Enjoy complimentary access to top ideas and insights — selected by our editors.

Want unlimited access to top ideas and insights?Subscribe Now

Want unlimited access to top ideas and insights?

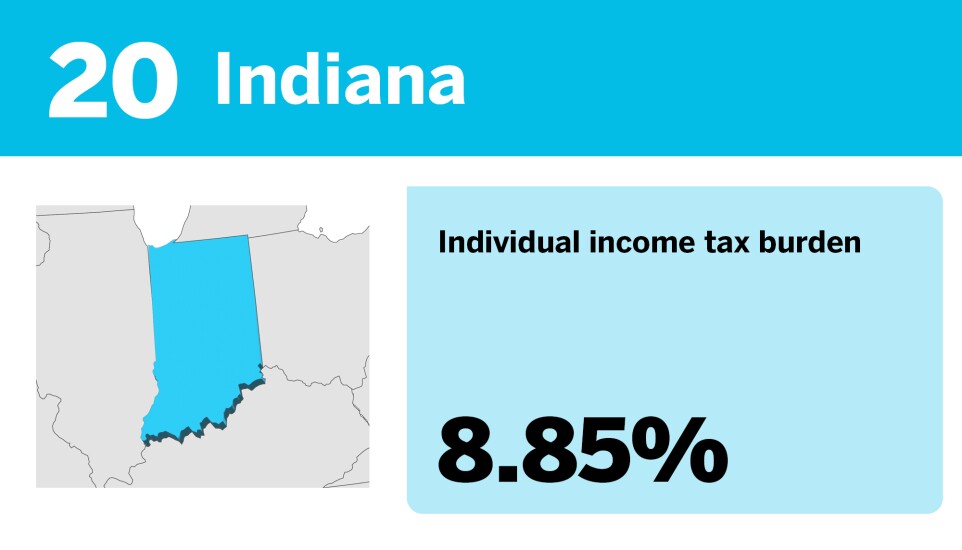

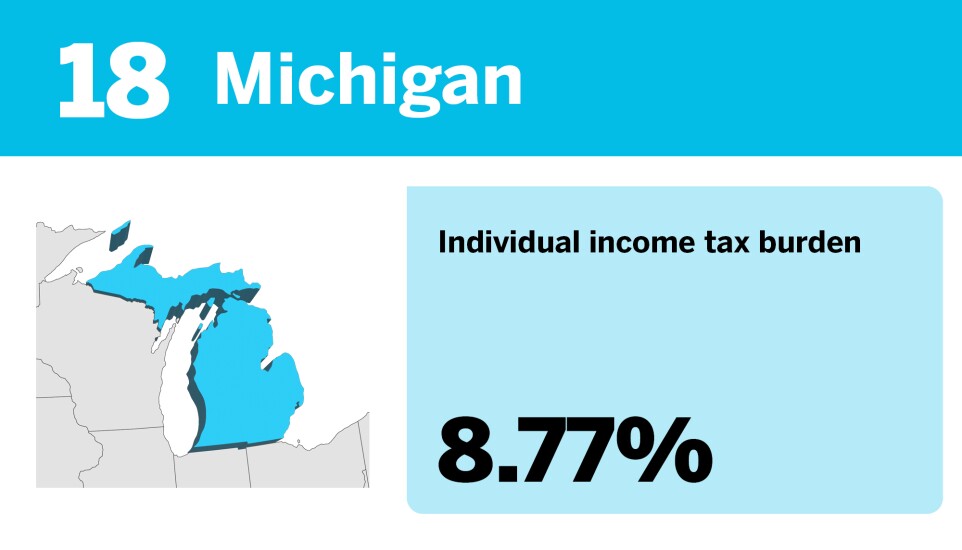

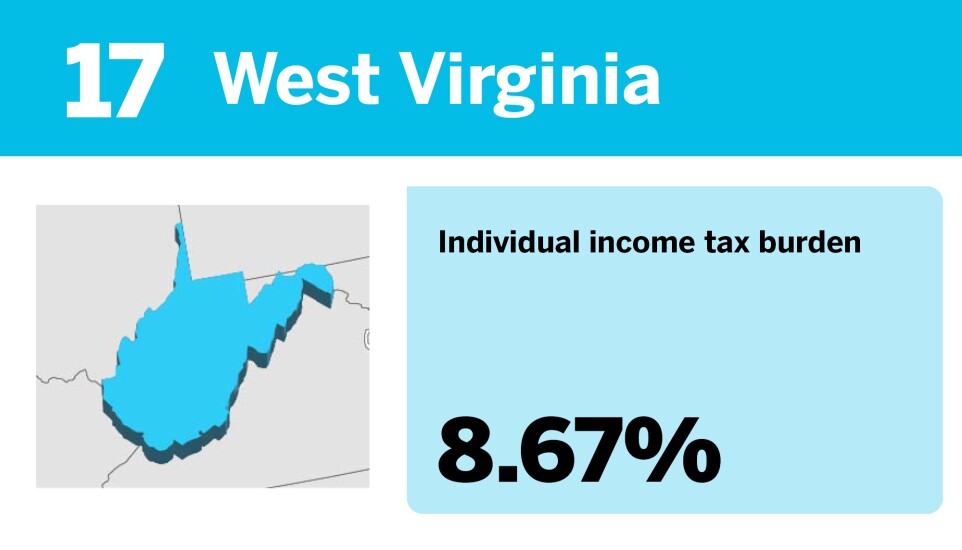

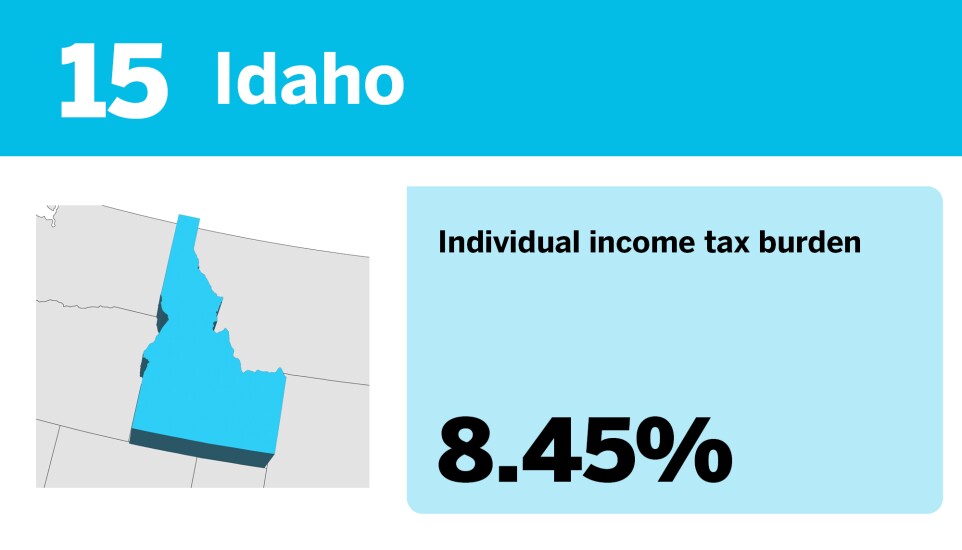

While high earners already tend to pay a smaller percentage of their income in taxes, residents in the top income brackets can get even more out of their money and spend even less on taxes depending on where they live.

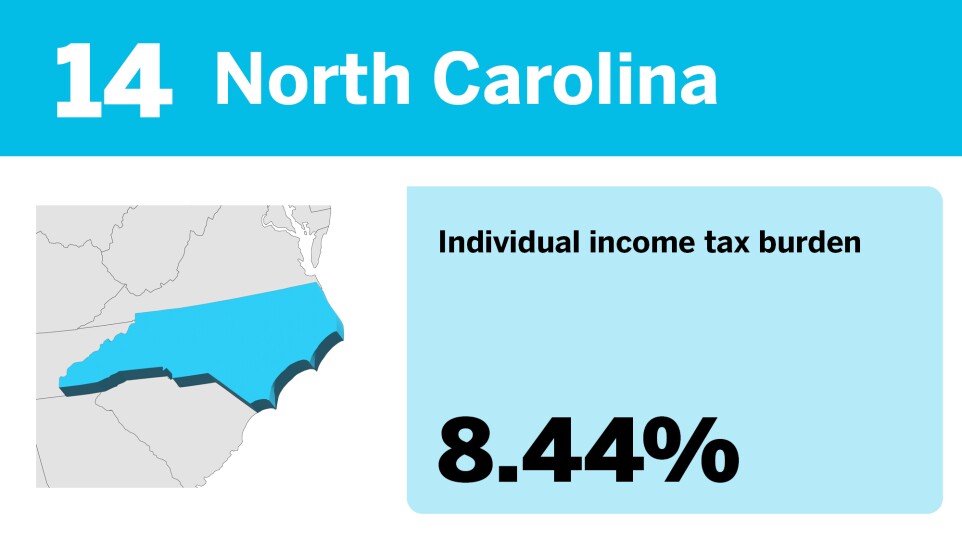

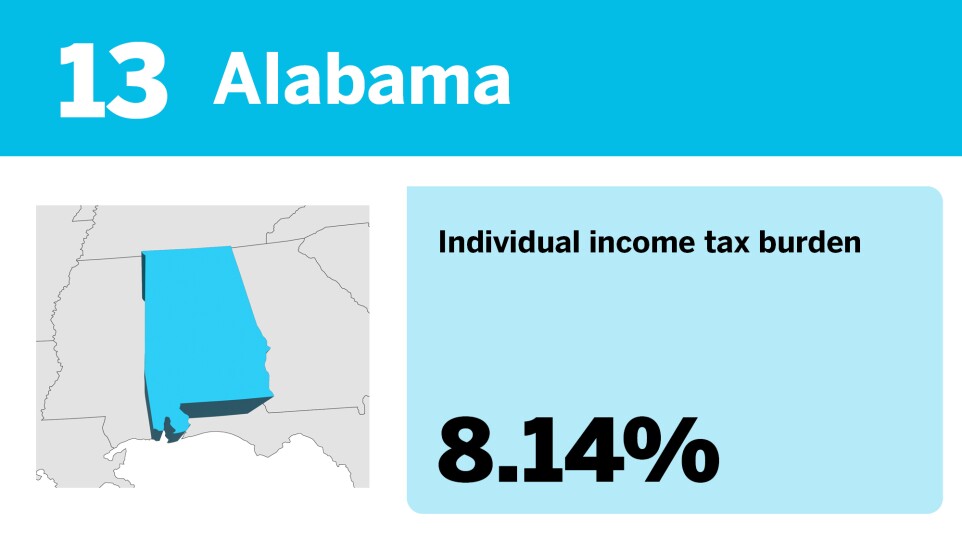

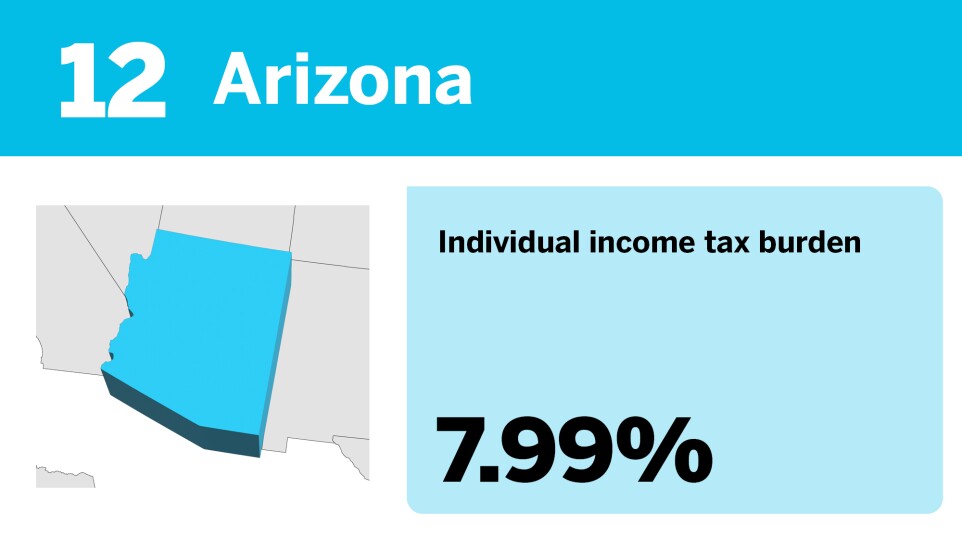

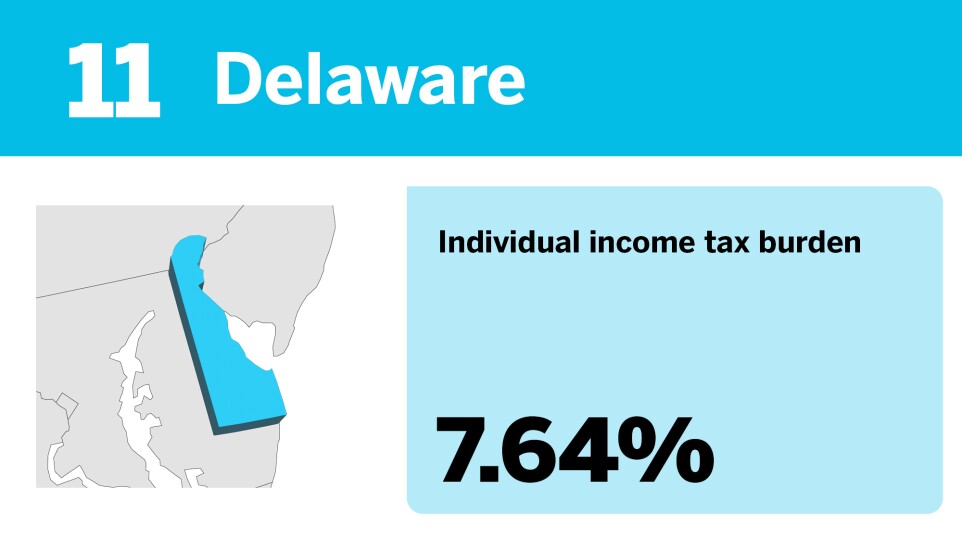

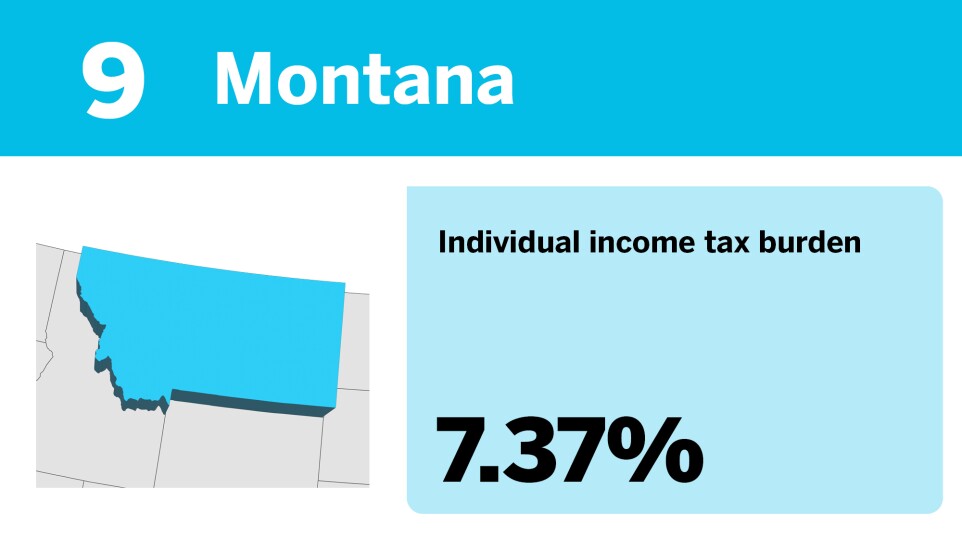

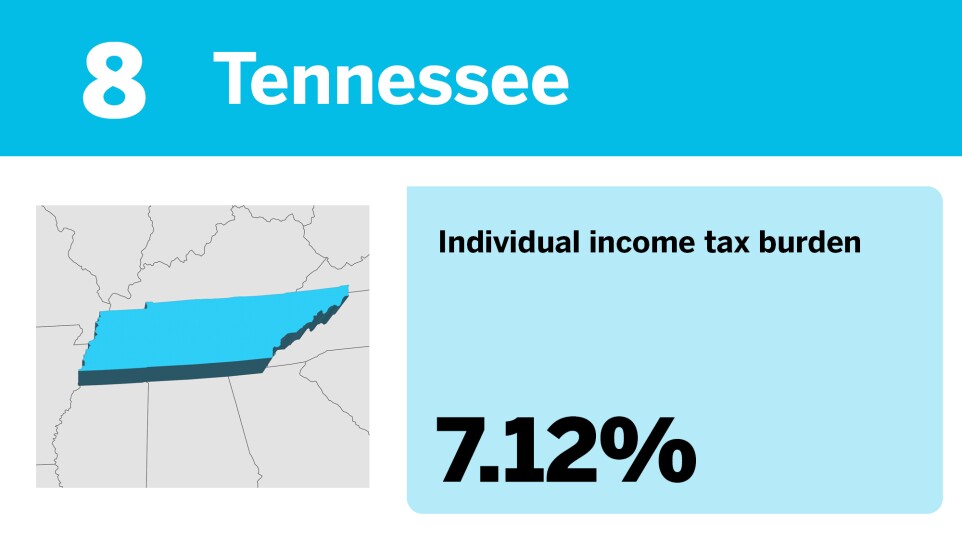

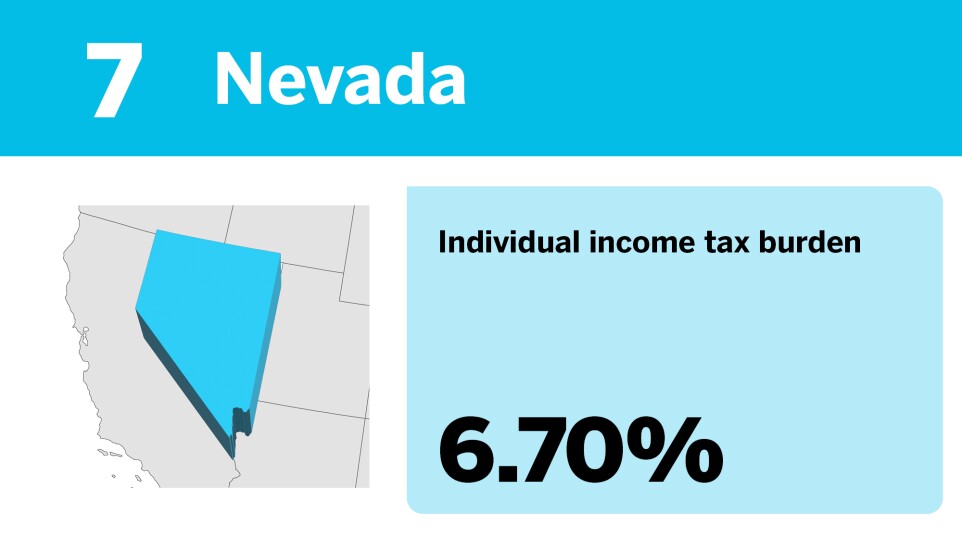

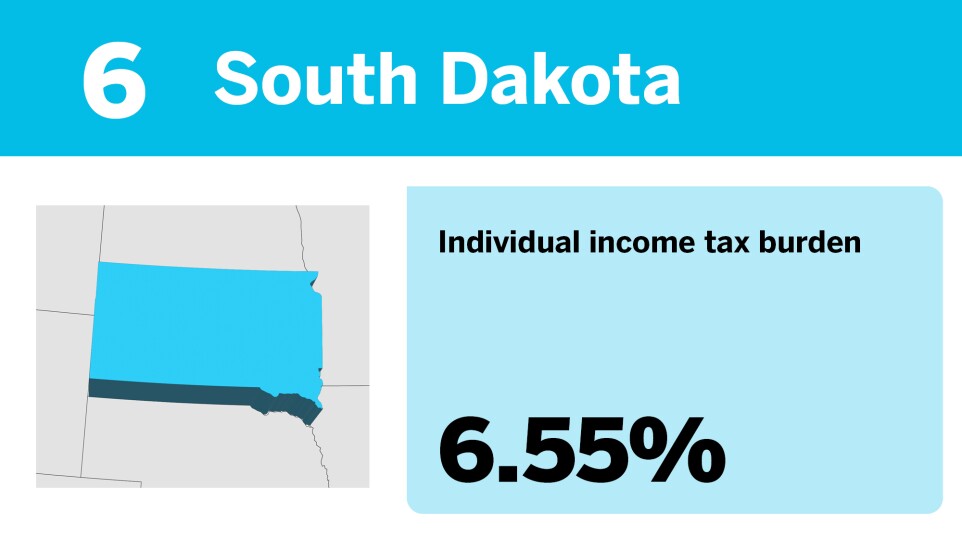

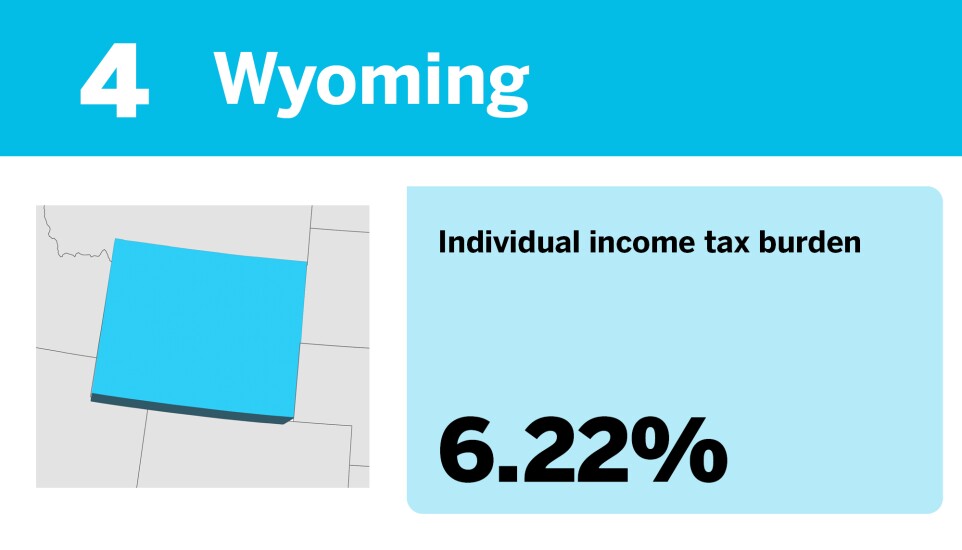

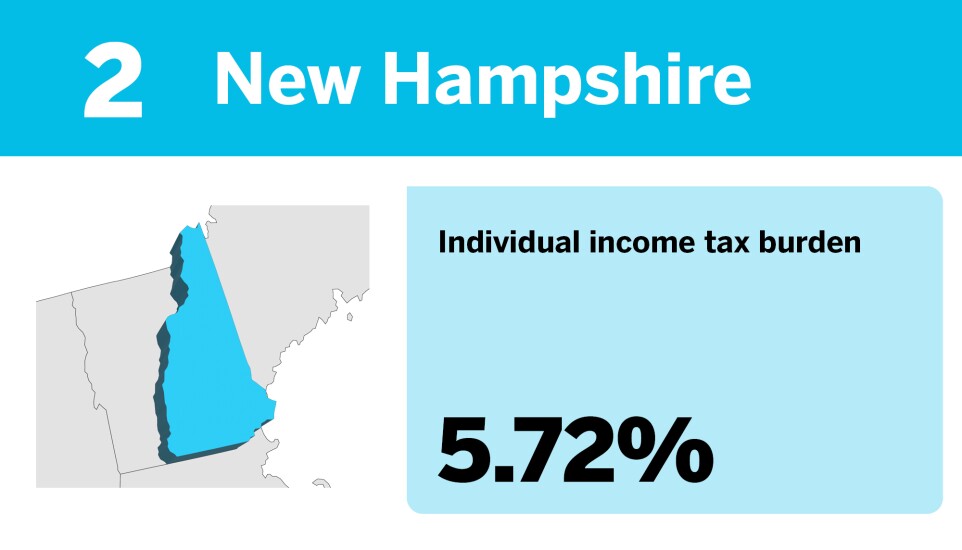

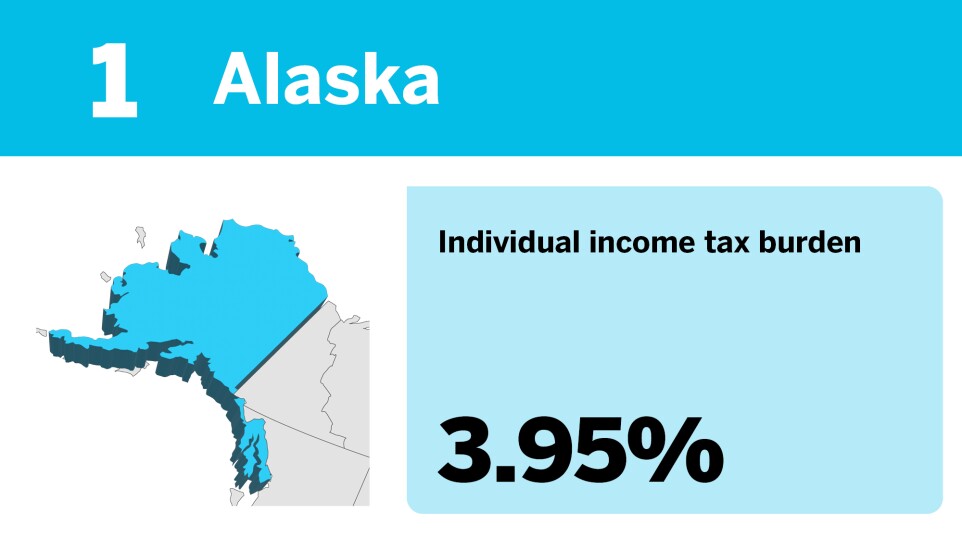

WalletHub recently ranked all 50 states and Washington, D.C., to determine where people in different income brackets spend the most and least on sales and excise taxes, property taxes, and income taxes, measuring the share of a resident's income that is contributed to taxes.

High-income earners in the top state of this ranking have a 3.95% total tax as a percentage of income.

Scroll through to learn more about the best states to be rich from a tax perspective.

Source: