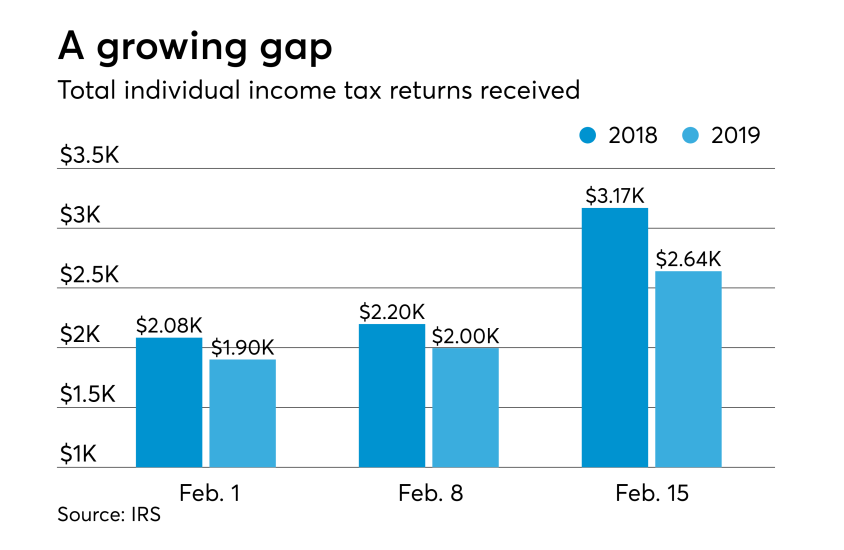

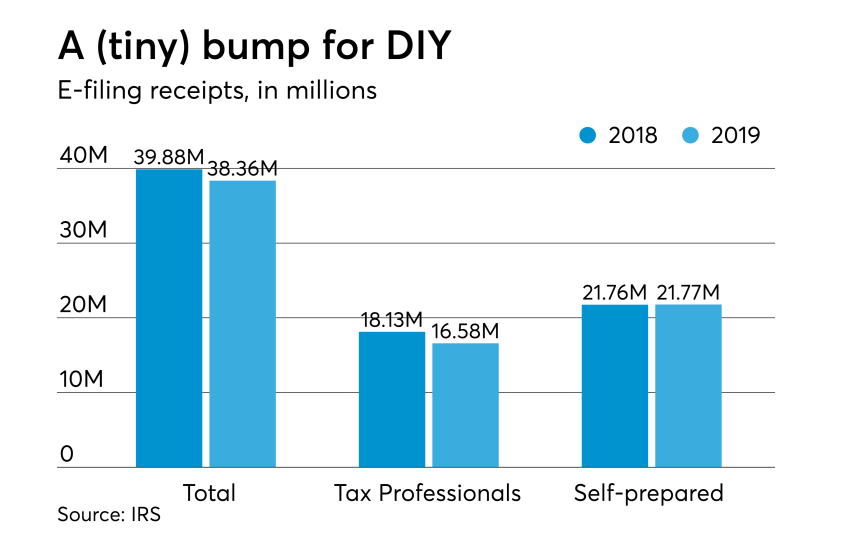

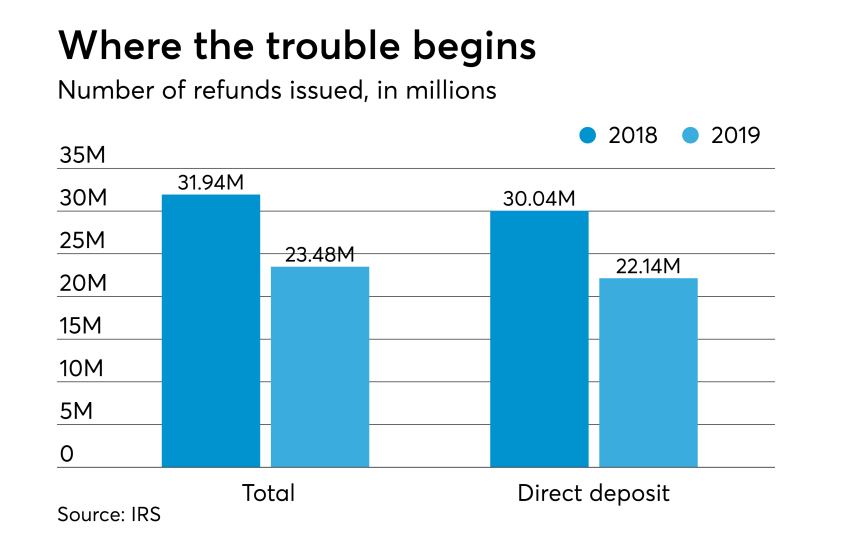

IRS data released Friday shows that up to the middle of February, tax season was off to a slightly slower start than last year. Refund amounts, however, were down significantly, both overall and in terms of average refund.

Needless to say, many taxpayers were unhappy to receive a much smaller refund than usual, or no refund at all, or, worse yet, to discover that they owned money. While the IRS had been warning anyone who would listen about the need to update their withholding in response to the Tax Cuts and Jobs Act for a year, it seems many didn't listen.