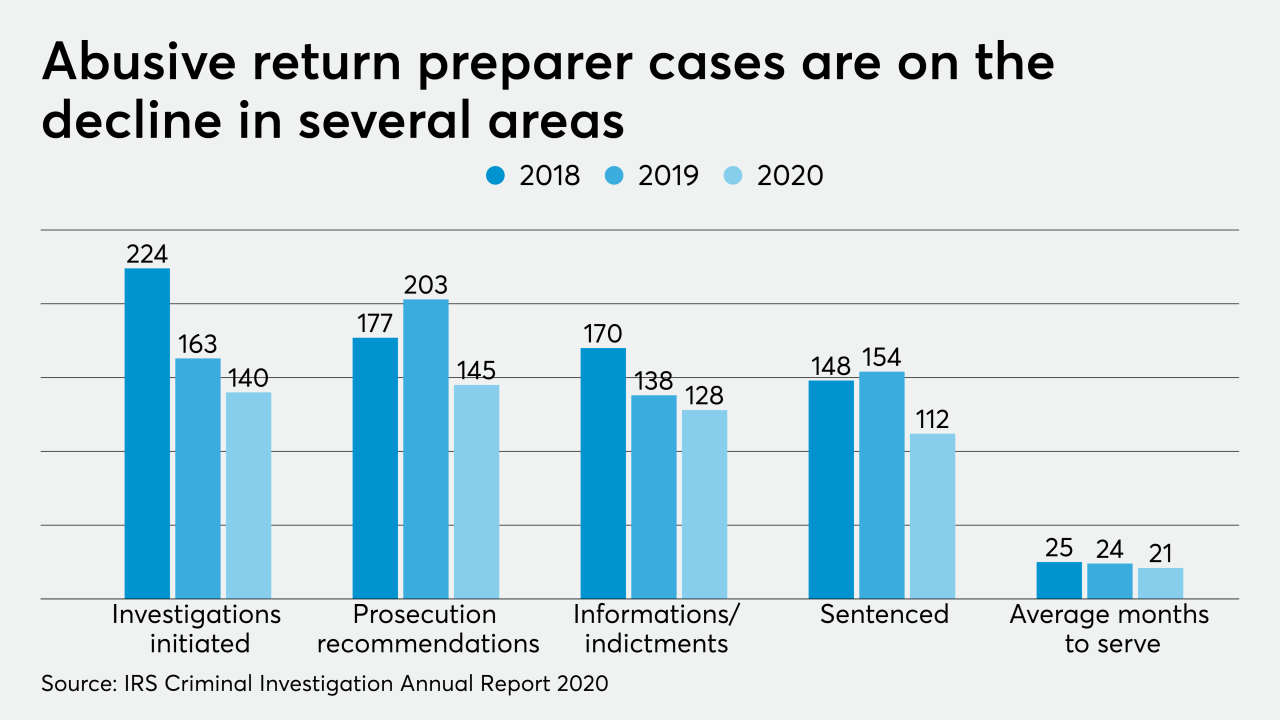

The Internal Revenue Service’s Criminal Investigation unit has been initiating fewer investigations of abusive tax return preparers this past year, while also recommending fewer prosecutions, and seeing fewer indictments and prison sentences this year.

The Governmental Accounting Standards Board is giving state and local governments extra time to implement its new leases standard because of the coronavirus pandemic, and they will need it.

The board has been making changes to its strategic plans and agenda in response to the pandemic as it sees auditors doing more work remotely.

The percentage of workers asking for compensation for work-from-home expenses with their employers hasn’t gone up significantly since the outbreak of COVID-19.

Are ransomware hackers the 21st century Robin Hood? Plus nine other developments in technology from this past month, and how they’ll impact your clients and your firm.

It’s not too early to start planning how to make your firm better next year.

Practitioners share how they handled charging for stimulus services, and interacting with clients.

Insights on how firms can prepare themselves and their clients for the world after COVID-19.

-

The institute released the pair of reports as companies increasingly rely on their CFOs and accounting departments to help them survive beyond the coronavirus pandemic.

November 16 -

The Internal Revenue Service’s Criminal Investigation unit has been initiating fewer investigations of abusive tax return preparers this past year, while also recommending fewer prosecutions, and seeing fewer indictments and prison sentences this year.

November 16 -

The Governmental Accounting Standards Board is giving state and local governments extra time to implement its new leases standard because of the coronavirus pandemic, and they will need it.

November 13 -

The board has been making changes to its strategic plans and agenda in response to the pandemic as it sees auditors doing more work remotely.

November 11 -

The percentage of workers asking for compensation for work-from-home expenses with their employers hasn’t gone up significantly since the outbreak of COVID-19.

November 11 -

Are ransomware hackers the 21st century Robin Hood? Plus nine other developments in technology from this past month, and how they’ll impact your clients and your firm.

November 11 -

The association’s annual report details a difficult year.

November 10 -

It’s not too early to start planning how to make your firm better next year.

November 10 -

Practitioners share how they handled charging for stimulus services, and interacting with clients.

November 10 -

The service is rolling out new systems and expanding forms that can be electronically filed by tax-exempt organizations.

November 9