-

IRS CEO Frank Bisgnano announced changes in the agency's executive ranks and priorities only a few days before the start of tax season on Jan. 26.

January 21 -

Pumping up energy credits; rental prop problems; the OBBBA and financial aid; and other highlights from our favorite tax bloggers.

January 20

-

The Internal Revenue Service and the Treasury said the payment of $1,776 for members of the military announced by President Trump last month would not be taxed.

January 20 -

Rev. Proc. 2026-08 updates procedures for exemption from income tax on a group basis for 501(c) organizations that are under the control of a central organization.

January 20 -

Statehouse skirmishes: the Gold Card; how returns get prepared; and other highlights from our favorite tax bloggers.

January 16

-

Notice 2026-11 from the IRS provides guidance on the permanent 100% additional first-year depreciation deduction provided by the One Big Beautiful Bill Act.

January 15 -

The House Ways and Means Committee voted unanimously to approve a bipartisan bill to accelerate processing of tax returns through use of scanning technology.

January 14 -

The Internal Revenue Service Advisory Council issued its annual report after a turbulent year at the agency, criticizing the repeated funding and staffing cuts.

January 14 -

As tax professionals, we need to figure out which version of reality is going to show up on tax season opening day.

January 14 Friedlich Law Group

Friedlich Law Group -

The Treasury and the IRS issued proposed regulations to revise the threshold for when third-party settlement organizations need to perform backup withholding.

January 8 -

Tax season is starting as a number of new provisions of the One Big Beautiful Bill Act take effect.

January 8 -

The Institute wants the IRS to develop an automated procedure to expedite extension requests for taxpayers to replace property destroyed by disasters.

January 7 -

Impacted taxpayers have until May 1 to file tax returns and make payments.

January 6 -

The tax deduction applies to new cars assembled in the U.S. purchased from 2025 through the end of 2028.

January 2 -

From the decline of the 150-hour rule to staff cuts at the IRS and the ongoing impact of PE, the last 12 months have been very busy for the profession.

December 31 -

The proposed regulations relate to the new deduction for interest paid on vehicle loans incurred after Dec. 31, 2024, to purchase new made-in-America vehicles for personal use.

December 31 -

Whether crypto tax legislation is coming; don't miss QSBS savings; Bears on the move; and other highlights from our favorite tax bloggers.

December 30

-

Provisions from the OBBBA required new answers to questions about the Premium Tax Credit.

December 30 -

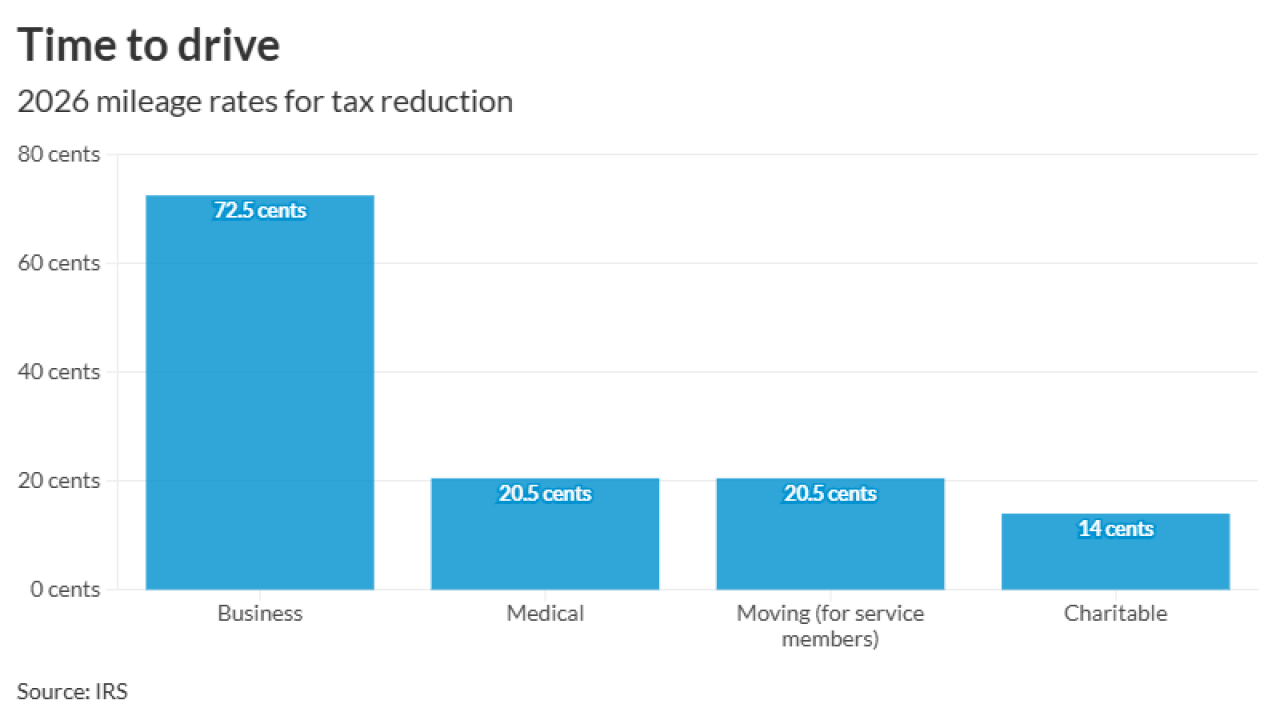

According to IRS Notice 2026-10, however, some other mileage rates will go down.

December 29 -

Agents with the Internal Revenue Service's Criminal Investigation unit reportedly helped track down the shooter who terrorized Brown University and MIT.

December 29