The IRS and its private-sector partners have opened its 2017 Free File program, which gives eligible taxpayers free access to a dozen brand-name tax filing software options.

Taxpayers can get a jump now on preparing their returns and the companies will hold the returns until Jan. 23, when filing season begins – though the IRS is reminding taxpayers that the agency must hold refunds claiming the Earned Income Tax Credit or the Additional Child Tax Credit until Feb. 15.

Anyone whose 2016 AGI was $64,000 or less is eligible for Free File. Those who earned more than $64,000 may use Free File Fillable Forms, the e-version of IRS paper forms that will be available on Jan. 23.

Free File is available at

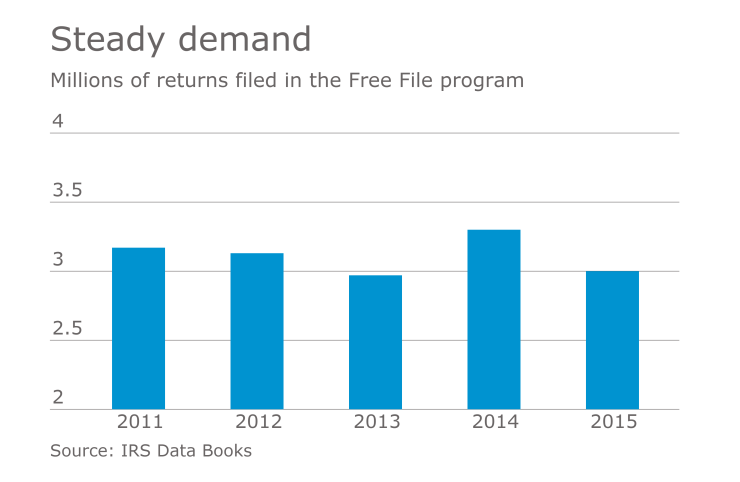

Since 2003, more than 49 million people have used Free File. The IRS works with the Free File Alliance for taxpayer choices for free state options as well as free federal returns. Several offer both.

Each of the 12 Free File providers sets differing criteria for use of their product, generally based on income, age or state residency.

For 2017, active duty military personnel with incomes of $64,000 or less may use any Free File software product of their choice without regard to the criteria.

Free File walks users through the tax prep process and helps identify those tax changes that may affect their return, such the delay for refunds that contain an EITC or ACTC. Taxpayers file normally and can e-file and use direct deposit. Free File also can help taxpayers with health-care law requirements.

Free File makes all versions of the Form 1040 available without cost, including the 1040, 1040A and 1040EZ and related schedules. All Free File forms are available throughout the filing season.