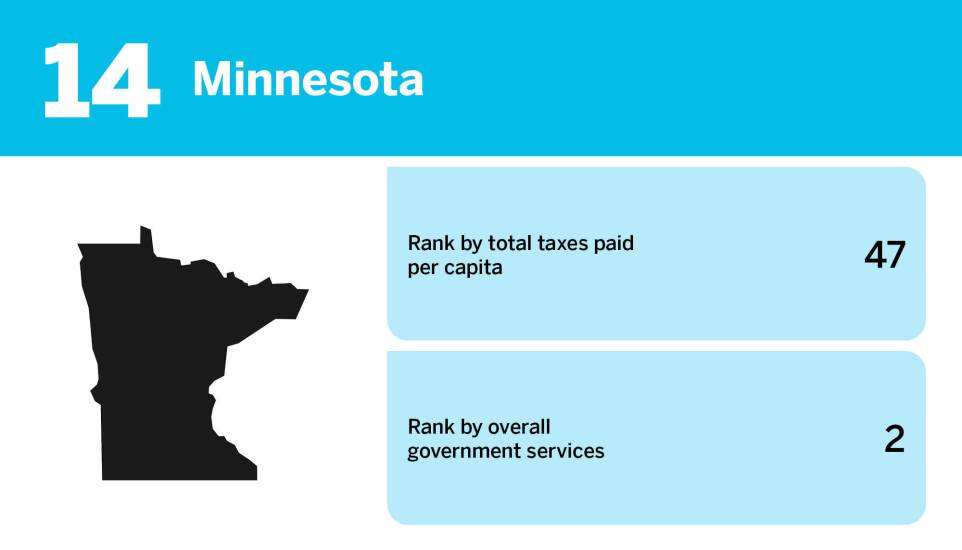

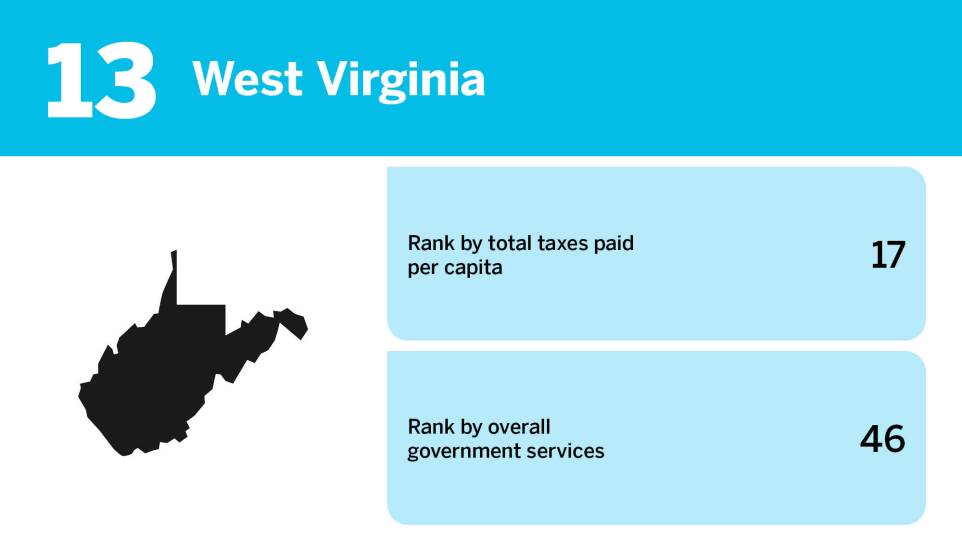

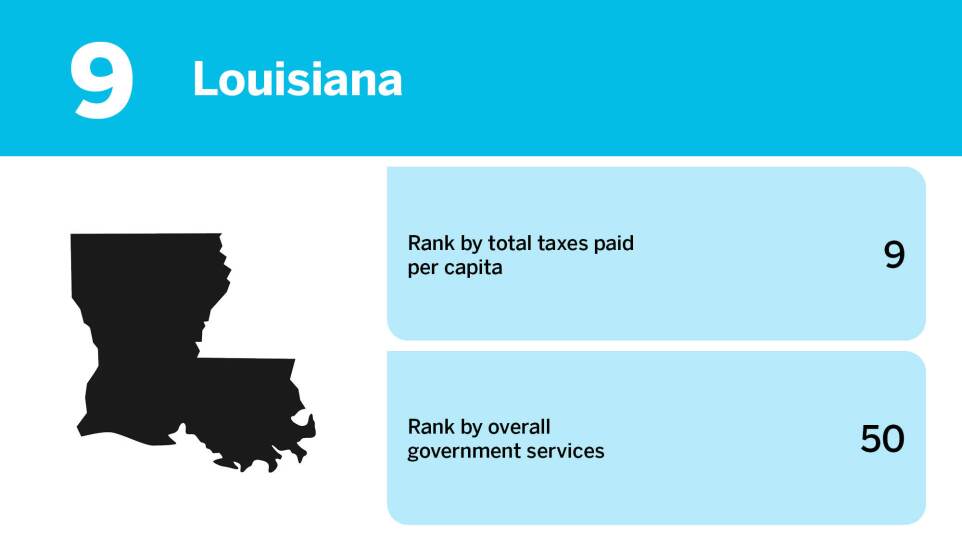

Tax rates vary greatly from state to state, and living in a high-tax state doesn't necessarily mean high-quality services — but if you make the move to live in a low-tax state, will you end up getting low-quality services?

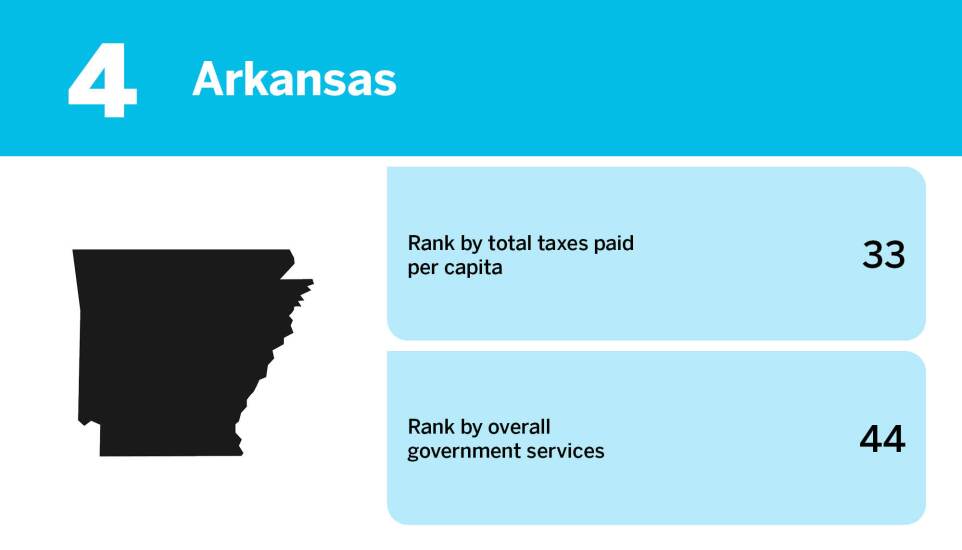

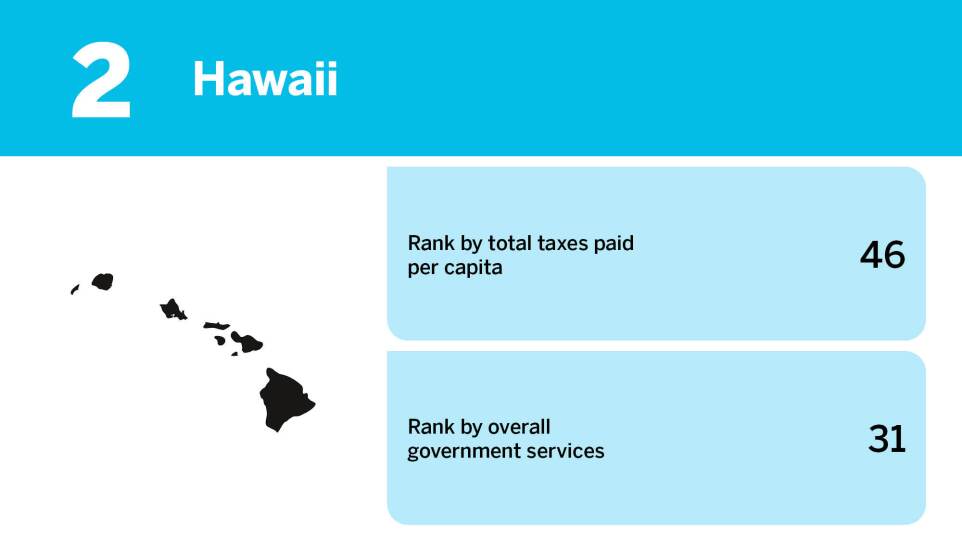

To compare return on investment for taxpayers between states, WalletHub looked at the quality of government services offering each state, including education, health, safety, economy, and infrastructure, versus the total state and local taxes that residents pay.

Within these categories, they ranked each state on a descending scale, with 1 being the best (i.e., having the best services, or having the lowest taxes).

From there, they determined the overall taxpayer ROI ranking by comparing each state's overall government services score to its score on total taxes paid per capita (with "per capita" including the population aged 18 and older).

Scroll through the ranking to see which states were in the bottom 20 for ROI and how they fared (and check out

Source: