Democratic presidential contenders divided sharply on Tuesday over whether middle-class taxes would have to increase to pay for a government-run health care system known as “Medicare for All.”

Senators Bernie Sanders and Elizabeth Warren — two of the most ardent supporters of replacing private health coverage with government-sponsored care — have said that taxes for corporations, Wall Street, the wealthy and middle-earners would go up, but that overall costs for middle class families would go down.

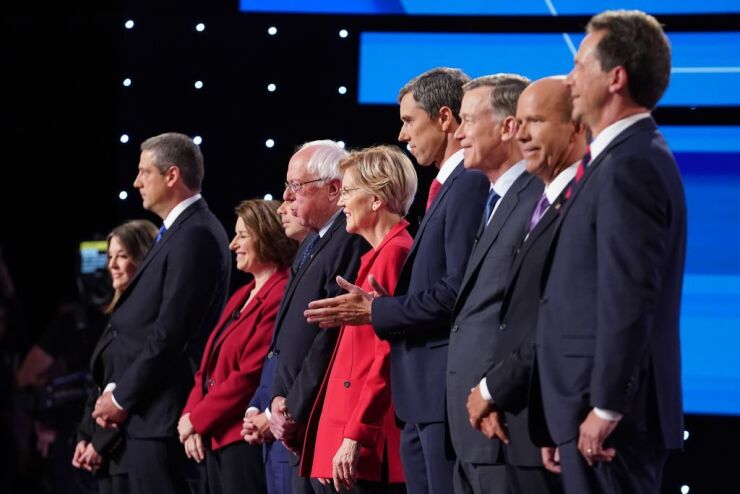

Warren said during Tuesday night’s Democratic debate in Detroit that members of the middle class would pay less in premiums and deductibles under her proposal, though she declined to give a specific answer about how the tax rate for middle-income earners would change.

“This is a distinction without a difference, whether you are paying the same money for taxes or premiums,” said South Bend, Indiana mayor Pete Buttigieg, who has said he supports moving toward a universal health care program, but also wants to preserve private insurance.

But not all Democrats were willing to embrace higher middle-class taxes as the trade-off for expanding health coverage, an issue that has been at the heart of their 2020 presidential campaign.

“The answer is no,” former Texas Congressman Beto O’Rourke said. “The middle class will not pay more in taxes.”

O’Rourke has said he supports a public Medicare-based option, but also wants to maintain employer-provided health insurance. Former Maryland Congressman John Delaney also interjected to say there should be universal health care, but with choices and without middle-class taxes.

Estimates for Sanders’s Medicare for All plan project it would cost at least $30 trillion over a decade. To pay for those programs, candidates have focused on taxing corporations and the wealthy. But many of the plans they’ve put on the table would require across-the-board tax increases that would hit middle-earners as well as the wealthy.

Some of the less ambitious plans that would preserve employer-based insurance — like those Buttigieg and O’Rourke have said they support — would likely cost less than Sanders’s proposal, but could still require middle-class tax increases, depending on their size.

Taxes on individuals represent the largest pot of money lawmakers could tap as they look to expand government programs. Income levies and payroll taxes — taxes that are largely paid for by individuals — make up about 86 percent of the federal tax base. By comparison, corporations pay about 6 percent of all federal taxes.

Health policy experts say it’s hard to design a plan with a net economic burden that decreases for all families. That’s partly because health-care costs are so disparate under the current system.

For example, a family of four with two incomes that total $100,000 who buy insurance on their own and have at least one member in poor health spends about $30,400 on health costs annually, according to estimates from the Kaiser Family Foundation. An identical family that has employer-sponsored health care spends $15,000 annually.

If the family with the $30,400 annual health bill were to face a $20,000 tax increase instead of their health bill under Medicare for All, they’d come out ahead. But the family with the $15,000 coverage would effectively pay $5,000 more.