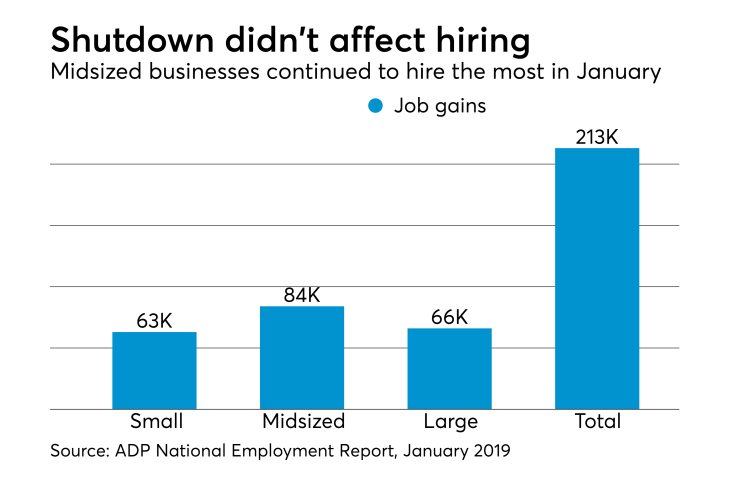

The private sector added 213,000 jobs in January, according to payroll giant ADP, in a sign of a continuing robust job market despite the partial government shutdown and the fading impact of corporate tax cuts.

Small businesses added 63,000 jobs in January, including 30,000 at businesses with between one and 13 employees, and 32,000 at businesses with between 20 and 49 employees. Midsized businesses with between 50 and 499 employees added 84,000 jobs. Large businesses gained 66,000 jobs, including 33,000 at companies with between 500 and 999 employees, and even larger companies with 1,000 employees or more.

The goods-producing sector accounted for 68,000 of the job gains, including 33,000 in manufacturing and 35,000 in construction. The service-providing sector added 145,000 jobs, including 46,000 in professional and business services such as tax preparation and accounting and 11,000 in financial activities. Franchise employment increased by 33,000 jobs.

“The labor market has continued its pattern of strong growth with little sign of a slowdown in sight,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute, in a statement. “We saw significant growth in nearly all industries, with manufacturing adding the most jobs in more than four years. Midsized businesses continue to lead job creation; however, the share of jobs was spread a bit more evenly across all company sizes this month.”

Mark Zandi, chief economist at Moody’s Analytics, which compiles the

However, he added that the shutdown appears to be weighing heavily on both consumer sentiment and business sentiment, as evidenced in recent surveys by the Conference Board and the University of Michigan. He warned the impact could be even more negative if there is another government shutdown in February or if the debt limit becomes an issue again later this year.

“We do have the debt limit issue coming back on the radar screen,” said Zandi. “The Treasury debt limit, which is the actual cap on the Treasury debt outstanding, was suspended back during the budget deal over a year ago. That debt limit is now going to be reinstated on March 1, and the Treasury will use the cash it has socked away in different places until it runs out. When it runs out is unclear. A lot depends on the April tax filings and how much cash the Treasury raises through the tax filings, but the best guesstimate is that the Treasury will run out of cash and will hit the debt limit. Some hard choices will have to be made by sometime in August, or with a little bit of luck, perhaps in September.”

Meanwhile the juice provided by the tax cuts may be running out, as far as business hiring and expansion plans go. The National Association of Business Economics reported this week that 84 percent of the companies polled for its NABE Business Conditions Survey for January indicated that one year after its passage, the 2017 Tax Cuts and Jobs Act has not caused their firms to change their hiring or investment plans.