States are struggling to preserve an eroding tax base in a changing economy. It’s a trend that your clients should guard against.

(They should also bear in mind that different nexus standards apply to income tax and sales tax. For corporate income tax nearly every state determines nexus based on “economic presence,” which can include a wide range of business activities. For sales tax, states are required to determine nexus based on “physical presence.”)

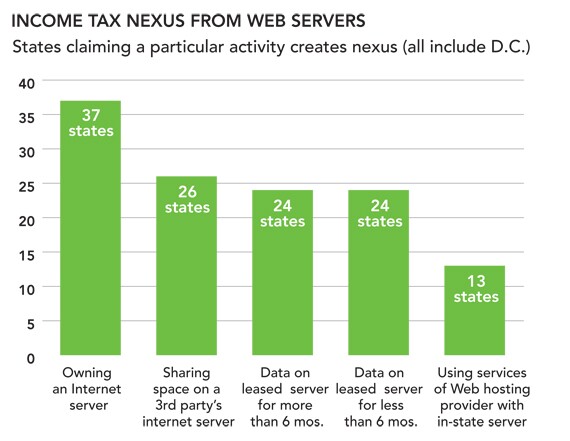

Just having data on a server leased in one of these states for a short period of time can create income tax nexus – though only 12 states and the District of Columbia said nexus would arise from using the services of a Web-hosting provider with a Web server in their jurisdiction.

Most of those who say telecommuting employees create nexus also don’t care if the employee is only part-time.