-

A tweak to the deductibility of gambling losses may not bring in a lot of tax revenue, but it could certainly alter a lot of wagers next year.

December 1 -

The law requires the IRS to provide a clear explanation of tax-filing errors to taxpayers on its math error notices.

December 1 -

The IRS and the Treasury are asking for comments on regulations they plan to propose for a new tax credit for donating to organizations that give scholarships.

November 26 -

Understanding the authority, eligibility criteria and automation advantages of the program will be essential for firms representing clients before the IRS.

November 25 Friedlich Law Group

Friedlich Law Group -

In Notice 2025-69, the IRS and the Treasury offer clarifications and examples of how to claim the One Big Beautiful Bill Act deductions.

November 24 -

Staff have begun working through the backlog of correspondence and messages, and are expected to begin reaching out to tax pros and taxpayers soon.

November 23 -

The IRS and the Treasury released interim guidance giving new tax benefits to banks that provide loans secured by rural or agricultural real property.

November 20 -

The American Institute of CPAs is urging the IRS not to merge its Office of Professional Responsibility with its Return Preparer Office to avoid confusion.

November 20 -

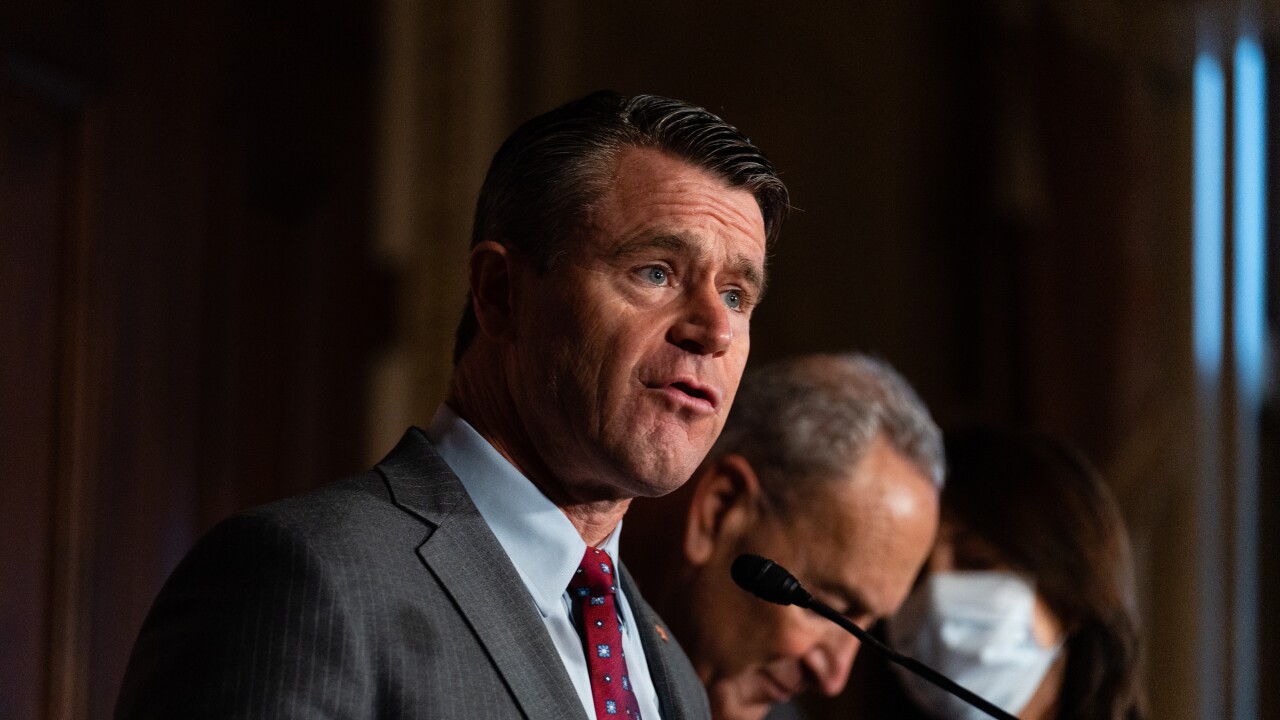

Senator Todd Young is urging the IRS to reconsider guidelines on the tax treatment of rewards crypto owners collect for locking assets on a blockchain network.

November 19 -

A group of former Internal Revenue Service leaders discussed the state of the IRS at an AICPA tax conference after a wave of departures and layoffs.

November 18 -

The Treasury Inspector General for Tax Administration will examine the workforce reductions by the Trump administration and the elimination of paper checks.

November 17 -

Pressure from political activist Laura Loomer apparently torpedoed the nomination of Donald Korb, who had previously served as chief counsel under President George W. Bush.

November 14 -

The Internal Revenue Service announced the rates for the start of next year, which will stay the same as this quarter.

November 14 -

Borrowers who receive discharges of their student debt under the Income-Driven Repayment program could be facing tax bills as high as $10,000 next year.

November 13 -

Mike Lyons blamed a raft of operational shortcomings for the earnings disappointment that triggered a record rout in the payments giant's stock last month.

November 13 -

The Internal Revenue Service increased the annual retirement plan contribution limits for 2026 thanks to cost-of-living adjustments for inflation.

November 13 -

Handling tough clients; not all revenue is created equal; military returns; and other highlights from our favorite tax bloggers.

November 12

-

The Internal Revenue Service has provided a safe harbor for certain trusts enabling them to stake their digital assets without jeopardizing their tax status.

November 11 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 11 -

Regardless of when the government gets back up and running, it is likely that the effects of the reduced staff, reduced funding, and the shutdown will be felt during the 2026 tax filing season and perhaps beyond.

November 11 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting