It is now well-accepted that blockchain is an accounting technology that can significantly reduce the time needed for recording, reconciliation and reporting in almost any industry. Here are the top five trends in the evolution of the blockchain ecosystem that accountants should know in order to prepare for a better future in the profession:

1. Regulatory framework

The regulators in the U.S. are approaching blockchain technology with what they like to call a "light touch regulatory framework." Both the SEC and CFTC are very aware of the products this technology has given birth to, such as digital assets. Neither the SEC nor CFTC wants to scuttle the process of innovation. They are encouraging innovators to have a continued dialogue with them, so that they can guide them through the regulatory process. A lot of participants are asking for guardrails and both institutions are actively working to develop appropriate regulatory framework in collaboration with the industry and lawmakers.

2. Tokenization of assets and securities

A bunch of startups and financial services industry veterans are exploring various ways to use the technology of blockchain in tokening assets, which were earlier not accessible to retail investors easily. Mechanisms such as Initial Coin Offerings and Security Token Offerings are innovations enabled by the blockchain technology. Tokenizing real estate asset holdings is at the top of the list, followed by commodities and small cap equity. Tokenization is expected to unlock trillions of dollars of assets into the economy.

3. Cryptocurrencies are perhaps here to stay — in some form or the other!

With the advent of JPM Coin, there has been a new impetus for the cryptocurrency and tokens discussion. Even though JPM Coin is not a cryptocurrency, it’s a perfect way to look at using blockchain in a business case such as a settlement. JPM Coin is providing the perfect testing rails for J.P. Morgan and peer firms. We will soon see more financial institutions joining the party and eventually coming together for interoperable settlement tokens.

While there are a number of fraudulent activities, cryptocurrencies are proving to be a viable alternative in the international money transfer process. More work is being done in this area and central banks across geographies are keenly studying the phenomenon.

4. New business models

Blockchain will enable transfer of value and digital assets similar to how the internet enabled the exchange of data and information. New business models that use blockchain as an underlying technology are emerging fast. In the last 30 years, internet technology has enabled easy information exchange through tools such as email and browsers. In addition, the industry of e-commerce, which includes many business models such as online video streaming, online advertising, social media, shared rides, etc., are entirely based on the internet. The technology of blockchain will enable a new industry where digital transfer of value would be the new norm. There are currently public-private partnerships in the works across many states in the U.S. to explore the viability of technology in the areas of transferring car titles and property titles.

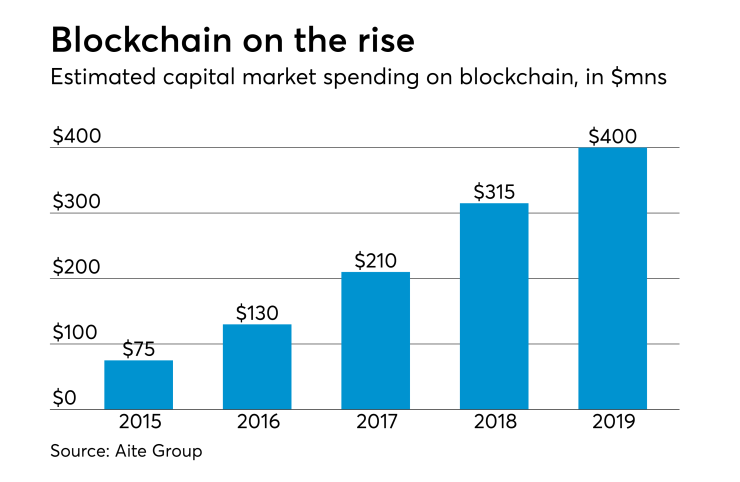

5. Industry adoption of blockchain is on the rise

Every industry, including nonprofits and the government sector, is working on building proof of concepts on blockchain platforms. While some industries such as financial services and supply chain have taken the lead, other industries such as manufacturing, construction, media and aerospace are catching up quickly. Accountants will need to understand how the information is tracked and how the value is transferred on blockchain. It’s very likely that existing accounting and ERP products will start integrating blockchain technology.

There is a significant role for CPAs in this ecosystem through processing audit, system testing and model validation. The designing of a blockchain-based system involves not only the design of technology, but also looking at the business process afresh. Once the overall system is in place, it’s prudent for businesses to seek professional help to test the process and technology before deploying it into production. It’s very likely that such professional help will almost become mandatory, like audit and attestation. One such example is the government of Malta, which needs blockchain-based companies to go through a certification process. As we move forward with the evolution of blockchain ecosystems, I think it behooves the accounting profession to participate with industry leaders in understanding the new business models and increasing the adoption of this technology.