-

Tax season is starting as a number of new provisions of the One Big Beautiful Bill Act take effect.

January 8 -

The Institute wants the IRS to develop an automated procedure to expedite extension requests for taxpayers to replace property destroyed by disasters.

January 7 -

Impacted taxpayers have until May 1 to file tax returns and make payments.

January 6 -

The tax deduction applies to new cars assembled in the U.S. purchased from 2025 through the end of 2028.

January 2 -

From the decline of the 150-hour rule to staff cuts at the IRS and the ongoing impact of PE, the last 12 months have been very busy for the profession.

December 31 -

The proposed regulations relate to the new deduction for interest paid on vehicle loans incurred after Dec. 31, 2024, to purchase new made-in-America vehicles for personal use.

December 31 -

Whether crypto tax legislation is coming; don't miss QSBS savings; Bears on the move; and other highlights from our favorite tax bloggers.

December 30

-

Provisions from the OBBBA required new answers to questions about the Premium Tax Credit.

December 30 -

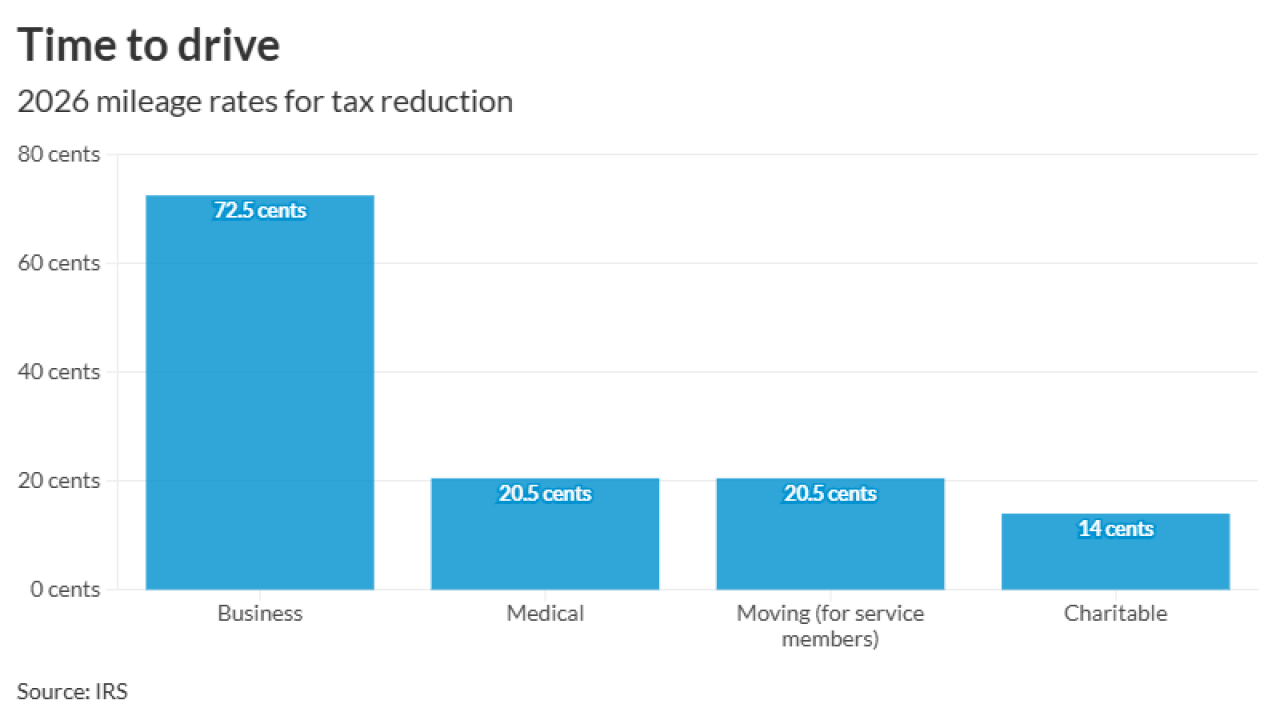

According to IRS Notice 2026-10, however, some other mileage rates will go down.

December 29 -

Agents with the Internal Revenue Service's Criminal Investigation unit reportedly helped track down the shooter who terrorized Brown University and MIT.

December 29 -

Britney Spears is disputing a $600,000 tax claim from the Internal Revenue Service.

December 29 -

Trump administration officials are confidently forecasting that Americans will see the largest refunds next filing season thanks to the tax cuts in the OBBBA.

December 29 -

The Treasury and the IRS are asking that taxpayers hold off on claims until they clarify the rules.

December 26 -

The IRS Criminal Investigation unit cited its top cases that led to multiyear prison sentences and multimillion-dollar financial settlements for tax crimes.

December 26 -

Comments on the proposed framework are due by March 22.

December 24 -

Postmarks and donations; tuning up your comp system; please, Santa…; and other highlights from our favorite tax bloggers.

December 23

-

Led by Elizabeth Warren, 17 senators sent a letter to Treasury Secretary Scott Bessent expressing their "serious concerns."

December 23 -

The new Form 211, Application for Award for Original Information, lets people report tax noncompliance digitally.

December 23 -

Amanda Reynolds filed a complaint asking the court to determine whether pets can be recognized as non-humans dependents.

December 19 -

No expertise needed; losing Trump benefits; excise taxes can't replace property taxes; and other highlights from our favorite tax bloggers.

December 17