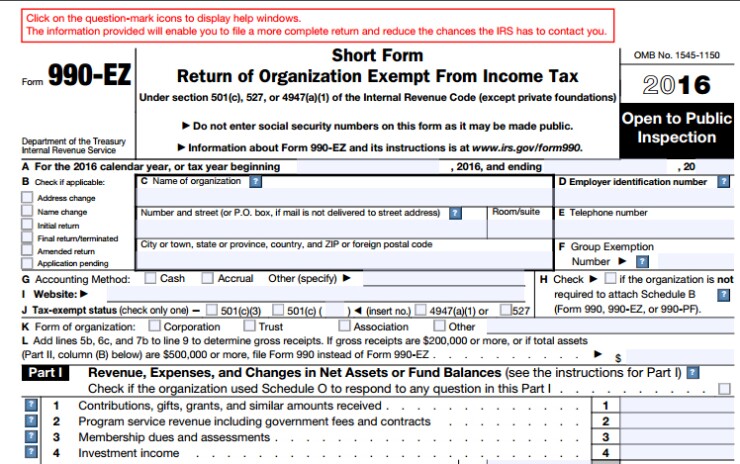

The IRS has updated Form 990-EZ, Short Form Return of Organization Exempt From Income Tax to help tax-exempt organizations avoid common mistakes when filing their annual return.

The

In 2016, the error rate for e-filed 990-EZ returns was only 1 percent, compared with the 33 percent error rate in paper-filed returns. In 2016, the IRS processed more than 263,000 990-EZs, with 139,000 of those on paper.

“One out of three paper filers has an error on their form,” said IRS Commissioner John Koskinen in a statement.

On the new form, the help icons are marked in boxes with a blue question mark. The icons and underlying links work on any device with Adobe Acrobat Reader and internet access. Filers can print the completed 990-EZ and mail it to the IRS.

A list of providers assisting with e-filing is on IRS.gov.

The help icons do not replace the 990-EZ instructions. The IRS also reminds exempt organizations that 990-series returns are due on the 15th day of the fifth month after an organization’s tax year ends.