A month after President Donald Trump moved to shore up workers’ incomes by giving employers the option of deferring payroll taxes, the effort has failed to energize a U.S. economy still reeling from the coronavirus pandemic.

2020 has been a year of disruption -- but also of innovation and rapid evolution.

The Internal Revenue Service added six more forms to the 10 that support e-signatures.

EY earned a record $37.2 billion in the fiscal year ending June 30.

The Internal Revenue Service plans to mail out letters later this month to an estimated 9 million non-filers, encouraging them to claim their economic impact payments by an Oct. 15 deadline.

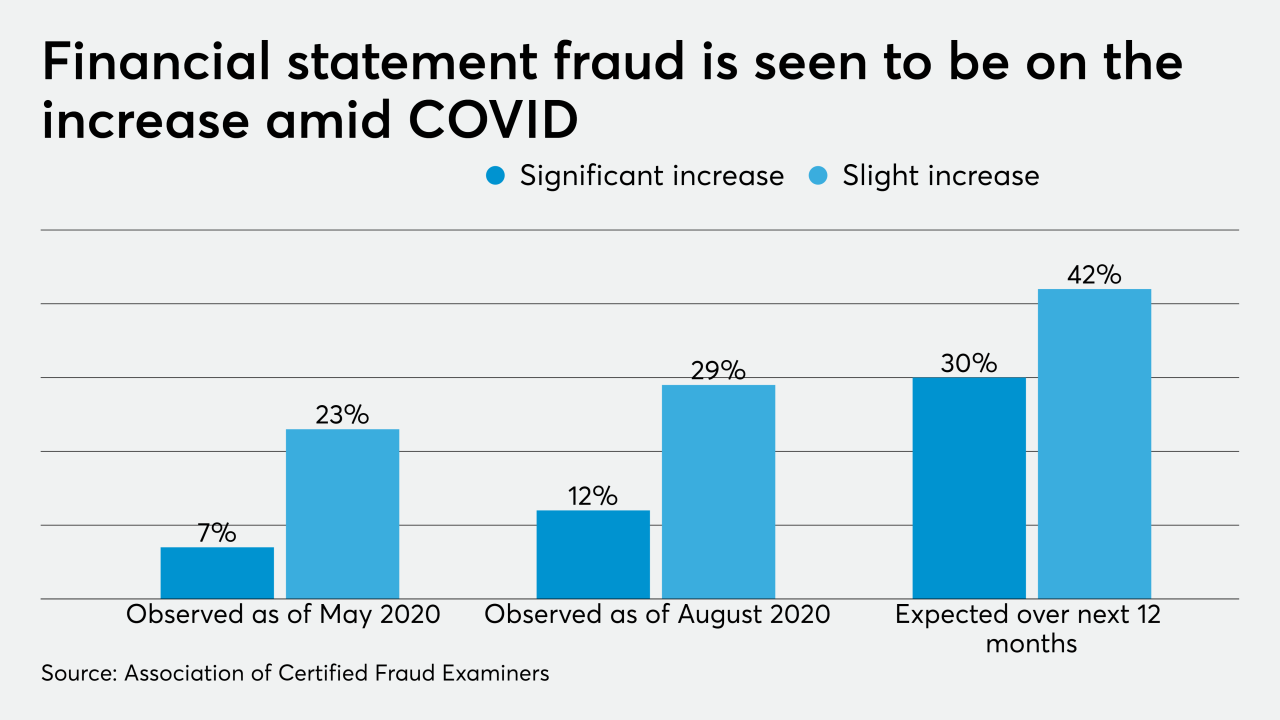

COVID-19 has created new challenges and a remote work environment that heightens the risk of fraud at public companies.

But enough issues remain that employers are not over-enthusiastic about the option, experts say.

Accounting firms are still managing to see increases in their fees and income per partner this year, despite the economic downturn from the COVID-19 pandemic, according to the latest edition of the annual Rosenberg Survey.

Insights on how firms can prepare themselves and their clients for the world after COVID-19.

-

The COVID-19 pandemic is encouraging various forms of fraud, according to the Association of Certified Fraud Examiners.

September 11 -

A month after President Donald Trump moved to shore up workers’ incomes by giving employers the option of deferring payroll taxes, the effort has failed to energize a U.S. economy still reeling from the coronavirus pandemic.

September 11 -

2020 has been a year of disruption -- but also of innovation and rapid evolution.

September 11 Boomer Consulting Inc.

Boomer Consulting Inc. -

The Internal Revenue Service added six more forms to the 10 that support e-signatures.

September 10 -

EY earned a record $37.2 billion in the fiscal year ending June 30.

September 10 -

The Internal Revenue Service plans to mail out letters later this month to an estimated 9 million non-filers, encouraging them to claim their economic impact payments by an Oct. 15 deadline.

September 10 -

COVID-19 has created new challenges and a remote work environment that heightens the risk of fraud at public companies.

September 10 Ropes & Gray

Ropes & Gray -

But enough issues remain that employers are not over-enthusiastic about the option, experts say.

September 10 -

Accounting firms are still managing to see increases in their fees and income per partner this year, despite the economic downturn from the COVID-19 pandemic, according to the latest edition of the annual Rosenberg Survey.

September 9 -

Senate leaders will be trying to hold their parties together for a vote Thursday to advance a slimmed-down stimulus bill that Democrats have already rejected, with both sides jockeying for advantage in public perceptions two months before the election.

September 9