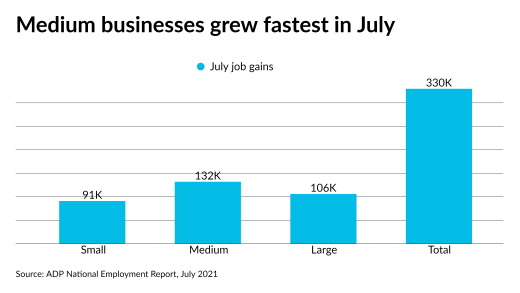

The economy showed signs of a boost despite increasing worries over the Delta variant of COVID-19, according to ADP.

The bipartisan infrastructure bill would end a tax break Congress crafted to help businesses struggling during the pandemic but relatively few companies have claimed.

Most states have managed to get through the COVID-19 pandemic without increasing taxes, despite predictions last year, according to a new report.

The Federal Accounting Standards Advisory Board released a standard for accounting and financial reporting on government-owned land and delayed the effective date due to the pandemic.

Employers can claim tax credits equivalent to the wages paid for providing paid time-off to employees to take a family or household member or certain other individuals to get vaccinated for COVID-19.

The key tactic for CPA firms moving forward is strategic prioritization, according to the panel of AICPA and CPA.com leaders.

The U.S. Small Business Administration will be unveiling an online portal where Paycheck Protection Program borrowers can directly apply for forgiveness on loans of $150,000 or less without going through their bank.

Despite strong efforts by the service, the pandemic claimed dozens of its employee, according to a TIGTA report.

Insights on how firms can prepare themselves and their clients for the world after COVID-19.

-

Congress is weighing a proposal to end the tax break next month to pay for the bipartisan infrastructure plan.

August 4 -

The economy showed signs of a boost despite increasing worries over the Delta variant of COVID-19, according to ADP.

August 4 -

The bipartisan infrastructure bill would end a tax break Congress crafted to help businesses struggling during the pandemic but relatively few companies have claimed.

August 3 -

Most states have managed to get through the COVID-19 pandemic without increasing taxes, despite predictions last year, according to a new report.

August 2 -

The Federal Accounting Standards Advisory Board released a standard for accounting and financial reporting on government-owned land and delayed the effective date due to the pandemic.

July 30 -

Employers can claim tax credits equivalent to the wages paid for providing paid time-off to employees to take a family or household member or certain other individuals to get vaccinated for COVID-19.

July 29 -

The key tactic for CPA firms moving forward is strategic prioritization, according to the panel of AICPA and CPA.com leaders.

July 28 -

The U.S. Small Business Administration will be unveiling an online portal where Paycheck Protection Program borrowers can directly apply for forgiveness on loans of $150,000 or less without going through their bank.

July 28 -

Despite strong efforts by the service, the pandemic claimed dozens of its employee, according to a TIGTA report.

July 28 -

Small business owners have been coping with unpaid invoices and inadequate accounting during the pandemic and needed to cover expenses by selling family heirlooms and other valuables.

July 27