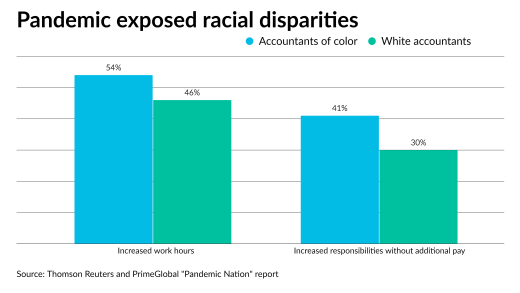

Accountants of color and women took on increased workloads at firms during the COVID-19 pandemic, but didn’t necessarily see their careers advance, according to a new study.

Revenue from advisory services made up 39% of fees, accounting and auditing fees comprised 35%, and tax services accounted for 26% of revenue.

The Internal Revenue Service mailed out nearly 90,000 premature notices and demands for overdue taxes to taxpayers last year, even though the filing date had been extended.

ADP has updated its payroll and HR software with new user design, artificial intelligence and machine learning features, as well as employee vaccine tracking.

Predictive analytics, combined with knowledge of the business and scenario planning, can help organizations make better forecasts.

Internal auditors are seeing far-reaching effects from the COVID-19 pandemic on the way they do their work, according to a new survey.

The service is reminding taxpayers that they can pay for at-home tests with their FSAs, MSAs, and Archer MSAs.

The Small Business Administration is increasing the cap for COVID Economic Injury Disaster Loans from $500,000 to $2 million.

Insights on how firms can prepare themselves and their clients for the world after COVID-19.

-

Accountants of color and women took on increased workloads at firms during the COVID-19 pandemic, but didn’t necessarily see their careers advance, according to a new study.

October 1 -

Revenue from advisory services made up 39% of fees, accounting and auditing fees comprised 35%, and tax services accounted for 26% of revenue.

October 1 -

The Internal Revenue Service mailed out nearly 90,000 premature notices and demands for overdue taxes to taxpayers last year, even though the filing date had been extended.

September 20 -

ADP has updated its payroll and HR software with new user design, artificial intelligence and machine learning features, as well as employee vaccine tracking.

September 15 -

Predictive analytics, combined with knowledge of the business and scenario planning, can help organizations make better forecasts.

September 14 -

Internal auditors are seeing far-reaching effects from the COVID-19 pandemic on the way they do their work, according to a new survey.

September 13 -

The service is reminding taxpayers that they can pay for at-home tests with their FSAs, MSAs, and Archer MSAs.

September 10 -

The Small Business Administration is increasing the cap for COVID Economic Injury Disaster Loans from $500,000 to $2 million.

September 10 -

The service warned Thursday of an issue that’s affecting business taxpayers who need transcripts for requesting COVID-19 employment tax relief.

September 9 -

The unemployment rate declined, but the jobs report fell far short of economist expectations.

September 3