(Bloomberg Opinion) Slap a tariff on steel and you’re sure to roil markets. But behind the big headlines on trade sanctions are developments that might be just as momentous for the global economy: About 135 of the world's countries are negotiating a radical change to the rules about where and how much multinational companies pay in taxes.

The topic was the subject of back-room talks in Davos last week and continue this week in Paris at a working meeting of the Organization for Economic Cooperation and Development. There are important reasons that this effort — after so many false starts — may actually deliver change.

First, the interests of rich and poor countries are aligned in an unusual desire to seize these untaxed profits. Second, the global corporations that benefit from the current system worry about new and uncoordinated taxes popping up around the world. Third, if there’s one economic issue that angers voters more than unfair trade, it’s rich corporations that skirt paying taxes.

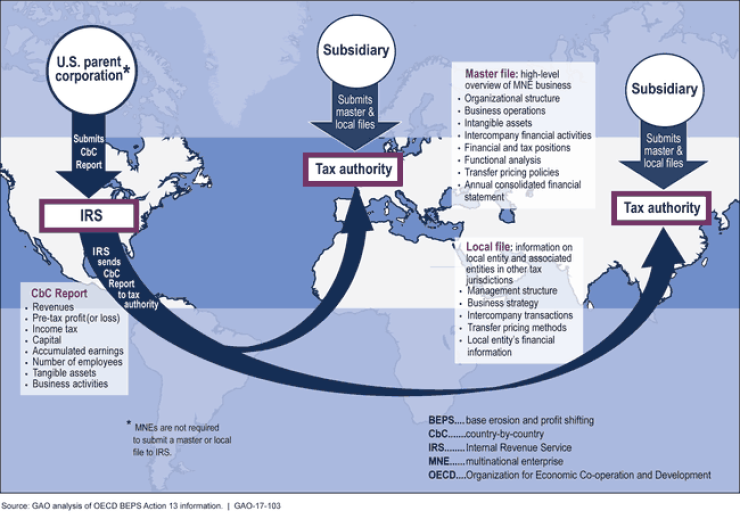

The G-20’s leaders started this process in 2013, and experts at the OECD are on the hook to build support for major reforms by the end of this year. The jargon for the technical problem they are tackling is “base erosion and profit shifting,” which refers to corporate efforts to book profits in low-tax jurisdictions and in many cases avoid taxes where they have no physical presence.

International rules generally allow countries to tax only business activities in their own territory. The advent of digital services and online sales, however, makes it harder to pinpoint exactly where many business activities occur. Moreover, the rising value of brand names and intellectual property opens the way for financial engineering that makes sales by companies such as Amazon, Google and Starbucks in high-tax countries look less profitable.

Measuring worldwide corporate tax avoidance involves a little guesswork. The OECD puts the number at about

The OECD proposals that will be further fleshed out this week focus on two principal reforms. First, countries would be allowed to tax a proportion of a business’s global profits based on a company’s sales within that country. This would be a significant help for developing countries where many multinationals sell without a physical presence. A second set of proposals would establish the right to impose a minimum tax on global profits.

It doesn’t take much imagination to see the devilishly complex issues such rules might trigger around definitions, reporting and fairness. A key goal of President Donald Trump’s 2017 tax reform was to bring home untaxed profits parked abroad, but so far its results

More dramatically, France’s unilateral tax on digital transactions triggered a sharp reaction — and tariff threats — from the Trump administration because the biggest targets were American.

Trump and French President Macron brokered a temporary truce on the digital tax in Davos, with each side agreeing to stand down while multilateral negotiations continue. But the U.S. administration seems inclined to strike a broader deal. On the one hand, if Washington doesn’t like raising taxes, it certainly doesn’t like losing revenues to other countries. On the other, digital taxes similar to France's are on the table in the U.K., Canada, Australia and elsewhere. Trump is unlikely to punish them all as anger mounts over corporate tax evasion at home.

Companies themselves are watching closely and sense that change is afoot. The only thing worse than coordinated change is uncoordinated change, although the details of the final deal will be crucial.

There are the political calculations as well. If current leaders fail to deliver meaningful change, they may be swept aside by rising populist waves of unhappiness over inequality and excess corporate wealth. What’s currently on the table looks mild in comparison to proposals by the U.K. Labour Party and some U.S. Democratic presidential candidates.

Investors may be reluctant to focus on such abstruse negotiations at the moment, especially when the economic data looks mostly promising. Political, national security and public-health headlines all are more likely to trigger market volatility.

Still, it’s not too soon to start incorporating the risks of higher taxes on the world largest businesses. Investors ignore the consequences at their own peril.