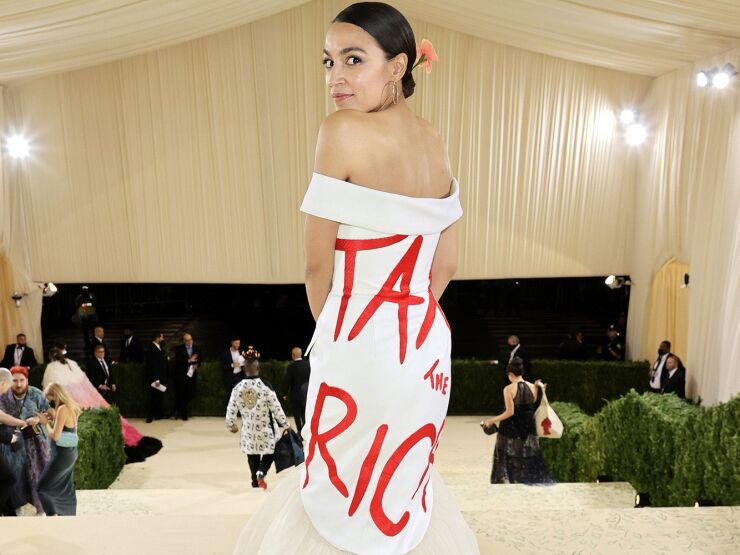

Representative Alexandria Ocasio-Cortez attended last week’s Met Gala wearing a dress emblazoned with the slogan, “Tax the Rich.” It’s certainly catchier than what would have been a more appropriate slogan: “This Event Is a Tax Loophole for the Rich.”

Intended to attract attention from her fellow celebrity guests as well as the mainstream media, AOC’s dress instead became a focal point for the

As an example of American society’s ability to turn anything and everything into grist for the culture war, it was an impressive display. But it was also a lost opportunity to talk about how the tax code privileges events such as the Met Gala.

While a ticket to the Met Gala costs $35,000, for tax purposes it is not the equivalent of buying floor seats to an NBA playoff game. The gala is a fund-raising event for the Metropolitan Museum of Art, so your $35,000 is a charitable contribution. In New York City — where the combined top federal, state and local income tax rates add up to about 50% — that tax deduction is incredibly valuable, and will only become more so if Democrats in Washington get their way and substantially raise taxes on the rich as part of President Joe Biden’s Build Back Better agenda.

This loophole doesn’t apply if, say, you buy something at the Met gift shop. (Admittedly, it’s hard to spend $35,000 there, but it has some

The way this works for gala-type events is that your ticket is construed as having two parts. One pays for the meal. The other is money you spend over and above the monetary value of what you get. Only the latter part is tax deductible. For the Met Gala, probably a few hundred dollars would be non-deductible, and the rest would be considered a charitable contribution rather than payment for goods and services received.

There are probably contexts in which this makes sense. But it’s an absurd way to look at the Met Gala and similarly star-studded events. The event is an annual media occasion because the guest list inevitably includes an impressive roster of celebrities decked out in haute couture and outlandish costumes. The celebrities are invited guests,

The tickets, in other words, are an admission fee to a very expensive show, one of the few truly exclusive events in an information-saturated era. That the celebrities themselves are eager to attend is further demonstration that the event is fun. For the paying customers, it’s an upscale consumption experience, comparable to any other luxury good.

The difference, of course, is that it is given preferential tax treatment thanks to the association with the Met, which is designated as a nonprofit organization by the IRS. But that issue is considerably more difficult to describe on the back of a dress.