At the center of things

You can see a text-only version of the list

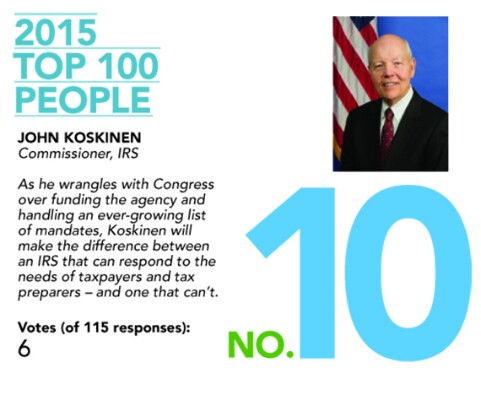

10. JOHN KOSKINEN<P>IRS Commissioner

9. ALLAN KOLTIN<P>CEO, Koltin Consulting Group

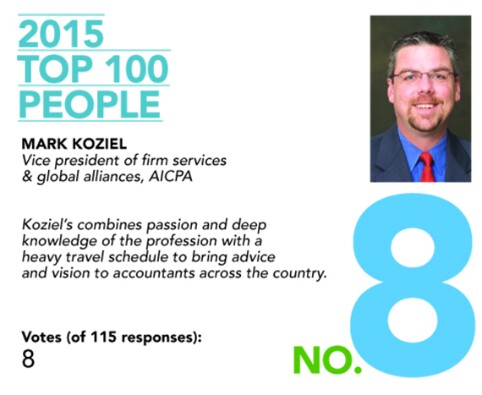

8. MARK KOZIEL <P>Vice president of firm services & global alliances, AICPA

7. JAMES DOTY <P>Chairman, Public Company Accounting Oversight Board

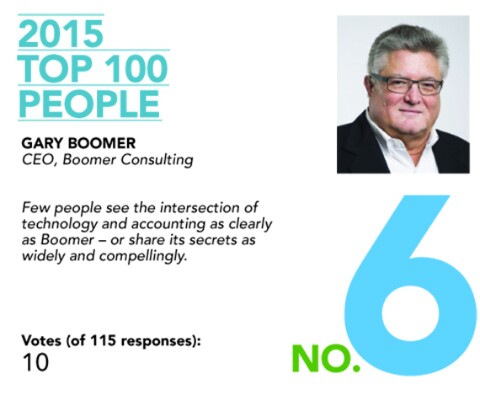

6. GARY BOOMER <P>CEO, Boomer Consulting

5. MARY JO WHITE <P>Chair, Securities & Exchange Commission

3. RUSSELL GOLDEN <P>Chair, Financial Accounting Standards Board

3. RON BAKER <P>Founder, VeraSage Institute

2. TOM HOOD<P>CEO and executive director, MACPA