Want unlimited access to top ideas and insights?

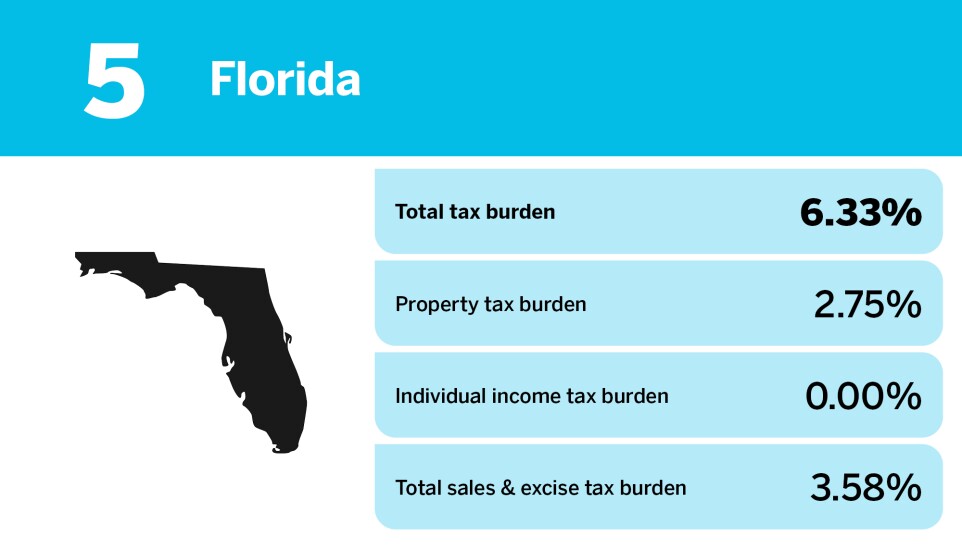

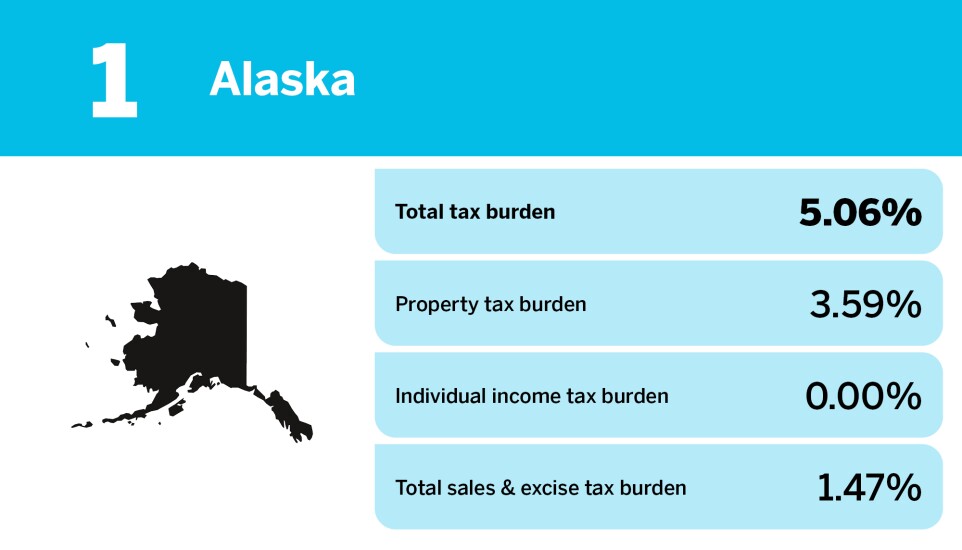

The best five states in the ranking have an average total tax burden of 5.97%. The average property tax burden is 2.96% in these states.

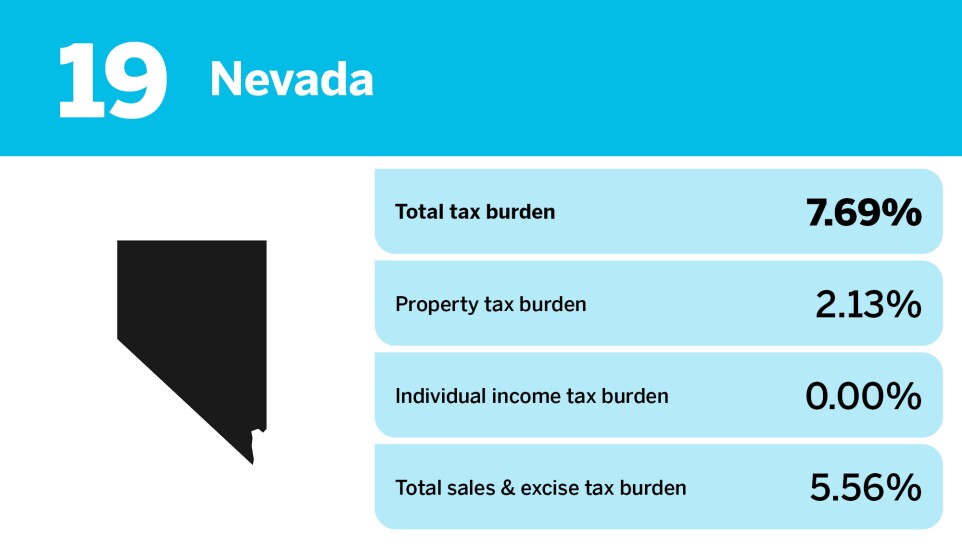

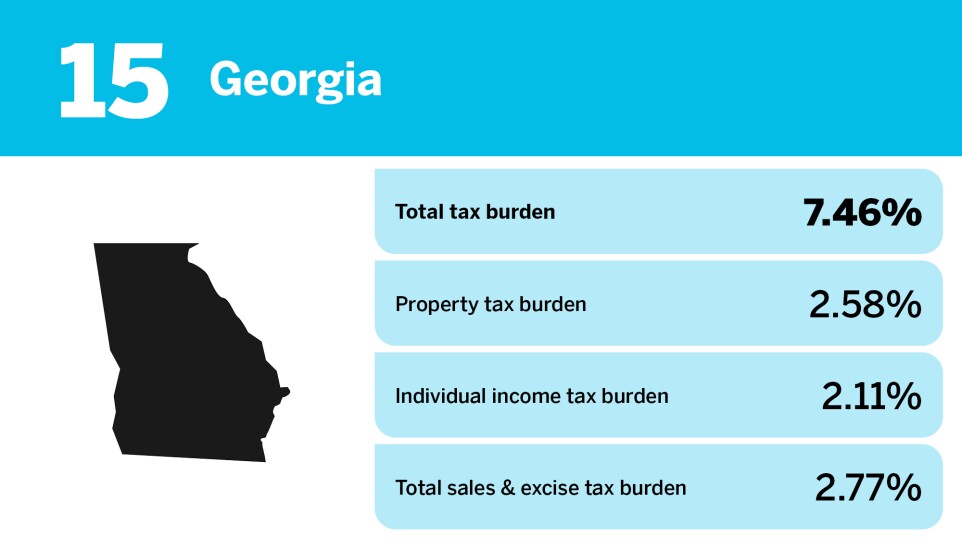

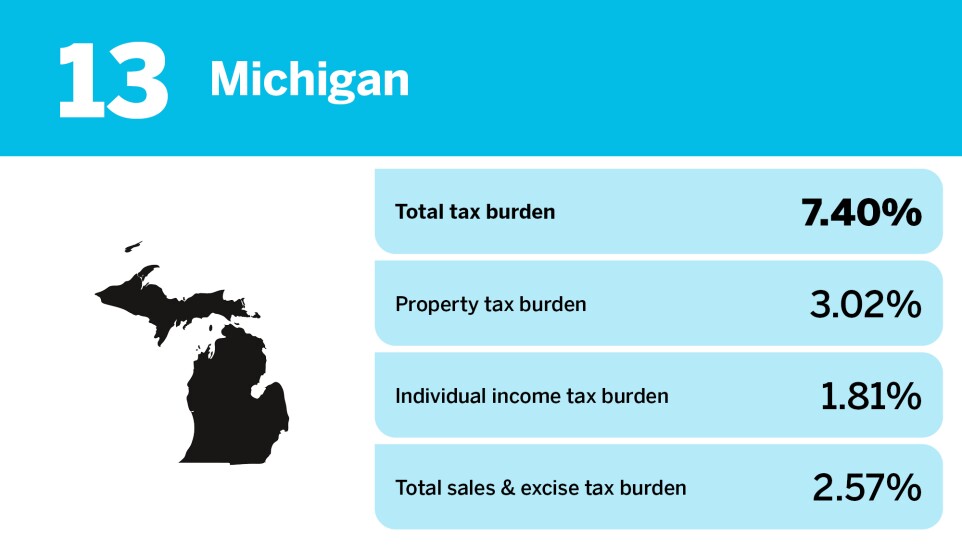

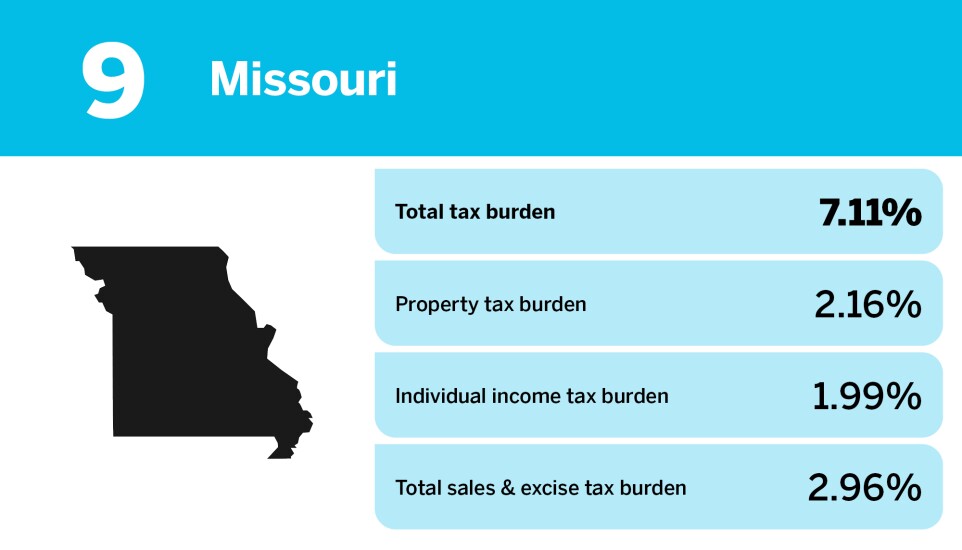

Scroll through to see which states are in the top 20 and how they tax their citizens (and

Source: